This blog describes rules for ESI and PF Deduction, where ESI is Employee State Insurance (ESI) and PF is Provident Fund (PF). These are two social security schemes available to employees working in India.

However, payroll administrators often struggle to keep up with the latest standards in these 2 areas. This leads to wrong deductions and deposits, queries from government departments, the dreaded scrutiny, and even fines.

Significant information is available on the web and the government websites. But that is often contradictory, confusing, poorly written, or sometimes even wrong or misleading.

This blog explains both schemes and describes the Rules of ESI and PF Deduction in detail. These rules are updated in this post whenever there are changes in government schemes. This helps you implement Best Practices of Payroll Processing in your organization.

Note: All figures, eligibility criteria, and contribution rates mentioned in this blog are updated for FY 2024–25 and are valid as of October 2025.

Employees’ State Insurance (ESI) Scheme

ESI is a contributory fund that enables Indian employees to participate in a self-financed, healthcare insurance fund with contributions from both the employee and their employer.

The scheme is managed by Employees’ State Insurance Corporation, a government entity that is a self-financing, social security, and labor welfare organization.

The entity administers and regulates ESI scheme as per the rules mentioned in the Indian ESI Act of 1948.

ESI is one of the most popular integrated need-based social insurance schemes among employees. The scheme protects employee interest in uncertain events such as temporary or permanent physical disability, sickness, maternity, injury during employment, and more. The scheme provides both cash benefits and healthcare benefits.

Eligibility for ESI

ESI scheme applies to all types of establishments, including corporates, factories, restaurants, cinema theaters, offices, medical and other institutions. Such units are called Covered Units.

What is the criteria for Covered Units

- – All units that are covered under Factory Act and Shops and Establishment act are eligible for ESI.

- – Where 10 or more people are employed irrespective of their monthly earnings.

- – Units which are located in the scheme-implemented areas. In 2025, the national implementation status of the ESI scheme stands as follows:

Total Districts Covered (Fully + Partially): 689

Fully Notified Districts: 586

Partially Notified Districts: 103

Non-Notified Districts: 89

Total Districts in India: 778 - – The ESIC launched SPREE 2025, a special initiative aimed at expanding social security coverage under the Employees’ State Insurance (ESI) Act. This scheme is active from 1st July to 31st December 2025. It offers a one-time opportunity for unregistered employers and employees, including contractual and temporary workers to enroll without facing any inspection or demands for past dues.

All the establishments covered under the ESI act and all the factories that employ more than 10 employees (in some states, 20 employees) and pay a maximum salary of INR 21,000 per month (Rs. 25,000 for employees with disability) must register with ESIC and contribute towards the ESI scheme.

How to identify eligible employees?

All employees of a covered unit, whose monthly incomes (excluding overtime, bonus, leave encashment) does not exceed Rs. 21,000 per month (or Rs. 25,000 for employees with disabilities), are eligible to avail benefits under the Scheme. The ESIC has fixed the contribution rate of the employees at 0.75% of their wages and the employer’s contribution at 3.25% of the wages.

Employees earning a daily average wage up to Rs. 176 are exempted from ESIC contribution.

However, employers will contribute their share for these employees.

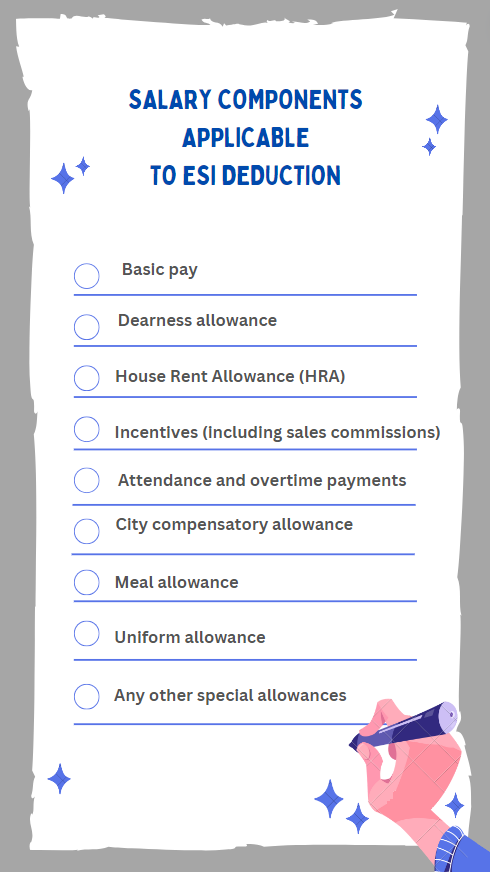

What salary components are applicable to ESI deductions?

ESI contributions (from the employee and employer) are calculated on the employee’s gross monthly salary.

Most people face challenges in understanding ESI deduction rules because they aren’t clear about the concept of Gross Salary. So let us explain this concept first.

Gross salary is described as the total income earned by the employee, while working in their job, before any deductions are made for health insurance, social security and state and federal taxes.

For ESI calculation, the salary comprises of all the monthly payable amounts as shown in the image:

The gross monthly salary, however, does not include Annual bonus (such as Diwali bonus), Incentive bonus, Service charges, Gazetted allowance, Saving scheme, Retrenchment compensation, Encashment of leave and gratuity, and more.

Collection of ESI Contribution

It is the employers responsibility to contribute to the ESI fund by deducting the employees’ contribution from wages and combining it with their own contribution.

An employer is expected to deposit the combined contributions within 15 days of the last day of the Calendar month. The payments can be made online or to authorized designated branches of the State Bank of India and some other banks.

ESI Calculations

The rates of contribution, as a percentage of gross wages payable to the employees, is explained in the table below

| Percentage of Gross Pay | Example Gross Salary | Contributions | |

| Employee Deduction | 0.75% | Rs 15,000 | 15,000 * 0.75% = 112.50 |

| Employer Contribution | 3.25% | 15,000 * 3.25% = 487.50 | |

| Total Contributions for this employee | 112.50 + 487.50 = Rs 600.00 | ||

In case, the gross salary of the employee exceeds Rs. 21,000 during the contribution period (explained next), the ESI contributions would be calculated on the new salary and not Rs 21,000.

Contribution Period and Benefit Period

Payroll administrators often face confusion when employees salaries change – especially when the monthly salary exceeds the ESI limits of Rs 21,000.

To handle this situation, ESI has a concept of contribution periods during which the ESI contributions have to continue, even when the salary exceeds the maximum limits.

There are two contribution periods each of six months duration and two corresponding benefit periods also of six months duration.

| Contribution Period | Cash Benefit Period |

| 1st April to 30th September | 1st January of the following year to 30th June |

| 1st October to 31st March of the following year | 1st July to 31st December |

After the commencement of a contribution period, even if the gross salary of an employee exceeds Rs. 21,000 monthly, the employee continues to be covered under ESI scheme till the end of that contribution period.

The contribution is deducted on the new salary. Let us look at an example to understand this better.

If an employee’s gross salary increases in June from Rs. 18,000 (within ESI limit) to Rs. 22,000 (above ESI limit), the deductions for ESI will continue to happen till the end of the ESI contribution period i.e. September.

And the deduction amount for both the employee and employer will be calculated on the increased gross salary of Rs. 22,000.

At the end of the contribution period, if the employee salary is more than the ESI limit, no further deductions and contributions are required. The employee will still be covered under ESI till 30th June of the following year.

Similar rules apply when an employees salary increases in the 2nd contribution period.

Rules related to Employee Provident Fund (EPF)

Just like the ESI scheme, the Employees Provident Fund (EPF) is a Contributory fund with contributions from both the employee and their employers.

While the focus of the ESI scheme is healthcare, Provident Fund is focused towards post Retirement Income and Benefits.

EPF is a compulsory and contributory fund for Indian organizations under “The Employees’ Provident Fund and Miscellaneous Provisions Act 1952”.

Employee and Employer Contributions to the Employee Provident Fund (EPF)

For EPF, both the employee and the employer contribute an equal amount of 12% of the monthly basic salary of the employee. The contributions are payable on maximum wage ceiling of Rs 15,000.

Employees can voluntarily contribute more than 12% of their salary, however the employer is not bound to match the extra contribution of the employee.

The PF deduction rate of 10% is only applicable to some establishments where less than 20 employees are employed and they meet the following conditions:

- – If it is a sick industry declared by BIFR

- – If industry belongs to brick, jute, beedi, gaur and coir industries

- – If an organization is operating with a wage limit of Rs 6,500

- – If an organization has seen annual loss which is more than its net value

For PF contribution, the salary comprises of fewer components:

- – Basic wages,

- – Dearness Allowances (DA),

- – Conveyance allowance and

- – Special allowance.

