This blog describes rules for ESI and PF Deduction, where ESI is Employee State Insurance (ESI) and PF is Provident Fund (PF). These are two social security schemes available to employees working in India.

However, payroll administrators often often struggle to keep up with the latest standards in these 2 areas. This leads to wrong deductions and deposits, queries from government departments, the dreaded scrutiny, and even fines.

Significant information is available on the web and the government websites. But that is often contradictory, confusing, poorly written, or sometimes even wrong or misleading.

This blog explains both schemes and describes the Rules of ESI and PF Deduction in detail. These rules are updated in this post whenever there are changes in government schemes. This helps you implement Best Practices of Payroll Processing in your organization.

Employees’ State Insurance (ESI) Scheme

ESI is a contributory fund that enables Indian employees to participate in a self-financed, healthcare insurance fund with contributions from both the employee and their employer.

The scheme is managed by Employees’ State Insurance Corporation, a government entity that is a self-financing, social security, and labor welfare organization.

The entity administers and regulates ESI scheme as per the rules mentioned in the Indian ESI Act of 1948.

ESI is one of the most popular integrated need-based social insurance schemes among employees. The scheme protects employee interest in uncertain events such as temporary or permanent physical disability, sickness, maternity, injury during employment, and more. The scheme provides both cash benefits and healthcare benefits.

Eligibility for ESI

ESI scheme applies to all types of establishments, including corporates, factories, restaurants, cinema theaters, offices, medical and other institutions. Such units are called Covered Units.

What is the criteria for Covered Units

- – All units that are covered under Factory Act and Shops and Establishment act are eligible for ESI.

- – Where 10 or more people are employed irrespective of their monthly earnings.

- – Units which are located in the scheme-implemented areas. The government plans to implement ESI across the entire country by 2022 so all units will be considered as Covered Units.

All the establishments covered under the ESI act and all the factories that employ more than 10 employees (in some states, 20 employees) and pay a maximum salary of INR 21,000 per month (Rs. 25,000 for employees with disability) must register with ESIC and contribute towards the ESI scheme.

How to identify eligible employees?

All employees of a covered unit, whose monthly incomes (excluding overtime, bonus, leave encashment) does not exceed Rs. 21,000 per month, are eligible to avail benefits under the Scheme. The ESIC has fixed the contribution rate of the employees at 0.75% of their wages and the employer’s contribution at 3.25% of the wages.

Employees earning daily average wage up to Rs. 137 are exempted from ESIC contribution.

However, employers will contribute their share for these employees.

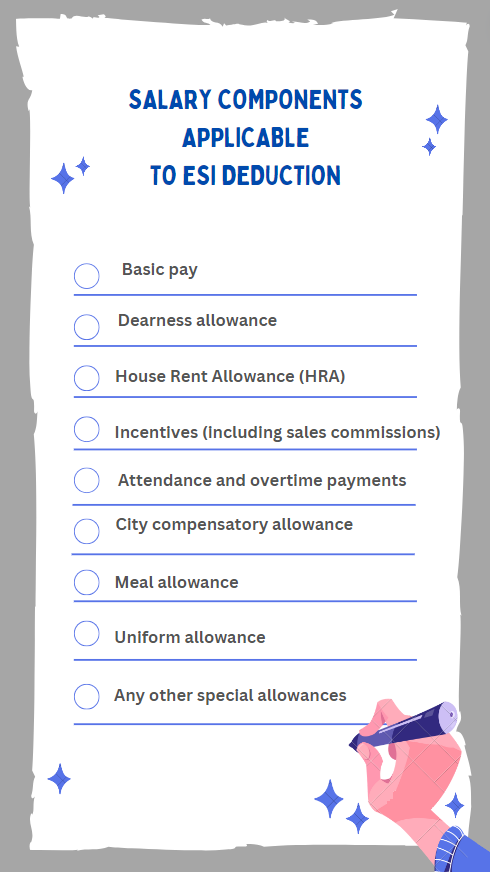

What salary components are applicable to ESI deductions?

ESI contributions (from the employee and employer) are calculated on the employee’s gross monthly salary.

Most people face challenges in understanding ESI deduction rules because they aren’t clear about the concept of Gross Salary. So let us explain this concept first.

