Payroll is a complex process that becomes more challenging with a company’s unique processes, compliance issues, varying allowances and deductions, and with constantly changing legislation. This often puts businesses at a risk as there is so much at stake in terms of penalties, additional scrutiny and reputation of the company. Many organizations manage this process in-house while some look for professional service providers. The goal is to avoid compliance risks and to adapt to the constantly evolving regulations.

With India’s new labour codes now being implemented, payroll structures and statutory obligations are undergoing major changes as well. Our detailed labour code blogs break down what employers need to prepare for.

According to the 2017 NGA Payroll Complexity Index, payroll complexity is impacted by key factors such as managing payroll and employee data, security and control in an ever more complex tax and legal landscape. Understanding challenges clearly and coming up with the right solution is the best way to overcome risks.

Industry

IT services

Location

India

Employees

1500+

Key Outcomes

- » 100% statutory compliance

- » Automated PF ECR generation

- » Reduced effort & time

- » Increased transparency

- » Higher productivity

- » Faster reporting

One of the most important concerns of an employer is to meet statutory compliances. Statutory compliance refers to the legal framework which organizations must abide by, with respect to the treatment of their employees. A lot of effort, time and money goes into ensuring that payroll is compliant through statutory audits. Since each company has unique payroll challenges, they need a solution which is reliable, customizable, integrated and meet all their requirements.

Despite numerous software providers, there are very few vendors that offer payroll solutions that are fully integrated with government statutory portals, leave, attendance, travel, loan, expense, timesheet and expense and claim management systems. Empxtrack payroll software has the capability to manage the entire process in an integrated manner – efficiently and smoothly. It supports:

- Computation of accurate taxes, PF, ESI, professional tax, gratuity, Labour Welfare Fund and other deductions.

- Generation of correct reports and challans

- Linking of government statutory portals for filing returns and remittances

Recently, Empxtrack team was approached by an IT company that was looking for a payroll solution that could be easily integrated with their Provident Fund portal. A software that could eliminate complexities in generating ECR file, reduce data upload time and minimize any data errors.

Here’s how Empxtrack provided a solution:

Payroll Solution that Meets Statutory Compliance Requirements

This case study is about an Information Technology company managing more than 1500 employees deployed in multiple cities. The organization wanted to replace their legacy payroll software to meet statutory compliance requirements, get better transparency and accuracy in the payroll management.

The case describes the challenges that the company faced, and the solution provided by Empxtrack team to increase intended usability of the payroll software for finance department as well as employees.

BUSINESS PROBLEM

The company faced a key challenge in maintaining statutory compliance and transparency in the payroll management. The Finance team perhaps found that their existing payroll software was old and lacked significant features to meet compliance requirements. The company was using other systems from a different vendor to meet compliance requirements.

Their legacy software was used only for calculation of employee salaries. It couldn’t be integrated with statutory portals, leave, attendance, timesheet, loan and advances, travel & expense, benefits management tools. The organization wanted to migrate to a comprehensive, configurable and integrated solution to meet its compliance needs.

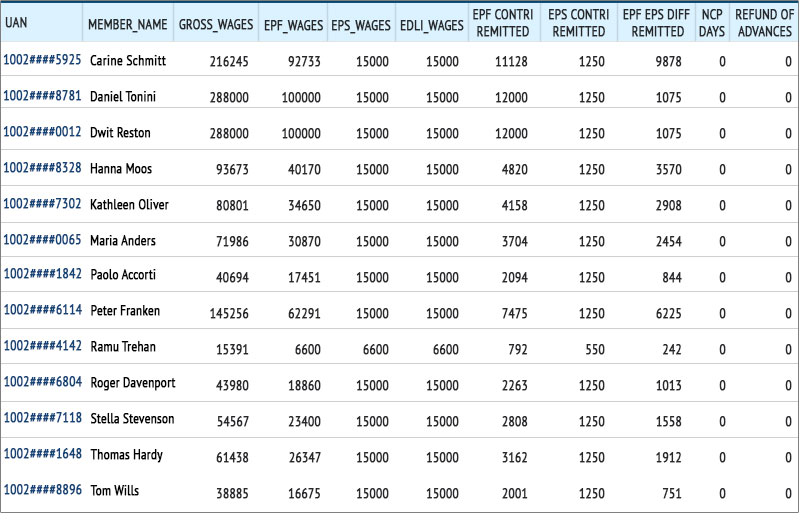

Processing and managing Provident Fund was a challenging task for the team. Every month, manual creation of a flat file in a specific government-trusted format with 11 fields required a lot of effort. The file needed details like employees’ UAN ids, monthly contributions made by employees and their employer, multiple wages and other details.

| Serial No. | Field Names |

|---|---|

| 1 | UAN |

| 2 | MEMBER_NAME |

| 3 | GROSS_WAGES |

| 4 | EPF_WAGES |

| 5 | EPS_WAGES |

| 6 | EDLI_WAGES |

| 7 | EPF_CONTRI_REMITTED |

| 8 | EPS_CONTRI_REMITTED |

| 9 | EPF_EPS_DIFF_REMITTED |

| 10 | NCP_DAYS |

| 11 | REFUND_OF_ADVANCES |

Image 1: List of mandatory fields that need to be filled when filling PF returns.</small >