The employers monthly contribution is restricted to a maximum amount of Rs 1,800. Even if the employee’s salary exceeds Rs 15,000, the employer is liable to contribute only Rs 1,800 (12% of Rs 15,000).

For international workers, wage ceiling of Rs 15,000 is not applicable.

Details of EPF

The statutory compliance associated with PF contribution has some lesser known facts associated with it.

The contributions by the employee and employer are divided into two separate funds:

- – EPF (Employee Provident Fund) and

- – EPS (Employee Pension Scheme).

The breakup happens as follows:

| Employee | Employer | |

| Total contribution | 12% of monthly salary | 12% of monthly salary (subject to a maximum of Rs 1,800) |

| Employee Pension Scheme (EPS) | 0 | 8.33% (of the 12%) |

| Employee Provident Fund (EPF) | Full amount | 3.67% (of the 12%) |

| Example Monthly Salary: Rs 12,000 | ||

| Total Contribution | 12,000 * 12% = Rs 1,440 | 12,000 * 12% = Rs 1,440 |

| EPS | 0 | 12,000 * 8.33% = Rs 999.60 |

| EPF | Rs 1,440 | 12,000 * 3.67% = Rs 440.40 |

Provident Fund Withdrawal Rule

A PF account holder can withdraw up to 75% of the total amount if they have been unemployed for more than a month. And the remaining 25% after 2 months. On retirement, the full balance can be withdrawn without any limit.

The offline PF withdrawal process usually takes upto 20 working days, and online PF withdrawal takes upto 3 working days.

An employee cannot withdraw full or partial PF until he/ she is employed. Full PF balance can be withdrawn only if the employee has been unemployed for at least 2 months or the joining date of the new job is more than 2 months from the last working day at the previous employer.

In any case, if an employee withdraws ₹50,000 or more within 5 years of opening a PF account, then a TDS of 10% is applicable on the withdrawal (provided you have a valid PAN card) or 20% (if you don’t have a PAN card).

How an Automated Payroll Software helps implement Rules for ESI and PF Deduction

Manual computation of statutory compliances involves lot of paperwork and filling in of challans and forms on paper and submitting them to banks. This makes the process time-consuming, can introduce inaccuracies and can often lead to mistakes.

Both the ESI and PF departments encourage online filing and payments.

It is advisable to use automated payroll processing tools to calculate ESI, PF and income tax deductions..

A good payroll management software puts an end to increased complexities of payroll processing and offers following benefits:

- – Accuracy in PF, ESI and other statutory calculations

- – Increased transparency in payroll processing

- – Reduced number of queries from employees

- – Higher compliance

- – Lower load on payroll administrators

Empxtrack Payroll Processing Software helps in automating and simplifing the deduction processes. All deductions ranging from PF, PT, ESI, TDS, LWF are easily managed using Empxtrack. The software automatically calculates all these and also takes care of the latest changes in income tax rules.

Frequently Asked Questions

Q1. | What is PF in salary? |

| Ans. | Provident Fund, EPF is a retirement savings scheme for salaried employees. It is a contributory fund with contributions from both the employee and their employers. PF in salary is focused towards post-retirement income and benefits. |

Q2. | How to do PF calculation on basic salary? |

| Ans. | Any employee drawing a basic salary of less than Rs 15,000 per month has to become a member of the EPF. As per the formula of PF, the PF percentage calculation on basic salary is as follows: The employee pays 12% of their monthly salary. The employer pays 12% of the employee’s monthly salary (subject to a maximum of Rs 1,800) |

Q3. | What is ESI and how is it calculated? |

| Ans. | ESI is a self-financing social security and health insurance scheme for employees. It is contributory in nature and funded by both employees and employers. Currently, the employee’s contribution rate is 0.75% of their wage, and the employer’s contribution is 3.25% of the wage, which is paid in every wage period. |

Q4. | Who is eligible for ESI? |

| Ans. | Employees are eligible for coverage under the Employees’ State Insurance (ESI) scheme if they: ● Work in a non-seasonal factory or establishment that is covered under the ESI Act. ● Earn wages up to ₹21,000 per month (or ₹25,000 per month in the case of persons with disabilities). ● Are employed in sectors such as shops, hotels, restaurants, cinemas, road transport, newspaper establishments, private medical and educational institutions, or municipal bodies, as notified by the respective State or Central Government under Section 1(5) of the Act. |

Q5. | Which salary components are considered for ESI calculation? |

| Ans. | ESI is calculated on total monthly earnings, which include components like basic pay, dearness allowance (DA), house rent allowance (HRA), city compensatory allowance, and other regular allowances such as meal and uniform allowances. |

Q6. | How often is ESI contribution deposited? |

| Ans. | ESI contributions are deposited by the employer on a monthly basis. |

Q7. | What is the contribution period and benefit period in ESI? |

| Ans. | There are two contribution periods, each of six months’ duration, and two corresponding benefit periods, also of six months’ duration. These are: Contribution period: 1st April to 30th Sept and 1st Oct to 31st March of the following year Benefit period: 1st Jan of the following year to 30th June and 1st July to 31st December |

Q8. | What are the components of PF contribution? |

| Ans. | PF contribution has two main components, employee’s contribution and employer’s contribution. Employee’s contribution: 12% of their monthly salary Employer’s contribution: 12% of the monthly salary The employer’s contribution is split, with 8.33% going to the Employee Pension Scheme (EPS) and the remaining 3.67% going to the Employees’ Provident Fund (EPF). |

Q9. | Can PF be withdrawn before retirement? |

| Ans. | Yes, the PF can be withdrawn before retirement under some specific conditions allowed by the Employees’ Provident Fund Organisation (EPFO). Complete withdrawal: A member can withdraw 75% of the PF balance after 1 month of unemployment and the remaining 25% after 2 months. Partial withdrawal: Partial EPF withdrawal is allowed only for specific reasons such as marriage, education, medical, land purchase, etc., with each having a limit. |

Q10. | How can automated payroll software help with ESI and PF deductions? |

| Ans. | A good payroll management software simplifies the complexities of payroll processing and offers the following benefits: ● Accuracy in PF, ESI, and other statutory calculations ● Increased transparency in payroll processing ● Reduced number of queries from employees ● Higher compliance ● Lower load on payroll administrators |

Both employee and employer PF contributions are being deducted as part of employee salary structure. While the employee’s contribution is already accounted for under Section 80C, I would like to confirm under which section the employer’s PF contribution should be shown in Form 16, to ensure it is not treated as taxable income—provided it falls within the prescribed limits.

Employer’s PF contribution is not included in taxable salary of the employee’s Form 16, so it doesn’t need to be claimed under any section by the employee.

Hi my organisation is deducted employee pf and esi and employer pf and esi from my gross salary now I am confuse is it they are deducting correctly how I will get know that are deducting

You can consult your HR or accounts department and clarify this.

Hi my company is pvt ltd. ( services industries – manpower supplies) under it we are 4 employee that are working under 40k salary and my company told me that we cant deduct your pf and esic because your salary is more then the govt norms. ?

As you have less than 20 employees, PF is not mandatory to deduct for your employees. Although, if you wish to deduct then you can go for the PF registration process.

The Contribution is

Basic Salary/Total Days of Month * Working Days

In this blog, learn the rules for ESI and PF deduction, including how to calculate employee and employer contributions. A great resource to ensure compliance and proper payroll management!

And Can this be changed mid way i.e., and employee is being paid at 12%- can this be changed to Rs.1800 Max?

Hello, your article is really helpful. We have a query, our private limited company (construction industry) is having two employees (both are the directors). For getting work order from a client, they are asking us to have ESI & PF registration. Though by government norms we are not in the mandatory condition. But, as we need to take the work order, we have submit those documents to them. May you please let us know that can we do the ESI & PF just for the two employees (their monthly salary is above 40k).

Yes, you can obtain ESI and PF registration for just the two employees, even if it’s not mandatory. Just ensure you comply with the relevant rules for contributions and documentation.

what if as an employer, i deducted less PF. So i did not know my employee has foreign passport and not citizen of India. I came to know mid year, hence from mid- year i started deducting 12% on gross pay and not basic as required for foreign nationals. But will i have to deduct and pay arrears on previous months? What if employee has left now?

Since you realized this mid-year, you should ideally calculate the shortfall in PF contribution for the months where you deducted less than the required 12% on gross pay. Arrears would apply for these months. It is your responsibility as the employer to pay the arrears (the difference between what should have been deducted and what was actually deducted) to the PF authorities. This needs to be done even if the employee has left the organization.

The employee’s PF account should reflect the correct contributions made during their tenure with your organization.

