India is set to modernise its labour framework by replacing the 29 existing central labour laws. The move is aimed at modernising India’s labour workforce and is being called a “historic decision” by the government.

The four laws consolidating the existing labour laws are: the Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020), and Occupational Safety, Health and Working Conditions (OSHWC) Code (2020).

Together, these reforms are meant to safeguard workers’ rights and welfare and streamline compliance. They also modernise outdated provisions and create an efficient framework that will promote ease of doing business.

This blog highlights India’s new labour codes’ implications on workers and businesses.

Table of Contents

How the Labour Codes Will Affect Businesses and Workers

The new laws will affect both employers and employees. They aim to simplify both regulations and compliance for employers and ensure a uniform wage structure for workers, along with stronger social security protection. This will improve the working conditions of millions of workers in the country.

For businesses, the new labour codes introduce both opportunities and responsibilities. Small businesses may feel the impact of these reforms more sharply as the compliance requirements and rising payroll obligations could add to their administrative burden. They may experience short-term adjustment pressures as they adapt to the new rules.

Overall, the labour codes’ long-term impact is expected to be positive, which aims to reduce ambiguity and improve efficiency. Nevertheless, companies will be required to upgrade their payroll systems and strengthen their compliance processes to ensure better transparency and consistent alignment with the new statutory obligations.

With these reforms reshaping the employment framework, here is a closer look at the labour codes effect on employees.

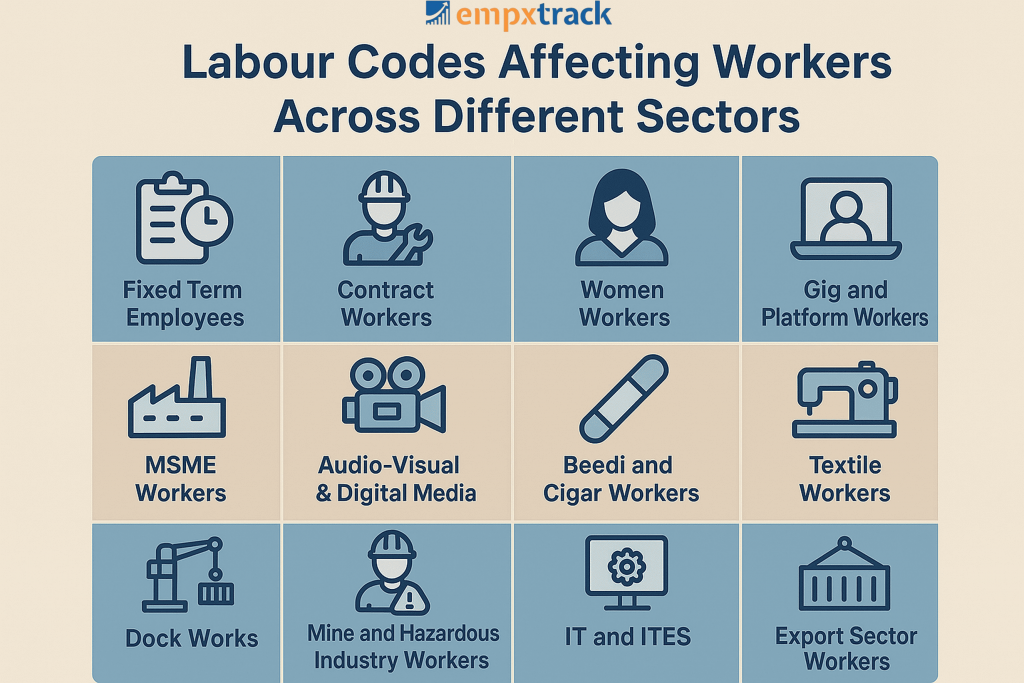

Benefits of Each Worker Category Across Key Sectors

The implementation of the four labour codes India introduces some of the most comprehensive workers’ protections with targeted reforms across critical sectors.