Gross salary is described as the total income earned by the employee, while working in their job, before any deductions are made for health insurance, social security and state and federal taxes.

For ESI calculation, the salary comprises of all the monthly payable amounts as shown in the image:

The gross monthly salary, however, does not include Annual bonus (such as Diwali bonus), Incentive bonus, Service charges, Gazetted allowance, Saving scheme, Retrenchment compensation, Encashment of leave and gratuity, and more.

Collection of ESI Contribution

It is the employers responsibility to contribute to the ESI fund by deducting the employees’ contribution from wages and combining it with their own contribution.

An employer is expected to deposit the combined contributions within 15 days of the last day of the Calendar month. The payments can be made online or to authorized designated branches of the State Bank of India and some other banks.

ESI Calculations

The rates of contribution, as a percentage of gross wages payable to the employees, is explained in the table below

| Percentage of Gross Pay | Example Gross Salary | Contributions | |

| Employee Deduction | 0.75% | Rs 15,000 | 15,000 * 0.75% = 112.50 |

| Employer Contribution | 3.25% | 15,000 * 3.25% = 487.50 | |

| Total Contributions for this employee | 112.50 + 487.50 = Rs 600.00 | ||

In case, the gross salary of the employee exceeds Rs. 21,000 during the contribution period (explained next), the ESI contributions would be calculated on the new salary and not Rs 21,000.

Contribution Period and Benefit Period

Payroll administrators often face confusion when employees salaries change – especially when the monthly salary exceeds the ESI limits of Rs 21,000.

To handle this situation, ESI has a concept of contribution periods during which the ESI contributions have to continue, even when the salary exceeds the maximum limits.

There are two contribution periods each of six months duratio n and two corresponding benefit periods also of six months duration.

| Contribution Period | Cash Benefit Period |

| 1st April to 30th September | 1st January of the following year to 30th June |

| 1st October to 31st March of the following year | 1st July to 31st December |

After the commencement of a contribution period, even if the gross salary of an employee exceeds Rs. 21,000 monthly, the employee continues to be covered under ESI scheme till the end of that contribution period.

The contribution is deducted on the new salary. Let us look at an example to understand this better.

If an employee’s gross salary increases in June from Rs. 18,000 (within ESI limit) to Rs. 22,000 (above ESI limit), the deductions for ESI will continue to happen till the end of the ESI contribution period i.e. September.

And the deduction amount for both the employee and employer will be calculated on the increased gross salary of Rs. 22,000.

At the end of the contribution period, if the employee salary is more than the ESI limit, no further deductions and contributions are required. The employee will still be covered under ESI till 30th June of the following year.

Similar rules apply when an employees salary increases in the 2nd contribution period.

Rules related to Employee Provident Fund (EPF)

Just like the ESI scheme, the Employees Provident Fund (EPF) is a Contributory fund with contributions from both the employee and their employers.

While the focus of the ESI scheme is healthcare, Provident Fund is focused towards post Retirement Income and Benefits.

EPF is a compulsory and contributory fund for Indian organizations under “The Employees’ Provident Fund and Miscellaneous Provisions Act 1952”.

Employee and Employer Contributions to the Employee Provident Fund (EPF)

For EPF, both the employee and the employer contribute an equal amount of 12% of the monthly basic salary of the employee. The contributions are payable on maximum wage ceiling of Rs 15,000.

Employees can voluntarily contribute more than 12% of their salary, however the employer is not bound to match the extra contribution of the employee.

The PF deduction rate of 10% is only applicable to some establishments where less than 20 employees are employed and they meet the following conditions:

- – If it is a sick industry declared by BIFR

- – If industry belongs to brick, jute, beedi, gaur and coir industries

- – If an organization is operating with a wage limit of Rs 6,500

- – If an organization has seen annual loss which is more than its net value

For PF contribution, the salary comprises of fewer components:

- – Basic wages,

- – Dearness Allowances (DA),

- – Conveyance allowance and

- – Special allowance.

The employers monthly contribution is restricted to a maximum amount of Rs 1,800. Even if the employee’s salary exceeds Rs 15,000, the employer is liable to contribute only Rs 1,800 (12% of Rs 15,000).