If possible, communicate with the employee about the situation and the corrective actions you’re taking.

If the employee count has increased more than 20 employees for a medical college but eligible employees are only 13 should we still go in for PF and ESI deduction for that entity. please clarify

What components should be included while calculating PF and ESI in an employee’s salary?

To calculate the EPF amount, Basic Salary and Dearness Allowance are considered. One also has to see the ‘Salary Capping’. PF contributions are mandatory for employees earning up to a certain salary cap (currently Rs. 15,000 per month).

For ESI, Gross Salary and Contribution Rate are considered. The employer and employee each contribute a percentage of the gross salary towards ESI (currently 3.25% and 0.75%, respectively). ESI contributions are mandatory for employees earning up to a certain salary cap (currently Rs. 21,000 per month).

Hello Everyone

i am confuse to make CTC structure as per government PF rules. kindly help me how can i made structure componants and PF deduction on only basic or basic+ HRA

Dimpal Trivedi

You can include multiple salary components in the CTC, such as Basic, HRA, Special allowance, conveyance allowance, medical allowance, gratuity, ESI, performance linked remuneration, and others. The salary structure may vary depending upon the different grades of your employees.

Usually the basic salary is 50% of the CTC. Many of the components, such as gratuity, HRA, etc., are often calculated based on the percentage of basic salary. Hence, it is beneficial for the basic salary to be at least 50% of the CTC.

For PF deduction, you can opt from any of these rules:

12% of the basic salary

12% of the basic salary, maximum Rs. 1800

12% of the Gross salary minus HRA, maximum Rs. 1800

12% of the Gross salary minus HRA

Hello everyone.

I want to help from everyone regarding my question.

My question is if any employee salary more than 25000 thousand then can we deduct his pf according to pf rules or can we show him exempted employees.

Please give me reply regarding my question quickly.

All salaried employees in India earning a basic salary of up to Rs. 15,000 per month are eligible to contribute to EPF. However, employees earning more than Rs. 15,000 per month may still choose to contribute voluntarily.

Whether ESI/PF is mandatory or not for daily wage workers or weekly salaried workers.

ESIC and PF are subject to the number of employees in the company, irrespective of whether they are daily wage workers or weekly salaried employees.

Companies with 20 or more employees must register for EPF. ESIC registration is mandatory for companies with over 10 employees and monthly wages below or up to Rs. 21,000 (Rs. 25,000 for employees with disabilities).

ESIC contributions are set at 0.75% for employees and 3.25% for employers, with exemptions for those earning up to Rs. 176 daily. For PF, it applies to permanent daily wage workers, with a 12% monthly salary contribution.

I’m planning to start a retail garments store with around 50 employees. The salary for half them of 16-17k but the other half will start with 14k per month. I’m also providing them with accommodation which almost comes down to 1000 per person which i plan on deducting from their salaries. Do i have to deduct PF for all of them or just the ones with salaries less than 15000. I’ll deduct and contribute ESI for all my employees. Just a little confused about the PF rules.

As you have more than 20 employees, PF will be deducted for all your employees.

You may opt out any of the 4 PF rules for PF deduction:

12% of basic

12% of basic max Rs. 1800

12% of Gross – HRA max Rs. 1800

12% of Gross – HRA

Under which provision is the 1800 Max allowed even where the basic is more than 15K?

1800 Max allowance is based on company policy and is available regardless of the basic salary once a certain threshold is met.

Secondly, it is permissible to adjust an employee’s allowance mid-way to the maximum of Rs. 1800 if it aligns with company policies and contractual agreements.

I have recently started a web site, the information you provide on this website has

helped me tremendously. Thanks for all of your time & work.

Clarification Regarding EPF Deduction By the Employer

In case any employee wants to rewarded EPF on total salary of 20000/- i.e, 2400 per month.Then the Employer can Deposit EPF on 15000/- i.e, 1800 per month. Kindly Clarify.

yes, Employer maximum contribution only 1800.

How to Deal with the SCN given by the ESI department due to the reason of Late regestration of employees in Esi Portal

When a show-cause notice is issued to an employer by ESIC, it is important to reply within 15 days. Make sure to specify the reason for late registration and provide all the required documents to regional and sub-regional offices.

Hi, My employer started PF deduction from this month & he is deducting employee+ employer contributin both from my CTC including that he is deducting 1% Administrative charges also from my Gross salary.

is it correct?

As per the sources, the current EPF Admin charges are 0.50 %, subject to a minimum of Rs. 75 per month for every non-functional establishment having no contributory member and Rs 500/month/establishment for others.

If a person works with employer A for first 15 days with monthly gross salary 22000/_ and the next 15 days with employer B with monthly gross salary of 22000/- how will EMPLOYER A and employer B calculate the EPF contribution as the maximum mostly limit of contribution is only 15000/-???

Employer A and Employer B would calculate EPF contributions based on the actual wages earned by the employee during their respective employment periods. This calculation is subject to the statutory limit of ₹15,000. Any amount exceeding this limit would not be subject to EPF contributions.

Both employers would calculate PF contributions on the portion of the salary that falls within this limit (as per the PF rule followed in their organization).

Dear Sir,

I have 3 emploees in my Firm their Gross salary is 18000 + DA 6000 = 23000/- We wish to pay them PF & ESIC can we deduct PF and contribute to PF fud & ESIC

ESI registration applies to all factories or entities that employ 10 or more persons who have a maximum salary of Rs. 21,000.

On the other hand, PF deduction eligibility for a salaried employee with less than Rs. 15,000 per month (basic + dearness allowance), it is mandatory to open an EPF account by the employer. However, employees earning more than ₹15,000 can also voluntarily stay in the EPF scheme.

SIR, MY QUESTION IS MY FRIENDS SALARY IS BASIC RS.16000, CA – 1000, WA-400 AND THEY ARE DEDUCTING ESIC OF RS.120/- PER MONTH BUT AS I AS DO NOT WANT TO DEDUCCT PROVIDENT FUND I HAVE GIVEN LETTER AND PF IS NOT DEDUCTED. BUT NOW, SUDDENLY THEY ARE INSISTING FOR DEDUCTION OF PF, AS PER MY KNOWLEDGE IF THE SALARY IS ABOVE 15000/- NO NEED OF DEDUCTING PF ONLY ESIC IS ENOUGH PLEASE HELP ME WHETHER IT IS COMPULSORY THAT BOTH ESIC AND PF SHOULD BE DEDUCTED OR ONLY ESIC IS ENOUGH

Employees are covered under ESIC if their salary is below Rs. 21,000 per month and the organization is covered under ESI.

Since the salary of your friend is less than 21,000, they are eligible for ESIC deduction. As per the ESI Act, the employer contributes 3.25% of the wages, and the employee contributes 0.75% of the wages to the contributory fund, which is then used to provide insurance cover to the employees.

Whereas PF deduction eligibility for a salaried employee with less than Rs. 15,000 per month (basic + dearness allowance), it is mandatory to open an EPF account by the employer. However, employees earning more than ₹15,000 can also voluntarily stay in the EPF scheme.

I have two employee salary less than 20K and I have ESIC no, it was issued while I have incorporated my OPC. Do I need to Pay ESIC for them.

Since the salary of your employees is less than 21,000, they are eligible for ESIC deduction. As per the ESI Act, the employer contributes 3.25% of the wages, and the employee contributes 0.75% of the wages to the contributory fund, which is then used to provide insurance cover to the employees.

If salary is less than 21000 and registered for PF and then still ESI is mandatory?

Yes. All the establishments covered under the ESI Act and all factories that employ more than 10 employees and pay wages below Rs. 21,000 per month (Rs. 25,000 for employees with disability) must register with the ESIC and contribute towards the ESI scheme

MY CTC IS 24999

BASIC PAY – 13914

HRA – 4174

COVEYANCE ALLOWENCE – 1600

MEDICAL REIMBURSEMENT – 1250

SPECIAL ALLOWENCE – 2252

MY GROSS SALARY – 23191

PF DEDUCTION -1669

AND EMPLOYER DEDUCTION -1808

SO KINDLY CONFIRMED IS THAT NECESSARY TO DEDUCTED 2 TIME PF IN MY SALARY

For EPF, both the employee and the employer contribute an equal amount of 12% of the monthly salary of the employee. Employees can contribute more than 12% of their salary voluntarily, however, the employer is not bound to match the extra contribution of the employee.