Fixed Term Employees

- » Fixed-term employees will become eligible for gratuity after one year, instead of five.

- » Moreover, they will get equal wages as the permanent staff, which will increase their income and protection.

- » Overall, this provision promotes direct hiring and reduces excessive contractualisation while offering cost efficiency to the employers.

Contract Workers

- » The principal employers have to provide welfare facilities such as health and safety measures. Employees will also get annual health checkups.

- » Furthermore, the principal employer is liable to pay unpaid wages to the contract worker in case the contractor fails to pay wages.

- » The law now includes a provision for appointing a designated authority responsible for offering guidance on core and non-core functions.

Women Workers

- » The codes ensure equal pay for equal work and gender discrimination is prohibited.

- » Women can work in all types of establishments and during night shifts with safety norms, provided they give their consent.

- » In addition, the new codes update the family definition for female employees by adding parents-in-law, ensuring wider dependent coverage and supporting inclusive policies.

- » The new codes ensure proportional representation of women in the grievance redressal committee (GRC) for gender-sensitive redressal.

- » Significantly, the new codes extend maternity benefits, including 26 weeks of paid maternity leave, to women in the unorganised sector.

Gig and Platform Workers

- » For the first time, gig worker, platform worker and aggregator are getting legal recognition.

- » As a result, social security coverage now extends to gig and platform workers.

- » Similarly, aggregators to contribute 1- 2% of annual turnover (capped at 5% of payments to such workers).

MSME Workers

- » Employers must guarantee a minimum wage and timely payment to their employees.

- » Workers will get access to facilities such as drinking water, rest areas, and canteens.

- » Provisions for paid leave, standard working hours and double overtime wages.

- » The Social Security Codes, 2020 incorporates coverage for MSME workers and links its applicability to the number of employees in the unit.

Audio-Visual & Digital Media Workers

- » Digital and audio-visual workers, including journalists in electronic media, dubbing artists, and stunt persons, will now receive full benefits.

- » In addition, they will get mandatory appointment letters which clearly state their designations, wages and social security entitlements.

- » Overtime work to be based on consent and should be paid at least double the normal wage rate.

- » Timely payments ensured.

Beedi and Cigar Workers

- » All workers will receive guaranteed minimum wages and timely payment.

- » Workers perform overtime based on consent and receive at least double the normal wage rate.

- » Working hours are limited to 8–12 hours per day, with a maximum of 48 hours per week.

- » Finally, workers are eligible for a bonus after completing 30 days of work in a year.

Textile Workers

- » All migrant workers, whether directly employed, engaged through contractors, or self-migrated, are entitled to equal wages, welfare benefits, and PDS portability.

- » They may also file claims for pending dues for up to three years, ensuring easier and more flexible dispute resolution.

- » Additionally, provision for double wages for workers who work overtime.

Dock Workers

- » All dock workers will receive formal recognition and legal protection.

- » Moreover, issuing of appointment letters is now mandatory to ensure access to social security benefits.

- » Provident fund, pension, and insurance coverage will apply to all dock workers, including those engaged on a contract or temporary basis.

- » Dock workers to get access to decent working conditions and safety. They will get mandatory medical facilities, including annual health checkups, first aid, sanitary and washing areas, etc.

Mine and Hazardous Industry Workers

- » Markedly, health and safety for every worker are ensured. Employers to provide free annual health checkups.

- » Specific commuting accidents may be classified as employment-related, provided they meet defined conditions related to time and location.

- » Each site is required to maintain a dedicated safety committee responsible for monitoring workplace safety and managing hazardous chemicals appropriately.

- » Women are permitted to work in all kinds of establishments, including underground mining, heavy machinery, and hazardous jobs, thus ensuring equal job opportunities.

IT & ITES

- » Disbursement of salaries by the 7th of every month is now mandatory.

