As an HR technology solution provider, we often experience ever-increasing demand for an online payroll software, that requires fewer resources and increases productivity as well as return on investment (ROI).

An online payroll software not only saves time while processing payroll, but also reduces mathematical errors (less risk of being hit with IRS penalties). It turns out to be cost effective by saving on the cost of an in-house employee dedicated to payroll and the printing costs.

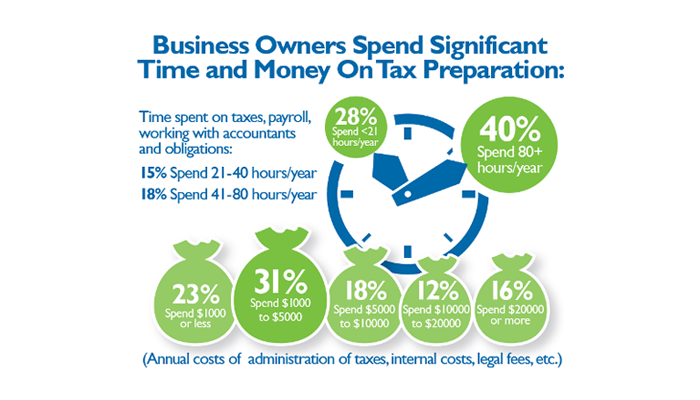

According to a report by a non-profit organization, SCORE, more than 40 percent businesses use approximately 80 hours per year in processing payroll, calculating taxes, and keeping up with regulations.

Value Propositions of Online Payroll Software

Export financial reports

An accounting software can be easily integrated with the online payroll software and the financial reports can be downloaded instantly. With this integration, the possibility of duplicate data entry in financial records can be eliminated and the time spent on accounting can be significantly reduced.

Time and attendance

Employee tracking, especially for hourly employees, is a very useful feature of an online payroll software. Any good payroll system will incorporate an in-built timekeeping feature that employees can use to sign in and out. At the end of each working period or day, the automated time card of the software will instantly calculate daily/monthly wages. There is no need to manually calculate and enter employee hours, which reduces expensive errors and saves time.

Employee self-service

With this feature, modern payroll software empowers employees, giving full access to their payroll information and subsequently reducing the workload of payroll administrators. After login into their account, employees can see, update, download and upload information about their payroll deductions, wages, fringe benefits, time-off balance and more.

Automated taxation

Taxes are a very tricky component of our salary. Each tax has a different rate. Most importantly, every tax has its own remittance and reporting rules. On top of all that, taxes vary by regions. Messing up on payroll taxes may invite penalty from the IRS. A comprehensive online payroll software will automatically calculate and file taxes with precise accuracy, giving you one less thing to worry about. It will provide support for complex statutory taxation legislation for various countries.

Wage payment options

A payroll software allows employers to pay employees by multiple options such as direct deposit, handwritten or printed checks, pay cards and more. With just a few clicks, an accountant can pay your employees without switching between different software programs. With everything in one place, you save time and make employees happy with the options of multiple payment methods.

Add-on HR modules

Few payroll software vendors offer additional HR modules as an add-on. For instance HRIS, travel, expense, loans and advances etc can be integrated with a payroll software, thus preventing repetitive data entry. These integrated HR software solutions streamline your workflow by keeping HRIS data and payroll information organized in one place.

Conclusion

If you are preparing for the year-end financial report, you should plan on investing in an online payroll software. It requires a low upfront investment, is cost effective as compared to manual payroll processes and saves a considerable amount of time that can be invested towards valuable and strategic business operations. Do you want to enhance your payroll process by considering all payment variables like leave, loans, advances, overtime, incentives, bonus, hourly wages and others as a part of an online payroll software? Consider taking a trial of one such payroll software.

A self-service portal at no cost

Process payroll for 25 employees at no cost

* No credit card required