In your case, your employer seems to have deducted PF for both contributions (employee and employer) from your salary. It must have been mentioned in your offer letter at the time of joining

it’s not 2 times deduction, 13914+4174+1600+1250+2252=23191+PF1669(13914*12%)=TOTAL 24859 THIS IS CORRECT CALUCULATION, EMPLOYER CONTRIBUTION IS GAIN FOR US,(13914*13%)

BUT ABOVE CALCULATION IS = 13914+4174+1600+1250+2252=23191+PF1808)=TOTAL 24999

EMPLOYEE CONTRIBUTON 12% + EMPLOYER CONTRIBUTION 13% = TOTAL 25%

Sir my salary is more than 21730: So I do not want to deduct EPF from my salary then sir any such rules or form

Dear Dinesh

If you r in PF your contribution will be deducted & deposits with PF authuthorities, no matter what’s your Basic/applicable salary.

Hi its Teena I just want to confirm that my total salary is 9000 and for the last 2 years my PF was decreasing from my full salary and now after 2 years suddenly my basic pay has been reduced and the PF has been reduced from it. And this work was done to save money.

Basic – 5400+HRA – 2250+CA – 1350+ Total – 9000+PF 648+ESI – 68. In hand 8284.Before changes my Pf was deducted from my full Salary that is 9000 and PF is 1080

I just want to know if it is correct or not. If not, please tell me what action can be taken on doing this work

As per practice, basic will not be reduced, it is never advisable to reduce basic.

If your basic is reduced then u have to check what all formalities was done to do so.

As it is objectionable matter

Basic+DA is not reduced because as per law whenever minimum wages is decided according to there category like unskilled, semi skilled, skilled or highly skilled it should be remain same according to law.basis is 5400 is totally worng.

Dear Concern

As per salary prescribed by your employer, the deduction rates are corrects.. no need to take further action on this matter..if you have any queries let me know..

Aadi Sharma

Hi, If the salary is 25000/- before any deduction and the contribution of the employer is 40% on the 25000/- i.e. (10000 x 12%=1200) and the employee share will be on the gross i.e.25000/-( in his own willingness ) which comes to 3000/- and how to file enter in the ecr ? can you please explain,it very urgent Please confirm if this is correct UAN NUMBER#~#NAME OF THE EMPLOYEE#~#25000#~#10000#~#10000#~#10000#~#3000#~#833#~#367#~#0#~#0

Hello, one of our employee’s monthly CTC is Rs. 22,000/-. The deduction includes Rs. 200 Professional Tax, Rs. 1430 Employer PF, Rs. 1320 PF Employee. So the total deduction is Rs. 2950. Hence the gross will go around 19,000. So do we still have to deduct ESI? Or PF Amount Deduction is considered as a part of Gross Salary? Thank you.

As per ESIC rules, if an employee getting monthly payable salary upto 21000 then he is liable to pay ESIC contributions.

Yes u have to

Suresh

As an employee, can I take only ESI ?… I dont want to contribute for EPF… please suggest

Yes, you can take only ESIC benefits and not contribute to PF, if your monthly gross salary is falling under the ESIC limit i.e 21000 per month.

Respected sir,

my basic salery is 18000 thosand and CTC 33000 thosand. how much pf will deducted and its deduction is mandatory or not?

and 33000 ctc included with EL and not according to rules?

If an employee wants to opt out of PF, he need to fill out Form 11 at the time of joining his first job. If you have contributed in PF scheme earlier then you need to continue your PF contribution.

There are three PF rules: 1) 12% of basic+DA 2) 12% of basic+DA with 1800 Maximum capping. 3) 12% of Gross-HRA with 1800 maximum capping 3) 12% of Gross-HRA with 1800 Maximum capping.

How many days to from start leave eligibility in esic

MY EMPLOYER WANT REMITE PF AMOUNT MORE THAN 1800 AS MY BASIC+ALLOWANCE WILL COME TO 40000 AND EMPLOYER IS READY TO REMIT 4800 CAN WE DO SO REPLY ME

Yes, you can contribute more amount in PF to get long term benefits.

Dear Sir,

I have seen that at many websites the employee deduction is of 12% and employer contribution is of 13% for PF.

But here it is stated that it is 12% including both employee deduction and employer contribution.

so please do help me in finding the actual rates.

12% Emplyee deduction 12 % Employer deduction 1% Administrative charge

Respected Forum,

Before deciding to raise the salary ceiling cap from 21000/- to 25000/-, the Hon’ble Minister and the Central govt. in power should think of the repercussions, i.e. who actually gets benfit and who looses. Fine, on paper it is rosy to say every thing by the Minister. Is he aware of the facts, related to the conditions and services rendered by ESIC Hospitals to the subscribers. Perhaps not! It actually hurts a lot. The related issue is to enhance the ceiling limit for Pension. It all goes to the head of an employer. The employer ,who ever he may be, has to pay from his business earnings.If at all, all the Govt. Rules and Regulations are to be implemented in its True perspective, they will have to pass on the expenses to consumer in the form of better margins. Ultimately, the product cost will go up naturally and it will be a burden on common man. Mind You, there are citizens ranging from 60-65 % of population who has to work on their own to earn their Bread and taking care of family members. It is my experience, it serves “no purpose”, except of few vested interests in the Govt, just to show figures of improvement in parliament.The opportunistic group of this country is making mockery of Democracy and looting the Public in the name of serving the poor. Knowingly, politicians introduce these schemes, only to fool the public in general and loot the Govt. funds.It is better for the Govt. to take a stand on it and initiate strict vigilance in monitoring their employees.

Hi I’m Priyanka ,

I teach in a school and my monthly salary is 20k and what i have told that i have to pay security amount which will be deduct on my monthly salary till the 20k is not completed and they have not mentioned about PF so should i mention this and is it beneficial for a loong go ?

You need to check your appointment/offer letter for the PF component in the salary breakup. If PF component is there it is beneficial.

Thanks for this information blog. I would like to know if we are required to calculate PF & ESI on pro-rata basis if an employee leaves the organization in the middle of the month. Say if the last working day of an employee is 18th April, do we deduct the PF & ESI for the entire month or is it calculated till the last working day?

ESIC/PF should be calculated on the payable salary for the month.

Hello Sir,

1) Suppose an Employees Gross Salary is Rs. 35000/50000 and If the Employee Wants to deducted his ESIC even above the celling limit (i.e. 21,000) then is that possible in ACT? As ESIC consultant is saying that an Employee can continue contributing his part of contribution voluntary if he/she wish to do so.

So, Is there any Amendments or Notification regarding Voluntary ESIC contribution above 21,000 can be done?

2) One more concern that, Is there any circular or notification that we have to stop contribution above 21,000/-

Please reply my concern immediately as we have to send the data to consultant.

ESIC medical benefits is allowed for lower salaried employee below 21000/-. And it is clearly mentioned on the ESIC official websites. You can visit ESIC official website for more clarification.

Please provide circular or notification, that employer does not contribute ESIC above 21,000/-

Because we have seen in the tender paper of Chief District Medical Officer Keonjhar, Odisha where clearly mentioned that the salary of the employee is 55000/- , and their EPF contribution 13% on 15K is 1950 and ESI contribution 3.25% 682.50 on 21K.

Please clarify the matter with proper document, we will be highly obliged.

If employee getting salary 19,000/- for upto July22 and he contributing ESIC, from Aug’22 month the employee salary increased 19K to 25K is the employee still need to contribute ESIC. if yes how many months need to pay.

If any employee ESIC contribution is deducted in any month then it should continue till the ESIC half yearly return period i.e April-Sep and Oct-Mar.

Dear sir/mam,

If the employee Basic is less than 15000 is it mandatory to deduct as gross-HRA or can we deduct from basic kindly suggest

ESI contributions are calculated on the employee’s gross monthly salary.

Sir, How much would be the contribution by a worker to his P.F. A/c. drawing ₹ 16,064/- as minimum wages i.e. Basic Per Month = ₹ 14,842/- + VDA per month ₹ 1,066/- in Delhi . Is it mandatory to give minimum wages of net amount ₹ 16,064/- after E.P.F. & E.S.I DEDUCTION ?

PF would be deducted @12% of total payable salary or the PF contribution may be capped at 1800/-

grass salary of our employee exceed Rs. 21,000 per month from april’22 one of rs.21160.00 and other one rs.21765.00

kya hame contribution jama karna chahiye

No need to submit ESIC contributions as the employee’s gross salary is exceeding 21000/- and the salary month is April.

CAN YOU PROVIDE RULE AND ACT FOR IF EMPLOYEE NOT WANT TO DEDUCT EPF CONTRIBUTION. AND HOW TO FILE FORM 11 IN EPF

You can visit to EPF official website i.e https://epfindia.gov.in to check or download the relevant forms.

Dear Sir, I found your blog very helpful. Thank you for the blog.

I have a query please help me.