For international workers, wage ceiling of Rs 15,000 is not applicable.

Details of EPF

The statutory compliance associated with PF contribution has some lesser known facts associated with it.

The contributions by the employee and employer are divided into two separate funds:

- – EPF (Employee Provident Fund) and

- – EPS (Employee Pension Scheme).

The breakup happens as follows:

| Employee | Employer | |

| Total contribution | 12% of monthly salary | 12% of monthly salary (subject to a maximum of Rs 1,800) |

| Employee Pension Scheme (EPS) | 0 | 8.33% (of the 12%) |

| Employee Provident Fund (EPF) | Full amount | 3.67% (of the 12%) |

| Example Monthly Salary: Rs 12,000 | ||

| Total Contribution | 12,000 * 12% = Rs 1,440 | 12,000 * 12% = Rs 1,440 |

| EPS | 0 | 12,000 * 8.33% = Rs 999.60 |

| EPF | Rs 1,440 | 12,000 * 3.67% = Rs 440.40 |

Provident Fund Withdrawal Rule

A PF account holder can withdraw up to 75% of the total amount if he/ she has been unemployed for more than a month.

The offline PF withdrawal process usually takes upto 20 working days, and online PF withdrawal takes upto 3 working days.

An employee cannot withdraw full or partial PF until he/ she is employed. Full PF balance can be withdrawn only if the employee has been unemployed for at least 2 months or the joining date of the new job is more than 2 months from the last working day at the previous employer.

In any case, if an employee withdraws ₹50,000 or more within 5 years of opening a PF account, then a TDS of 10% is applicable on the withdrawal (provided you have a valid PAN card) or 30% (if you don’t have a PAN card).

How an Automated Payroll Software helps implement Rules for ESI and PF Deduction

Manual computation of statutory compliances involves lot of paperwork and filling in of challans and forms on paper and submitting them to banks. This makes the process time-consuming, can introduce inaccuracies and can often lead to mistakes.

Both the ESI and PF departments encourage online filing and payments.

It is advisable to use automated payroll processing tools to calculate ESI, PF and income tax deductions.

A good payroll management software puts an end to increased complexities of payroll processing and offers following benefits:

- – Accuracy in PF, ESI and other statutory calculations

- – Increased transparency in payroll processing

- – Reduced number of queries from employees

- – Higher compliance

- – Lower load on payroll administrators

Hello everyone.

I want to help from everyone regarding my question.

My question is if any employee salary more than 25000 thousand then can we deduct his pf according to pf rules or can we show him exempted employees.

Please give me reply regarding my question quickly.

All salaried employees in India earning a basic salary of up to Rs. 15,000 per month are eligible to contribute to EPF. However, employees earning more than Rs. 15,000 per month may still choose to contribute voluntarily.

Whether ESI/PF is mandatory or not for daily wage workers or weekly salaried workers.

ESIC and PF are subject to the number of employees in the company, irrespective of whether they are daily wage workers or weekly salaried employees.

Companies with 20 or more employees must register for EPF. ESIC registration is mandatory for companies with over 10 employees and monthly wages below or up to Rs. 21,000 (Rs. 25,000 for employees with disabilities).

ESIC contributions are set at 0.75% for employees and 3.25% for employers, with exemptions for those earning up to Rs. 176 daily. For PF, it applies to permanent daily wage workers, with a 12% monthly salary contribution.

I’m planning to start a retail garments store with around 50 employees. The salary for half them of 16-17k but the other half will start with 14k per month. I’m also providing them with accommodation which almost comes down to 1000 per person which i plan on deducting from their salaries. Do i have to deduct PF for all of them or just the ones with salaries less than 15000. I’ll deduct and contribute ESI for all my employees. Just a little confused about the PF rules.

As you have more than 20 employees, PF will be deducted for all your employees.

You may opt out any of the 4 PF rules for PF deduction:

12% of basic

12% of basic max Rs. 1800

12% of Gross – HRA max Rs. 1800

12% of Gross – HRA

I have recently started a web site, the information you provide on this website has

helped me tremendously. Thanks for all of your time & work.

