It is difficult to anticipate the benefits of taking your payroll online. This was a challenge faced by one of our recent customers where the HR department found it challenging to estimate the ROI derived from implementing an online Payroll software.

In this post, I have analyzed time and money spent in manual Vs online payroll processing. Have a look at some of the benefits that were presented to the senior management of the organization to help them get best return on investment (ROI) of a payroll management.

The exercise which started as a small initiative actually helped me dive deeper into how a CFO or CEO perceive their human resources department and what are their expectations from an HR platform.

What I will share here is a small part of the study in how organizations are managing their human capital assets and the challenges being faced versus what are the best practices in using paperless payroll. In this, I will share what are the different metrics and how can organizations save costs in this critical area.

Consider the Elements of ROI before taking your Payroll Online

To determine the ROI in paperless payroll, we had to first understand how the payroll process works in a manual environment. Our interactions revealed that there are three distinct steps in the successful processing of a payroll which are:

1. Data gathering

2. Processing

3. Disbursement and Reporting

For each of these steps above, there are multiple sub-processes which may take substantial effort and time.

To understand the complexities involved in a payroll process and gaining deeper insights into challenges being faced, we further analyzed many other companies across multiple industry verticals, different employee types (blue collared, white collared, management) and found a median effort for each of the sub-processes. Some of these sub-processes on which we could identify the metrics are:

1. General

a. Number of FTE (Full Time Employees) required

2. Data Gathering in a Payroll Process

a. Number of time records processed in one year

b. Number of Employee Validation Errors seen during the year for time records which will require corrections and authorizations at multiple employee levels.

c. Time for adding a new employee to the system with salary structures and all other required data

d. Time for removing a terminated employee from the payroll system.

3. Processing of Payroll

a. Number of payroll transactions processed

b. Cycle time for audit of payroll prior to disbursement

c. Number of manual checks disbursed.

4. Disbursement and Reporting in a Payroll Process

a. Number of payroll related queries

b. No of payment errors

c. Cycle time to process a payroll error

d. Time for creation of reports which are submitted on a monthly, quarterly, half-yearly and annually per employee

Once these metrics were identified, we studied the impact of these metrics in manual processing vs processing using an online payroll software such as Empxtrack.

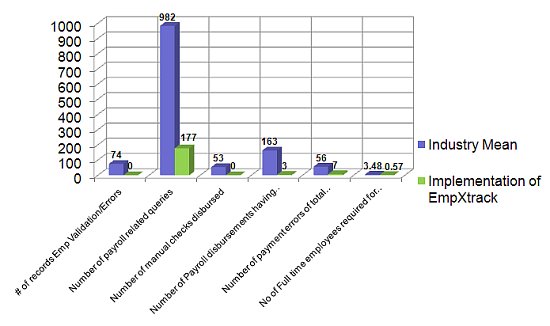

The example below refers to the results for a mid-sized organization with approximately 1,000 employees across multiple locations. The results are the total time spent in one year for processing monthly payrolls.

| Process | Manual Payroll | Best Practices | Number of FTE for managing the payroll process | 3.48 employees | 0.57 employees | Number of time records processed manually | 43,500 | 5,200 | Number of Employee Validation Errors seen during the year for time records | 350 | 4 | Time for removing a terminated employee from the payroll system. | 3.5 days | 1.5 hours | Number of payroll transactions processed | 18,500 | 16,500 | Number of payroll related queries | 982 | 177 | Number of manual checks disbursed. | 50 or more | 12 or lesser | No of payment errors | 56 | 7 | Cycle time to process a payroll error | 7.5 hours | 0.3 hour | Cycle time for audit of payroll prior to disbursement | 230 hours | 60 hours | Time for creation of reports which are submitted on a monthly, quarterly, half-yearly and annually per employee | 1050 hours | 75 hours | Cost for Processing Payroll | USD 190,750 | USD 27,550 | |||||||||||||||||||||||||||||||||||||||

| Process | Manual Payroll | Best Practices | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of FTE for managing the payroll process | 3.48 employees | 0.57 employees | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of time records processed manually | 43,500 | 5,200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Employee Validation Errors seen during the year for time records | 350 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time for removing a terminated employee from the payroll system. | 3.5 days | 1.5 hours | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of payroll transactions processed | 18,500 | 16,500 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of payroll related queries | 982 | 177 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of manual checks disbursed. | 50 or more | 12 or lesser | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No of payment errors | 56 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cycle time to process a payroll error | 7.5 hours | 0.3 hour | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cycle time for audit of payroll prior to disbursement | 230 hours | 60 hours | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time for creation of reports which are submitted on a monthly, quarterly, half-yearly and annually per employee | 1050 hours | 75 hours | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost for Processing Payroll | USD 190,750 | USD 27,550 |

The analysis of the above data gave an unimaginable saving of costs to the tune of $150,000 per year which is much higher than the cost of acquisition of the payroll services offered by a software such as Empxtrack..

Benefits of taking your Payroll Online

The following image graphically illustrates the impact of taking your payroll online by considering some of the parameters in the chart above.

We further analyzed the intangible benefits (some of which had cost implications as well) of using the payroll services of our online payroll software. Some of these are:

1. No need to print payslips. Employees can view their payslips online and these are emailed automatically as well for their records.

2. Minimum payroll related queries post processing. Allows the accounts/HR to complete many more important tasks.

3. Minimum impact when salaries change. Update at a single place is reflected automatically. This avoids reprocessing of payroll.