My workers salary is above RS 21000 per month which I hire on contract basis for the required work orders. I have total of 4 employees in my private limited company. So is it mandatory for me to get the registration of EPF?

It is not mandatory till you hire 10 or more employees.

sir my gross salary 21500rs and my deduction 2000, take home salary 19500rs, i am Eligible for esi

ESIC eligibility is checked on the basis of an employee’s gross salary not on the take home salary.

Sir salary 20500 .and 18k something in hand they said all deducting pf esi. What will be salary correctly given in hand to us

Dear Sir

We had taken Health Insurance policy for all employee.

So still we have to pay ESIC for all Employee.

Please assist

An employee covered by ESI benefits can opt out of ESIC after submitting documentary proof of having got himself covered under the medical insurance (an IRDAI-approved health cover). Once the employee exercises this option, the “employee shall be deemed to have exited from the ESIC deductions.

salary- 9000

Basic – 4950

PF= 594

Esi = 68

cash in hand = 8338

This is the calculation given by my company to me

Can you please help me with the in-hand salary that I am supposed to receive

You can check with HR for a complete salary breakup and deduction. They can guide you on what they are deducting from your salary.

Dear Arshad,

As per my understanding your gross salary is 9000 and basic is 4950.

according to this your pf contribution will be 12% of your basic which would be 4950*12/100=594.

your esic contribution will be 0.75% of gross which is calculated as 9000*0.75/100=68.

hence your inhand salary come up with 9000-594-68=8338.5

if an employee’s salary is 20000 and overtime or week offs is 1200 and the amount of week off varies from month to month then ESI contribution will be deducted or not? Is the limit of 21000 exceeding in this case? and if the the week off amount is 800 then on what amount esi will be deducted?

As you said the employee salary including Overtime is more than 21K, in such case the employee is out of ESIC range and ESIC will be not deducted for this employee subject to the condition. If employee ESIC is deducted for any month it will continue till the ESIC half yearly return period ends i.e April – September and October – March.

Thank you Sir.

Yes you are eligible for esi because your fixed gross is 20000 right then esi will be calculated on your earned if your fixed gross is less than 21k.

Which salary component included for pf deduction and which are salary heads excluded for pf calculation

For PF deduction there are 4 rules as mentioned below:

1) 12 % of basic salary

2) 12 % of basic salary with 1800 cap

3) 12% Gross-HRA (all the fixed salary heads are included except HRA)

4) 12% Gross-HRA with 1800 cap (all the fixed salary heads are included except HRA)

One of the 4 we can apply for deduction

Hello all,

I have a question, as we all know that the PF Celling is 15000, But my question is If my basic Salary + Allowance is Rs 30000, and I worked 10 day in a Month ,in that case my PF will be calculating on which amount

Please Share the fact along with PF act….

You need to check your company policy related to PF deduction/benefits. Ideally the company prorate the PF contribution as per the number of days worked in the month.

If my salary Component are as follow

Basic Rs. 12000/-, HRA Rs. 6000/-, Travelling Allowance Rs. 6000/-, Other Allowance Rs. 12000/-, Total Gross Salary Rs. 36000/-. We are deducting PF on Rs. 12000/- @ 12% i.e. Rs. 1,440/-.

Is it ok

Please confirm

Yes, it is per the PF rules i.e: 12% of basic.

Sir salary 20500 .and 18k something in hand they said all deducting pf esi. What will be salary correctly given in hand to us

SIR, Please clear my ESI point in this case.

Dear Mr. Mahera,

First of all the contribution, which has been given to you is not correct. As the Supreme court judgement while calculating for we need to calculate Basic+DA-HRA+Washing Allowance+Bonus(because can’t be given like this. If it is different every month then no PF but if it is same every month then has to give). Also some companies make a cap of upto 1800/-.

Thanks,

Biswajit

hello,

i wanted to know that suppose my organisation is registered under PF ESI act and some employee does not want to be registered in PF ESI scheme whose monthly salary is 15000/-. so my question is whether the organisation can pay them with bank or cheque by treating them as an expense for salary to those employees

Yes, employees have an option to opt out of ESIC after submitting documentary proof of having got himself covered under this product (an IRDAI-approved health cover), as per the rule. Once the employee exercises this option, the “employee shall be deemed to have exited from this Act”.

For PF, if there is no deduction for PF earlier, employee can opt out from the PF deduction.

Please share salary slip format in Excel with deductions ratios.

if a contractual labour work for 30-31 days per month, then for how many day of ESIC is to be deducted from the contractual worker

Contractual workers are covered under the Employees’ State Insurance Act, 1948 and entitled to social security cover if they draw up to Rs. 15,000/- in monthly wages. The employer has to register with the Employee State Insurance (ESI) corporation and is responsible to insure the workers. The current rates for ESIC deduction are: Employee= 0.75% and Employer = 3.25%

Hi

i have workers around 19-20 ppl and getting around 8000/- gross

1. Is it mandatory to get ESI and PF

2.How much i should deduct.

The minimum number of employees for ESIC and PF are: For ESIC= 10 For PF= 20

There are employee and company contributions for ESIC 1) 0.75% from employee’s salary 2) 3.25% from company side each month of the fixed salary.

For EPF, an employee contributes 12 percent of the basic salary (1800 cap can be put if basic salary is more than 15000 per month) while the employer contributes 8.33 per cent towards Employees’ Pension Scheme and 3.67 per cent to employees’ EPF (12% as total)

My Total Gross Salary is 24840/- par month break is under.

Basic pay : 9269

HRA : 9936

Washing Allowances : 4553

Bonus : 1081

——————————————–

Total earning : 24840

But my PF deducted only : 1112 Rs

So please help me because my contract change from July Earlier my PF Deducted : 1800 Rs

it is correct deduction bec pf is calculated on your basic pay ,which is 12%of9269

There are three pf deduction rules. 1) 12% of basic+DA 2) 12% of basic+DA with 1800 Maximum capping 3) 12% of Gross-HRA with 1800 Maximum capping. It depends on your company that which option they are using to deduct the PF for their employees.

For more information, you can check with your the HR department of your organization. .

can we opt 2 different methods for different people as per their salary? like for less than 10K one option and for more than 10K opt another one.

Sir,

My question is as per SC judgment Pf deduction on fixed allowances & my company is security service firm so can i deduct pf on washing allowance or not?

Hello sir

Employees not interested pf deduction

What’s rule of pf not deduction

YOU CAN FILLUP FORM 11 FOR THE SAME

For PF contribution, the salary comprises of fewer components:

– Basic wages,

– Dearness Allowances (DA),

– Conveyance allowance and

– Special allowance

So Pf deduct only basic salary+Da so Your pf deduct Amount of 9269*12%=1112.00

my salary 15000

basic is 30% 4500

pf deduction is 12%

basic which is 540 PF AMT

is this right deduction are going from company because i worked in ATUL PROJECTS INDIA PRIVATE LIMTED

Yes, it is based on the PF rules.

Yes your deduction is correct as per rule 4500*12%= 540

YEs YOUR pf deduction on your basic 4500*12% so pf amount is 540

It is truly a great and useful piece of info. I am glad that you simply shared this useful information with us.

Please keep us informed like this. Thanks for sharing.

If my salary more than Rs. 21000 ESI are apply cable or not

Hi Sir, i am working with a company where we have PF contribution options as below for new joiners,

NO- no PF will be deducted from salary

Fixed- 1800 will be deducted as Employee contribution and another 1800 will be deducted as employer contribution.

Yes- they will apply 12% of my basic pay for both employee and employer contribution,

my basic pay is 40000, initially when i joined 3 years ago i have opted PF option as YES, so now they are deducting straight 12% of my basic which is 4800 as employee contribution and another 4800 as employer contribution. so this 9600 makes my take home lesser.

Now when i asked my employer to convert my PF Option from YES to FIXED, they are not allowing me to do. i don’t see any PF rules saying employee can not reduce PF contribution. i think PF rules are saying i should contribute a min of 1800 per month.

Can you please help me on this…are there any rules supporting that employee can change their PF contribution option?

This will depend on your company’s policy.

BUT pf ceiling limit 15000 basic and ceiling amount is 1800

And I have not got any such rule till now, it is wrong, you should talk to your HR and and show them the government rules for pf deduction

Hi, An employee salary is Rs 22000/- till Jun effective from Jul the employee salary is reduced to Rs 20000/-.

The employee was not part of ESI to date since his salary is reduced below the esi ceiling, should the ESI deduction happen from Jul onwards or from the next cycle of Oct.

Please clarify.