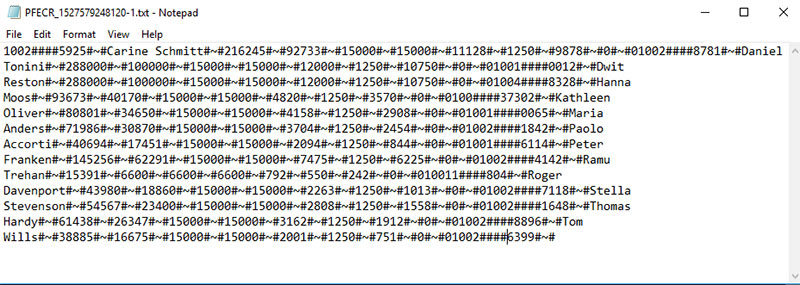

The data for each employee was generated according to their UAN number. Then this file was manually uploaded on the PF portal. This was a time-consuming and an error-prone task.

Image 2: Employee data prepared manually in a specific format.

Employees’ Provident Fund Organisation (EPFO) had already upgraded the process and reduced the complexity of the traditional process by introducing Electronic challan cum return (ECR) filing portal. Yet the organization faced difficulty in generating data in ECR file format accurately, due to the limited features in their legacy software.

The Finance team required a payroll software that could easily generate ready-ECR file to be uploaded on PF portal and make the task easier. Employees needed a quick way to find out whether their PF deductions were made on time and check the accuracy of deposited PF amount.

SOLUTION

The organization started looking for a solution and surveyed many products available in the market. They came across payroll solutions that were prohibitively expensive or did not offer required features. Empxtrack Payroll was demonstrated and soon the product implementation took place. It was best suited for their needs and the budget. Quick and easy integration of Empxtrack with statutory portals was the best feature that made an impact on the client.

With Empxtrack solution, the company found the most efficient way to calculate monthly PF contributions, develop PF ECR file in the latest format and upload it on the PF portal in just few minutes. The solution significantly impacted productivity of the payroll team. Empxtrack assured that ECR gets a timely process upgrade to migrate to the newer version of ECR under unified portal.

Image 3: Auto generated ECR file that can directly be uploaded on PF portal. Empxtrack can also generate a similar file for filling Arrear. The text file follows a standard format where #~# (hash tilda hash) is used as a separator – 100XXXX74743#~#NITESH KR#~#15000#~#15000#~#15000#~#1800#~#1250#~#550#~#40#~#0#~#0</small >

Earlier, the manual task of preparing flat file with data of 1500 employees used to take 2 or more days that could now be done automatically in just few seconds. It saved time & effort, increased accuracy, met statutory compliances and speed up payroll process.

Empxtrack provided employee self-service tools allowing employees to access payroll information on their own. This significantly cut down on HR and finance queries. Payroll Management became more transparent, hassle-free and employee-centric.

BENEFITS

- 100% Statutory Compliance The company now uses Empxtrack for PF, ESIC filing, Tax calculation, and other compliance processes.

- Increased Transparency – Employees can verify the accuracy of their monthly PF contribution.

- Reduced Effort – There has been elimination of numerous forms and creation of tables to prepare ECR file. The new system has even reduced administrative burden from the small payroll team.

- Increased Productivity – Payroll team can now save time and utilize it for accomplishing core operations.

- Better Employee Engagement – This simplified process has improved both long term employee satisfaction and happiness.

- Less Chances of Financial Leakage – The probability of data calculation errors has reduced to zero which has resulted into significant cost savings.

Integrating payroll software with HRIS and employee self-service tools offers multiple benefits.

- No Redundant Data When a payroll system is integrated with time, leave, attendance, employee database and other tools, the data can seamlessly move back and forth without additional workload of double data entry. The information is automatically updated in payroll system once the changes are made in HRIS, or vice versa. It saves time and effort in entering redundant data, thereby reducing chances of any mistakes.

- Faster Reporting It is difficult to manually collect data and generate reports from multiple disparate systems. When it comes to data analysing and reporting, an integrated system is more efficient. There are no challenges in integrating relevant data from two separate systems, and this reduces the complexity in generating reports.

- Better Collaboration Managing payroll, leave, attendance and employee records through a single interface aids in improving communication, collaboration and teamwork. Any changes made in one part of the system update the entire database and notify other teams.

- Improved Financial Planning With integrated solutions, financial planning in an organization becomes easier and accurate. All the available information can be used to forecast figures, while considering everything starting from employee wages to cafeteria costs. Quicker, easier access to accurate payroll information means better management reports for improved decision-making on costs and planning.

If you have been looking for an integrated payroll solution that performs all the monotonous, repetitive functions without a glitch and is completely scalable and user friendly, contact Empxtrack team.

Disclaimer: Maintaining security of our client data is our prime responsibility. The name of the company is not disclosed in the case study due to confidentiality agreement signed with our client. The images shown in this case study contain dummy data.

A must-read for HR professionals seeking a comprehensive payroll solution that prioritizes regulatory adherence and ensures that organizations foster a compliant work environment.