- » Social security coverage is ensured through fixed-term employment provisions, and additionally, the issuance of formal appointment letters is a must.

- » Mandatory equal pay for equal work strengthens fairness in the workplace and also supports increased participation of women in the workforce.

- » Prompt resolution of harassment, discrimination, and wage-related disputes.

Export Sector Workers

- » Fixed-term employees will be eligible for gratuity, provident fund (PF), and all other applicable social security benefits.

- » Further, all workers will have the right to avail annual leave after completing 180 days of service within a year.

- » Workers are entitled to timely wage payments, protection from unauthorised deductions, and freedom from any wage ceiling limitations.

- » Women can opt to work night shift, provided they give their consent, thus enabling greater opportunities to earn a higher income.

- » Comprehensive safety measures such as written consent, overtime at double wages, safe transport facilities, CCTV coverage, and security support are mandatory.

Additional Reforms

In addition to industry-specific changes, India’s new labour codes implement several broader, system-wide reforms.

- » National Floor Wage to ensure that no worker receives a wage below the minimum standard of living.

- » Gender neutral employment and job opportunities to explicitly prohibit discrimination, including against transgenders.

- » An Inspector-cum-Facilitator model that prioritises supportive compliance measures and awareness-building over strict penal action.

- » A faster dispute resolution system through two-member Industrial Tribunals, with workers and employers allowed to approach the tribunal directly after conciliation.

- » A single registration, a single licence, and a single return for all safety and working-condition requirements, thus eliminating multiple overlapping filings.

- » Establishment of a National OSH Board responsible for formulating harmonised safety and health guidelines across sectors.

- » Safety committees are mandatory in establishments with 500+ workers, therefore improving workplace accountability.

- » Increased factory applicability thresholds reduce regulatory pressure on small units while ensuring comprehensive worker protections remain in place.

- » Companies with up to 299 employees can now lay off staff without government approval (the threshold is raised from 100 to 300).

- » Smaller firms get greater flexibility with fewer compliance requirements on employment conditions.

Why Are Small Businesses Concerned

Small businesses have raised concerns about India’s new labour codes. Particularly, the impact of labour codes on small businesses in terms of costs and compliance cannot be ignored.

Compliance Pressure on MSMEs

Many MSMEs feel that payroll costs are set to rise due to a broader and better-defined social security net. Moreover, the introduction of guaranteed minimum wages, specified working hours, double overtime pay, and paid leave further adds to their financial burden.

According to the Association of Indian Entrepreneurs (AIE), the likely increase in operational costs for MSMEs is a concern.

Moreover, it comes at a time when businesses are already struggling with the existing challenges like inflation and rising capital costs. Hence, more clarity, transitional support, and flexible implementation mechanisms from the government are needed.

Administrative Readiness

The complexities of these new rules may not be manageable for small units that lack dedicated HR or legal teams. They may still struggle with understanding and implementing new registration, reporting, and record-keeping requirements.

Moreover, mandatory appointment letters and clear rules on timely payment of wages are expected to push small businesses to move workers onto proper rolls. They will additionally have to maintain clean, accurate muster and payroll records and upgrade payroll software.

Fear of Penalties

Even with the shift towards a facilitative enforcement approach, small businesses are anxious about potential fines or legal action if compliance is imperfect during the transition period.

Hence, SMEs should be protected from sudden regulatory pressure, and the Codes’ implementation must stay sensitive to their capacities. Otherwise, the reforms could unintentionally slow down job creation and discourage new entrepreneurs.