In this case, ESIC dedcution will be effective from Jul month or when ever the salary comes under the ESIC range.

what happened , When gross salary of a person is in this manner.

april – 25000, may – 23000, june – 21000, july – 18500, august – 25000 so on

So, Is he eligible for ESIC

As per the shared information, June month’s gross salary of employee is 21000/- which is under the ESIC limit. Hence the ESIC deduction will start deducting from the month of June and this will continue till the ESIC contribution period.

IF SALARY IS 27000

WHAT IS AMOUNT DEDUCT FROM SALARY FOR EPF & ESIC

EPF Deduction: 12% of the basic salary. For a ₹27,000 salary, assuming 50% basic (₹13,500), EPF is ₹1,620.

ESIC Deduction: Applicable for salaries up to ₹21,000 (₹25,000 for employees with disabilities). If employee falls out of ESIC deduction due to increase in salary, then employee is suppose to contribute till the ESIC half yearly return period i.e. April – Sept and Oct – Mar. Once the ESIC Half Yearly period is complete ESIC deduction will stop. There will not be any reimbursement of ESIC paid contribution.

Hey, Can anyone please help me with the below query:-

There is employee in my organization, his basic salary is 15000 and there is special allowances also of 6800 but we were deducting PF of 12% of basic salary but this month employee was on leave for around half month due to which his basic salary come around 7500 so My question is should I deduct PF on Basic salary or should I change my calculation and deduct pf on Basic + Special allowances?

Ideally you should deduct the PF as per the earlier logic i.e on monthly payable basic salary. If you wish to give the advantage to the employee, you can include the special allowance limiting it up to the 15000/-

If a employees salary 25000 in a month,but employer has not deduct any pf and esi because this is a partnership firm and his employee is less than 10,so the employee can harass for any kind of loan taken from bank?

No, there would not be any problem in bank loan

yes problem i think some bank person will ask pf

Dear sir,

My basic salary is Rs: 689/- and my da & other allowance is Rs:143/-

our company works for 26 days per month.

If calculated:

Basic 689 *26 = 17914

DA & Other allowance: 3718

Total =21632

im i eligible for ESI ?? iF YES then How?

As you said that you are getting a monthly fixed salary of 21632 which is more than the ESIC current limit i.e 21000/- per month. Hence you are not eligible for ESIC deduction. If there is an increase in the salary in between the ESIC contribution periods (Apr-Sep and Oct-Mar) then your ESIC deduction will continue till the last month of contribution period.

My package 273000. Then how much my monthly net salary

You can ask your HR to share your complete salary breakup. As per the given information your CTC is 273000/- with this your monthly gross salary 273000/12= 22750/-. Please note that Net salary calculation always depends on the salary component payable and deductions in a month.

Sir,

My Salary as given below

Gross Salary 20560/-

i asked to cut my pf

our company was deduction the PF Contribution Rs. 4500/-

how it is happen sir. please explain me.

There are three options for PF deduction. 1) 12% of Basic salary 2) 12% of basic salary with 1800 cap 3) 12% of gross salary – HRA with 1800 cap. Please check your PF deduction based on these rules. For any further doubt, you may contact the HR department of your company.

i think your compony cutting your PF [ employer 12 % + employee 12% ] from your payment

………….lmao……….

One Employee was getting Rs. 20000 til May 21, his salary has increase to Rs. 22000 in June 21.

Consultant says that there is capping on ESIC Deduction of Rs. 158 which is 0.75% of Rs. 21000.

Pls confirm.

ESIC will be deducted on total monthly salary till the month of September, as it is the ESIC return cycle.

No capping on ESIC Deduction. If your employees salary exceeded Rs. 22000/- due to wage revision then you have to deduct ESI from their salary till the contribution period ends ie. till September-2021 and respective person and his family eligible for medical benefit under ESIC till June-2022

SIR WITH REQUEST I ASK YOU AN EMPLOYEE HIS SALARY IS 19500/ IN MARCH -2021 HIS DEDUCTION ESI BUT IN MAY HIS SALARY IS 22000/- THEN I DEDUCTED HIS ESI PLEASE TELL ME SIR

There are two cycles of ESIC return. Cycle-1 start from Apr-Sep and cycle-2 start Oct-Mar. For example: If any employee’s salary changes more than ESIC limit in any month of define ESIC cycle then the ESIC will deduct till end of the ESIC cycle. In your case it will deduct till September.

Then till what time we can get ESI benifit

Your ESIC deduction will continue till the Sep month Payroll.

all the employee asking us to not deduct ESI ,because they dont want ESI, what is the solution for it

Make sure you formally communicate to your employees that ESI Act 1948 is applicable to every organization with minimum employee strength as 20. According to the Act, ESI deduction is mandatory for all employees earning Rs 21,000 or less monthly. There is no choice given, and the rule has to be obeyed.

Explain the long term benefits of ESI deduction to your employees. Each employee is eligible to avail medical care for self and family members from ESI Hospitals/Dispensaries by showing the ESI card.

In case, if an employee still wants to opt out from ESI deduction, then the individual needs to provide proof/ document for a personal medical health policy. It is important to have medical insurance or similar policy in which the person has already invested in.

There is a special case under which the employer is not bound to deduct ESI. If no ESI owned hospital or dispensary is found within a distance of 10 kilometers from the workplace, then the employer can specify this reason for not deducting ESI amount.

Hope this information helps you.

Can I be working for two company and get ESI in 2nd company and PF in 1st?

No, the provisions of Indian employment laws are against dual employment. You can take both the benefits from one company only.

If my salary is exceeding the limit on which PF is deductible, say Rs 2 Lakh a month, Employer is deducting and contributing @12% and deducting Rs 24,000 a month. Can i ask employer to restrict deduction and matching contribution to rs 15000 a month only

Yes, there is an option available with employers to deduct PF on capping wages i.e 15000/- per month.

EPFS, 1952 clearly states in Chapter V that “Employer’s share not to be deducted from the members” , is there any similar provision/rule in ESIC?

Yes there is the same rule for ESIC that employers have to pay their own contribution on behalf of employees.

What is the standard Basic pay % on CTC. Is PF mandatory even IF it is registered with the EPF.

What are the minimum labor wages of Employee as per Law.

There is no standard rule for basic allocation on CTC so far. It depends on the company how they are defining your salary structure. You can check with your HR to know more about your salary breakup. PF is mandatory if the company is registered under EPF. There are minimum wage state wise rules applicable to all employees based on certain categories like skilled, semi-skilled, unskilled. You can contact your HR to know more about your minimum wages.

Dear sir,

My salary is 12500/month

Now our company as gaving only 9000.

When we enquiry about this; they said other money are cutting for PFand ESI.

Now my request is, what is the accurate price of my month PF and ESI from 12500.like how to government rules

You can ask your HR for complete breakup of your salary i.e 12500/-. PF deduction would be 12% as employee contribution and 12% for company contribution from your basic salary. ESIC deduction would be 0.75% for employee contribution and 3.25% for company contribution.

My company’s salary calculation:-

Salary – 13000

May 21 salary payble – 12581

Epf 25% 2201

Esic 4% on total salary 503

Net salary 9875

Plz explain why employer’s contribution part is also deducting from my salary.

This depends on your company policy and the offer made to you. You can check with your HR department to understand the complete salary breakup.

hello 🙂

i got 25k per month ,

am i eligible for PF or not ?

Yes, you are eligible for PF if your company is registered under PF act and deducting PF for other employees.

Hi, For employees who are covered under ESIC for maternity leave Benifit, do employer needs to pay ESIC and PF contribution monthly on their 26 weeks of maternity leave entitlement as ESIC shall pay them their monthly Salary! If employer has to pay monthly ESIC and PF contribution then can we recover employers contribution (12% for PF and 3.25% for ESIC) from employee

ESIC contribution will be based on salary paid to employees and employer bears their ESIC/PF contributions as usual.

No, Employer do not need to pay ESI and PF contributions, since the women employee is being paid by ESIC as a form of benefit, it is not salary. So Employer has to file Zero days in working column and Zero Wages in Wages column while filing ESIC Returns and similarly has to file Zero wages and Zero deduction in PF Returns also

Dear Sir,

Please send voluntarily PF minim and Rules

Sir,

My Salary as given below

Baisc – 11200/-

HRA – 4700/-

City Compensation Allowance – 4800/-

Special Allowance – 1800/-

Education Allowance – 1000/-

Gross – 23500/-

our company was deduction the PF Contribution Rs. 1488/-

how it is happen sir. please explain me.

Generally companies deduct employee’s PF as per pf rules i.e. 1) 12% of basic+DA 2) 12% of basic+DA with 1800 Maximum capping. 3) 12% of Gross-HRA with 1800 Maximum capping. But here it seems that your company has deducted admin charges from your salary. You can cross check this with HR department.