4. Low impact when new employees are added. For example – for a multi-locational organization with distributed hiring, it becomes difficult to process payroll for new employees.

5. Minimum impact when employees quit.

6. Integration with time reporting systems saves costly mistakes and reprocessing time.

7. Automatic updates to the income tax rules to meet compliance requirement.

8. Archiving of Payroll data for statistical analysis in respect of different employee types.

To analyze the ROI for your company, please contact us. We will be happy to analyze your payroll process and guide you to take your payroll online, at no obligations, and suggest areas where improvements can be carried out.

Process payroll for 25 employees at no cost

* No credit card required

I think automated Payroll might be the best thing we did at our workplace, and the post covers it pretty nicely.

That’s good sharing, I would love to subscribe to your Blog but I can’t see any tab to subscribe to your blog.

Nice blog

Hence, outsourcing payroll management services is a convenient way to perform all these tasks without any complications and in a precise way.

After going over a handful of the blog articles on your website, I truly appreciate your technique of writing a blog. I bookmarked it to my bookmark webpage list and will be checking back in the near future. Please check out my website as well and let me know what you think.

Thank you for share this impressive blog with us.

Thank you for sharing this blog with us its very good for providing payroll information.

This is a pertinent post. A fabulous article with an amazing level of detail! I truly appreciate your effort to inform us. Many thanks for sharing this. Glad I came across this site.

Thanks for sharing this blog , it is very helpful.

Yes! Why stress yourself every day for tedious payroll procedures when you can offload your ERP and payroll obligations to team of experts.

Really impressive blog for all , also the Payroll Management Team. Seeking for new updates in future.

Great information shared through the blog worth reading it. Thanks for the sharing the well informative article

Really glad to see the efforts you have put in writing this article. Its a great information. Keep on posting such informative articles.

Thank you very much for posting this good content! I am looking forward to checking out more!

I discovered your blog web site on google and verify a few of your early posts. Proceed to maintain up the excellent operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to studying extra from you afterward!?

Great post! Thanks for sharing.

its very good site for providing payroll information

This is why i recommend a payroll system to every business who wanted their status to burst. In just obtaining a single software, you could compute in just a second the most important aspect of your business. So why wait? 🙂

Thanks for the giving useful information,This blog importance,scope,were elaborated.

_____________

Steven

Thank u for giving an nice information. Its an useful for all.

————————

sweety

This site really helped me It Is good one I have gained the wanted information.

——————

Chinna

Thank u very much…….You had pointed out a good topic……..

———————-

kiran………

Nice site. I am getting lots of informaton about ROI & payroll function.

——————-

SSSSS

Thank you payroll software is a nice blog. A very useful information in blog.

__________

Kim

Nice site. I am getting lots of informaton about ROI & payroll function.

________

geeta

Its really very good post.We enjoyed it lost.

________

Helen.

thanku its a useful article

he automation also has helped speed payroll and accounts payable … In 2002, HealthFirst added Web-based functionality to all its ERP applications. … and automating its supply chain and purchasing processes, Bonham estimates. …

Payroll software will actually make things easier for everyone. It will also help in keeping everything in track unlike the traditional process wherein papers are stacked everywhere. However, I would still prefer to have everything backed up, manually though. In case of some technical gliche.

Very informative post, thanks for the share.

Fantastic!

I really enjoyed this post. I can tell you put in a great deal of effort and time into this post. I will be back to read more as you post more!

Wow..very good…Nice blog and well updated…

Good brief and this mail helped me alot in my college assignement. Thanks you for your information.

You pointed some nice topic. These tips are very helpful.

This page is very helpful for me to choose the viable product.

You gave great points here. I did some research on the subject and have found nearly all people agree with your blog.

Great site. A lot of useful information here. I’m sending it to some friends!

The priority of any payroll accounting program is to reduce the pay preparation time. Two precious words for any effective payroll accounting software are quickness and accuracy.

The info you have here was extremely useful, thanks for opening my eyes to some other alternatives.

i have enjoyed reading thank for sharing your story Greeting.

thankyou lots, I must comment that your website is amazing!

Story, i enjoyed sharing this.

Hey could I use some of the insight here in this entry if I reference you with a link back to your site?

Totally digg your website thanks a lot for the info

I found your blog on google and read a few of your other posts. I just added you to my Google News Reader. Keep up the good work Look forward to reading more from you in the future.

Excellent info! I’ve been looking for something like this for a while now. Thanks!

Figuring this stuff can be super painstaking, thanks for typing this post to clear up some confusion.

Thank you! You can find the RSS feed to the blog at https://www.empxtrack.com/blog/feed/ which is also available at the right section under the Meta block (Entries RSS)

Hope that works.

Tushar

Very well written post, do you have an rss feed I can subscribe to?

Your blog looks nice, however it would be better if you can use lighter colors as well as a professional design. This will ensure that a lot more readers come to check it out.Informative post by the way!

Hi, this is one excellent article! Thanx for posting this. I was hunting for a site that has this kind of info. I just like very much farmville! Lucky I found this one! I’ll be frequenting here again for sure! ftw

Solid article well covered.

Technology has catch up on payroll processing making it systematic and cost – effective.

Hi, good day. Wonderful post. You have gained a new subscriber. Pleasee continue this great work and I look forward to more of your great blog posts.

This is a pertinent post. A fabulous article with an amazing level of detail! I truly appreciate your effort to inform us. Many thanks for sharing this. Glad I came across this site.

– Jaime