Key Takeaways for HR Leaders

- ● Fixed-term employees gets permanent benefits

- ● Universal minimum wage guaranteed to everyone

- ● Gratuity after 1 year, instead of 5 for fixed-term employees

- ● Mandatory appointment letters for all workers

- ● Gig and platform workers recognized

- ● Annual leave after 180 days of work in a year

- ● Free annual health checkups for all workers above the age of 40

- ● Pan India ESIC coverage, including small and hazardous establishments

- ● Night shift allowed for women. Equal pay for equal work

- ● Migrant workers entitled to equal pay, welfare benefits, and PDS portability

- ● Commuting accidents now qualify for compensation

- ● Safety committees for establishments with more than 500 workers

- ● One registration, one license, one return

- ● Digitization of registers and records

- ● Faster dispute resolution through two-member industrial tribunals

Why Your Take-Home Salary May Come Down

The government is expected to announce detailed rules in the coming weeks. Although the companies will be required to restructure their salary frameworks to comply with these new rules and regulations.

According to the new regulations, an employee’s basic salary must constitute at least 50% of their total CTC. This adjustment will consequently result in higher contributions as both the PF and gratuity calculations are based on an individual’s basic pay.

Even though these changes ensure enhanced retirement benefits for workers but it also means a reduced take-home salary, as the increased contribution is going to come from the existing CTC under India’s new labour codes.

Conclusion

The implementation of the new labour codes represents a significant step in India’s labour landscape.

While these codes aim for stronger worker protection and simplified compliance, small and medium businesses will likely need some time and support to adapt to these changes thereafter.

Ultimately, the success of India’s new labour codes depends on smooth implementation and a collaborative approach between employers, workers and the government.

We have also provided an easy-to-follow & actionable compliance checklist for 2026 for HR and employers.

Frequently Asked Questions

Q1. | How will the new labour codes affect take-home salary? |

| Ans. | The new labour codes require Basic and DA to be at least 50% of the total wages according to the new definition of wages, which in turn increases PF contributions. And as PF contributions will increase, consequently, employees may see a decrease in their take-home salary. |

Q2. | Why are small businesses concerned about the new labour codes? |

| Ans. | Small businesses are concerned as it may increase the compliance requirements, payroll costs and statutory contributions. Additionally, they are also concerned about the reduced flexibility in hirings, exits, which could increase their costs. |

Q3. | Are industries required to revise all appointments and contracts? |

| Ans. | Many industries will likely need to revise their appointment letters and employment contracts in order to remain compliant. However, whether a full rewrite is required depends on how closely existing documents already align with the statutory compliance standards. |

Q4. | What sectors will see the biggest impact? |

| Ans. | Usually, sectors with large workforces, high contract labour usage, or round-the-clock operations will feel the biggest impact. For instance, this includes manufacturing, construction, logistics, e-commerce, retail, IT/ITeS, hospitality, and gig-economy platforms. |

Q5. | Do the new codes change termination rules? |

| Ans. | The new labour codes in India raise the threshold for government approval of layoffs from 100 to 300 employees, allowing smaller establishments more flexibility. Nevertheless, employers must still follow notice and retrenchment compensation rules and contribute to a re-skilling fund for retrenched workers. |

Q6. | Can contract workers be employed in core activities? |

| Ans. | Yes, under India’s new labour codes, contract workers can be employed in core activities, but with stricter regulations. |

Q7. | Are gig and platform workers covered under social security? |

| Ans. | The gig and platform workers are legally recognised and covered under the social security code. |

Q8. | Do small businesses need to issue appointment letters? |

| Ans. | Yes, after the implementation of the four labour codes, all businesses, including the small ones, are required to issue appointment letters. |

Q9. | Are women allowed to work night shifts under the new codes? |

| Ans. | Yes, women are allowed to work night shifts, provided they give their consent and all mandated safety measures are in place. |

This gives a clear picture of what the new Labour Codes mean for workers, MSMEs, and HR teams. A useful read for understanding the practical changes coming ahead.

This is one of the clearest breakdowns of the new labour codes I’ve come across, especially in explaining how the reforms reshape both worker protections and business responsibilities. The section-wise insights into different worker categories make it much easier to understand the practical impact across industries. This kind of structured and jargon-free explanation is genuinely helpful for HR teams, employers, and employees alike.