From last two years we crossed the salary level 15000/month and from 2018 our PF deduction was stopped. Presently we are paid by around 26000/month and we are interested for PF deduction so what should we do ? Do we eligible for PF ?

Ideally PF deduction should not stop. If you wish to start again, its is better to check legal implications.

Hai sir please explain 33000 amount please explain basic and epf &esi

Hi , I have query I joined in one of the partnership firm here at the time of joining they done mistake in salary break up when I got salary in the first that time I seen my in hand was less and of is also more than limit. These people was not aware about maximum we can deduct 1800 and they given me my exact in hand in the next month but still they are deducting PF 2k from both side . I also said them this is not right but they told me we can change , can you give me the solution on it or is it fine. Please reply.

Your PF will be based on an opted option. PF rules are: 1) 12% of basic+DA 2) 12% of basic+DA with 1800 Maximum capping. 3) 12% of Gross-HRA with 1800 maximum capping

In case of Retrenchment of any staff member working for 1.5 yrs to 2 yrs. Can company deduct ESI & PF Contribution from compensation wages paid to the staff. Pls reply.

Yes, if the employee is eligible for ESIC and PF, it will be deducted from employee salary as usual.

please guide, one of emplyee gatting salary more than 1 lac monthly, working last 8 month, he request for EPF, can we deduct the epf of him and from which month it will be applicable, joing month or current month

As of now, you do not need to register in ESIC and PF. For ESIC, you have to register under ESIC when you are paying a salary less than 21K to at least one employee. Regarding PF, you have to register under EPF scheme when your employees count reaches 20.

In this month (Nov 2020)

10th employee has joined my Partnership firm…. All the employee has minimum salary as Rs 22000

# Do I need to register for ESI…as all employee are getting 22K+ salary

# Do I need to register for PF now ??

#, My Employees doesn’t want PF even we will become a team of 20. what solution we can opt ?? They want salary on hand and then invest as per their need. Do need to register for PF if Employees don’t want and ready to give a declaration.

As of now, you do not need to register in ESIC and PF. For ESIC, you have to register under ESIC when you are paying a salary less than 21K to at least one employee. Regarding PF, you have to register under EPF scheme when your employees count reaches 20.

Dear Sir,

Our company have 35+ Employees if my one employee

Gross Salary – 14000

OT – 3000

14000+3000=17000 Total Salary. What is the Calculation Amount for ESI and PF

Please Reply sir

ESIC would be deducted on gross salary i.e 17000/- @ 0.75% and PF will be charged as your our PF option opted. It may differ with different PF rules as there are three PF rules 1) 12% of basic+DA 2) 12% of basic+DA with 1800 Maximum capping. 3) 12% of Gross-HRA with 1800 Maximum capping.

My total sellary is 12500 ctc

Basic is 8398

HRA 2561

Gross 10959

Pf dedution 1008

Esic -83 ru.

P tex-150

Total deduction 1248

My on hand sellary -9718

So my qestion is is this correct net on hand sallary….ctc me dono side ka desuction emplyoee k sallary se hi cut jayega kya

CTC is cost to company and it includes employer’s side contributions.

Hey, i have a query regarding pf,

Do an employer need to bifurcate the salary to reduce the pf liablity as pf is only liable on basic+DA.

since i am paying salary to employee with a basic of 14000.

Should i bifurcate the salary in BASIC & HRA and other allowances to reduce the liablity of pf?

If it is yes, can i bifuecate it during the year?

It depends on your company policy makers how they want to design their salary breakups. If you wish to bifurcate the salary in Basic, HRA, other allowance etc, you can do that as and when you want.

Hi Sir,

I have joined in a company, its been 4 months currently, my mother has to undergo a operation. so i wanted to check the eligibility where i will be able to claim the bill and also i had a discussion with the dispensary people in my hometown they told that you have to work for a year after that only you will be able to claim. So kindly let me know whether is it compulsory to complete one year inorder to get eligibility for ESI

You are eligible for ESIC treatment from your ESIC first contribution that has been deposited. But there are some critical diseases covered after certain periods that ESIC officials/doctors may guide you better.

In my firm number of employees are more than 50 and 26 of them salary are more than 21000 per month balance 24 employees are below 21K per month. Now only we are going to register ESI, for registration we have show only 24 employees or total employee?

Kindly Reply..

For ESIC registration, you need to show total number of employees along with their gross salaries in the company at the time of registration.

in my central govt organisation , we float a tender for manpower supply. The service provider has not paid the wages to the employee hired by him(working in our organisation). Now my organisation has founded a committee who recommend to pay the wages to employee from employer(my organisation). Can we deduct EPF, ESI of the employee ? If yes, then how can we deposit the amount in the middle of the month ?

If no , then is it legal ?

please clarify

If you are paying wages to employees as an employer then you have to apply for ESIC and PF registration as that is mandatory for more than 10 employees. You have to pay PF/ESIC on a monthly basis before 15th of every following month.

Under which rules the ESIC AND EPF Contribution of employees challan can be shown to factory where our security guards deployed

Employers who are paying salary to the employee are liable to deduct ESIC/PF as per their eligibility. You have to show/submit those PF and ESIC challans to the factory.

If the esic payment of the workers is not made, can there be any problem while returning the pf?

ESIC and PF are two separate returns and you can submit PF returns separately.

i want to know if my gross salary is 21000. My ESI will be deducted or not and am eligible for esi benefits for the previous deductions. My PF deduction is 1800 and i want to know more about PF rules .

Yes your ESI will be deducted.

Yes your Basic salary is 15000 and it deduted Rs. 1800 at a rate of 12%

ESIC is an application for employees whose gross salary is 21000 or less per month. Regarding PF rules, there are three pf rules: 1) 12% of basic 2) 12% basic with 1800 maximum cap. 3) 12% gross-HRA with 1800 maximum cap.

Dear Sir,

I would like to ask that there is any money limit in esic treatment,? or we get full health cover by ESIC. and what about the family member’s treatment. my mother has a disease named “Ascites”, I have to admit her in hospital every month, Kindly Tell me the briefly answer so that i can feel better without any confusion

ESIC has framed/laid down some conditions in respect of super specialty treatments and long term serious diseases. It will be better, if you can visit ESIC local office or hospital to know more about the treatment or your eligibility.

Does PF deduction %/Amount differ from state to state and employee type (like consolidated/confirmed/grade pay) or is it uniform deduction across all states/employee types? Many companies seem to deduct different PF amount based on either full earned income or just the addition of Basic+GradePay+DA and that too it differs between state to state if they have multiple branches. Please advice.

statutory rate of PF is 12% across all states.

The employers monthly contribution is restricted to a maximum amount of Rs 1,800. Even if the employee’s salary exceeds Rs 15,000, the employer is liable to contribute only Rs 1,800 (12% of Rs 15,000).

PF deduction percentage @12 is the same for across all states. Regarding the PF deduction amount, it may differ with different PF rules as there are three PF rules- 1.12% of basic + DA, 2.12% of basic + DA with 1800 Maximum capping and 3.12% of Gross-HRA with 1800 Maximum capping.

Hi,

Due to current scenario our company has agreed to pay the transportation cost to employees whose salaries are less than 21000.(This is temporary setup for 3-4 months) so do we need to add this compensation for PF and ESIC calculation. Plz Advice

For ESIC, yes you need to add this compensation in ESIC calculation. Regarding PF, this compensation will be considered for all employees whose PF is deducted on Gross-HRA rule.

Sir my wife is working in a private school and her salary is around 9000 per month and me her husband is a government employee. Is she is eligible for ESI facility and my salary is 45000 per month.

our wife is not eligible for ESIC. ESIC Act is not applicable to the Government employees and their dependents who are availing government medical benefits.

which allowance does not include in pf calculation other than HRA?

please reply

All cash payments paid to an employee on account of a rise in the cost of living, house-rent allowance, overtime allowance, bonus, commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment.

I Have doubt regarding PF i have joined in the company salary of Rs.15000 they have deducted pf in my salary after 6 month the company have hiked my salary of 20000 as per new rule above 15000/- need not to pay pf form 11 to be submitted . but the company said we will deduct pf but i no need what todo please help

There is a rule to avoid PF deduction at the time of joining the company if employee monthly salary is less than 15 thousand. If an employee is already a member of the EPFO, the employer has to continue his/her PF obligations.

Hello sir/madam,

please help me with the solution.

if gross salary is 18000. then the calculation will be 18000*12%=2160…..

please give me the correct solution at the earliest

There are three rules for PF calculations

1) 12% of your basic salary

2) 12% of your basic salary and capped at 1800/-

3) 12% of PF your gross-HRA and capped at 1800/-

Please check your PF calculations as per above rules to get correct PF amount

It is really a very helpful blog.

I have a query regarding my PF

Basic salary – 21500

HRA-. 7200

Transport Allowance – 1500

Gross salary -31200

Company pf contribute – 1800

Company esi contribute – 0

Total CTC -33000

So I am ask you sir/mam what will be my PF deduction as per rule. And how many pf cut in total CTC.

Please help .

Thank you

Your gross salary is not matching with shared values i.e 21500+7200+1500= 30200/- please check your gross salary. Your PF deduction is correct as per PF capping rule and generally company PF contribution is a part of employee CTC.

It is really a very helpful blog. Thanks a lot.

I have a query regarding my PF

Basic salary – 8800

HRA-. 7700

Special Allowance – 5500

Total gross salary – 22000

So my question is what will be my PF deduction as per new statutory rules ?

Please help .

Thank you

Your PF deduction would depend on your company policy. If the company’s contribution is 12% of actual basic then your pf would be 8800*12%= 1056. If your company is considering revised PF rules then Gross salary-HRA i.e 22000-7700=14300, your pf would be 14300*12% = 1716

8800+5500=14300

Epf deducted= 1716

22000- 1716= payment = Rs. 20284

For Esi, If Gross Salary more than 21000 then Esi Will not deductable,

For Pf, If Basic Salary is more than 15000 then PF will be restricted upto 1800.

I think this will be helpful to you.

in my firm number of employees are more than 40 and all of them salary are more than 25000 per month

simultaneously we are registered under both PF and ESI act but we contribute only for 18 employees PF and ESI.

legally this is okay or not?

Legally you should contribute PF for all the employees and ESIC for those whose monthly salary is less than 21000/- if any.

if the wages of an employee exceeds Rs. 21,000 from the month July, and from the month of august she avails maternity leave in this case her maternity daily wage for 6 months will be calculated on what basis?

As per the law, maternity leave is paid leave and she will get full month salary till next six months.

MY SALARY 21005 BUT MY PF 1200 IT IS RIGHT OR WRONG

hello sir

my monthly salary is 12000/-

my office management deduct pf and esi both side of my salary.

so i can deduct only esi on my salary. because i don’t need pf duduction.

it is possible or not.

please explain CTC and Gross Salary.

because my appointment letter disclosed CTC Salary

thanks sir

Gross salary is the fixed salary for the month and CTC is the Cost to Company and ideally CTC includes both the company contributions (PF and ESIC). If the company is deducting PF then you have no choice to avoid PF deduction.

my basic salary is 15678 so what amount should deducted from my salary for employees EPF ?????? is that correct 15678*12 %= 1881

Either you can opt 12% of actual basic salary as per your current PF deduction or you can also opt capping option of PF deduction to 1800/- Max, if you want to increase your take home salary. PF Capping option can be opted if basic salary is more than 15000/- per month

My gross salary is Rs.22000/- my pf deducted Rs.1800/- But my company offer letter showing company pf 13% mean per month my pf balance (My 1800+Company 1950=3750) Rs.3750/- is correct or not

There is an admin charge 1.15% on PF amount which is borne by the employer. You can talk to your HR person regarding this, if they are charging these charges from you.

MY G SALARY 21005 BASIC 10000 HRA 5000 CONV. 2100 MED ALLOWANCE 3905 PF DEDUCTION 1200 IT IS RIGHT OR NOT

It is correct as it is 12% of your basic salary.

what is the difference between the contribution deposited on monthly basis by the employer in case of PF/ESI and a separate return twice in case of ESI

Employers deduct ESIC/PF amount from employee’s monthly salary as per their eligibility and deposit in government account by 15th of next month. As per the Government guideline every employer has to submit ESIC return as per defined cycle Mar and Sept every year. Return is the consolidation of esic paid data.

Is it important to give EPS to the employees? If an employee leaves 6 month or 1 or 2 year will that employee be getting the pension amount? If NO, then will the employer get the Pension deposited against the employee back with interest?

If the work order is issued to a firm only for one month period, is it mandatory for the firm to deposit EPF & ESI. The factory act is applicable on the firm where the work order was issued.

Yes, ESIC and PF deduction are mandatory for the principal employer, subject to firm’s eligibility i.e. having at least 10 employees.

Sir.. my regular Gross salary is Rs. 23000/-( ESIC not applied in my case ).. due to on leave i get salary Rs. 17000/-.. in my next month.. so ESIC applicable in my this salary?? ( This month my salary is below 21000/- )

ESIC will not be applicable as your regular monthly gross salary is more than the ESIC limit i.e Rs. 21000/-. Please note that the ESIC limit will always be checked with your fixed monthly gross salary.

And sir as u said if employee gross salary is more than 21000 they will not applicable for esic scheme.. ND if the person has 35000 per month salary then which scheme will applicable to them? Is there any different scheme for high salaried people . Please tell me.. I’m so confused

ESIC is the medical benefits for lower salaried workforce and currently the monthly salary limit is 21000/- or less. Generally companies provide group medical insurance facilities to their employees who are getting more than 21000/- per month. You can check for the same with your HR or you can buy your own medical insurance policy provided by different insurance companies.

Sir I was an injury in road accident…so I will applicable for ESIC pension..and how much amt of pension..is this for lifetime… and also my injury is in right leg…rod can be fitted so walking is not easy for me walk with help of stick…

Also my esi contribution is 114rs.p/m from last 3 years

So pls tell me for pension details

ESIC Pension depends on the disability certificate.

MY COMPANY DEDUCT THE PF AND ESI AMOUNT FOR THE MONTH OF APRIL, 2020 ON 5TH MAY, 2020. BUT THE PF ESI REGISTRATION HAS BEEN COMPLETED ON 7TH MAY, 2020. SO, MY QUESTION IS “CAN THEY PAY THE AMOUNT IN THE PORTAL FOR THE MONTH OF APRIL, 20???”

Check with your Payroll team whether your company has submitted your PF deduction or not. Ideally company deposits employee’s PF amount on the PF portal on or before 15th for previous month’s PF deductions. During this lockdown period, the last date has been extended to 31st July for all past months PF contributions.

Is form 15 mandatory??for claim form 31(Advance PF) .

It is not mandatory but if you fill 15G and 15H forms, you can save your Tax based on below conditions:

Form 15H is a self-declaration form which helps individuals above 60 years of age save Tax Deducted at Source (TDS) on the interest income earned by him on his fixed deposits. The assessee is supposed to submit a declaration form to his banker to apply for no deduction or lower deduction for fixed deposits made by him

Form 15G needs to be submitted for no TDS deduction. For EPF withdrawal if your contribution to EPF is less than 5 years and amount is more than 50,000 then TDS at the rate of 10% will be deducted. Remember EPF withdrawal before 5 years is taxable.

Whats the minimum amount has to contributed toPF deduction by both the side contribution added together, if my Basic is 30000/-

If there is a capping for PF deduction i.e. 1800/- for employee and employer then your PF contributions would be 3600/- per month i.e. 1800/- from employee and 1800/- from employer contribution. If there is no limit and it is 12% of basic salary then your PF contributions will be 7200/- per month i.e. 3600/- from employee and 3600/- from employer contribution. In addition to these you can voluntary contribute as employee contribute over and above of fixed or 12% of basic salary and employer will contribute only capped amount.

My salary is 11402/, In hand i get 10000/. what will be deduction for ESI.

Your ESIC deduction i.e. employee contribution, would be 0.75% of your gross salary i.e. 85.51/-, it will be upper round and final value would be 86/-. The employer contribution would be 3.25%, i.e. 370.56/-,it will be upper round and final value would be 371/-.

My Basic is 15,000

Gross is 28,003

PF 1800

PT 200

Gratuity 722

CTC 30,525

This is the calculation given by my company to me

Can you please help me with the in-hand salary that I am supposed to receive.

Hi, can you help me with the clarification of PF calculation, as you said PF is calculated as per revised PF rules, if the employee’s basic salary is less than 15000/- then pf deduction will be calculated @12% on monthly gross salary excluding HRA/Food Allowance. I need more details, it excluding HRA / FOOD ALLOWANCE / MEDICAL ALLOWANCE/ CONVENCY ALLOWANCE AS WELL.

Apart From above is there any way if we change the Head instead of “Special allowance” into “Travel – Projected Allowance” than its excluded from PF calculation.

For revised PF rules, formal notification still awaited about deduction of PF on gross salary if salary is less than 15000/-. Till final notification, you can deduct PF only on Basic component of a salary structure.

As employees, How much will my ESI be deducted at 12500 salary?