Clarification Regarding EPF Deduction By the Employer

In case any employee wants to rewarded EPF on total salary of 20000/- i.e, 2400 per month.Then the Employer can Deposit EPF on 15000/- i.e, 1800 per month. Kindly Clarify.

yes, Employer maximum contribution only 1800.

How to Deal with the SCN given by the ESI department due to the reason of Late regestration of employees in Esi Portal

When a show-cause notice is issued to an employer by ESIC, it is important to reply within 15 days. Make sure to specify the reason for late registration and provide all the required documents to regional and sub-regional offices.

Hi, My employer started PF deduction from this month & he is deducting employee+ employer contributin both from my CTC including that he is deducting 1% Administrative charges also from my Gross salary.

is it correct?

As per the sources, the current EPF Admin charges are 0.50 %, subject to a minimum of Rs. 75 per month for every non-functional establishment having no contributory member and Rs 500/month/establishment for others.

Dear Sir,

I have 3 emploees in my Firm their Gross salary is 18000 + DA 6000 = 23000/- We wish to pay them PF & ESIC can we deduct PF and contribute to PF fud & ESIC

ESI registration applies to all factories or entities that employ 10 or more persons who have a maximum salary of Rs. 21,000.

On the other hand, PF deduction eligibility for a salaried employee with less than Rs. 15,000 per month (basic + dearness allowance), it is mandatory to open an EPF account by the employer. However, employees earning more than ₹15,000 can also voluntarily stay in the EPF scheme.

SIR, MY QUESTION IS MY FRIENDS SALARY IS BASIC RS.16000, CA – 1000, WA-400 AND THEY ARE DEDUCTING ESIC OF RS.120/- PER MONTH BUT AS I AS DO NOT WANT TO DEDUCCT PROVIDENT FUND I HAVE GIVEN LETTER AND PF IS NOT DEDUCTED. BUT NOW, SUDDENLY THEY ARE INSISTING FOR DEDUCTION OF PF, AS PER MY KNOWLEDGE IF THE SALARY IS ABOVE 15000/- NO NEED OF DEDUCTING PF ONLY ESIC IS ENOUGH PLEASE HELP ME WHETHER IT IS COMPULSORY THAT BOTH ESIC AND PF SHOULD BE DEDUCTED OR ONLY ESIC IS ENOUGH

Employees are covered under ESIC if their salary is below Rs. 21,000 per month and the organization is covered under ESI.

Since the salary of your friend is less than 21,000, they are eligible for ESIC deduction. As per the ESI Act, the employer contributes 3.25% of the wages, and the employee contributes 0.75% of the wages to the contributory fund, which is then used to provide insurance cover to the employees.

Whereas PF deduction eligibility for a salaried employee with less than Rs. 15,000 per month (basic + dearness allowance), it is mandatory to open an EPF account by the employer. However, employees earning more than ₹15,000 can also voluntarily stay in the EPF scheme.

I have two employee salary less than 20K and I have ESIC no, it was issued while I have incorporated my OPC. Do I need to Pay ESIC for them.

Since the salary of your employees is less than 21,000, they are eligible for ESIC deduction. As per the ESI Act, the employer contributes 3.25% of the wages, and the employee contributes 0.75% of the wages to the contributory fund, which is then used to provide insurance cover to the employees.

If salary is less than 21000 and registered for PF and then still ESI is mandatory?

Yes. All the establishments covered under the ESI Act and all factories that employ more than 10 employees and pay wages below Rs. 21,000 per month (Rs. 25,000 for employees with disability) must register with the ESIC and contribute towards the ESI scheme

MY CTC IS 24999

BASIC PAY – 13914

HRA – 4174

COVEYANCE ALLOWENCE – 1600

MEDICAL REIMBURSEMENT – 1250

SPECIAL ALLOWENCE – 2252

MY GROSS SALARY – 23191

PF DEDUCTION -1669

AND EMPLOYER DEDUCTION -1808

SO KINDLY CONFIRMED IS THAT NECESSARY TO DEDUCTED 2 TIME PF IN MY SALARY

For EPF, both the employee and the employer contribute an equal amount of 12% of the monthly salary of the employee. Employees can contribute more than 12% of their salary voluntarily, however, the employer is not bound to match the extra contribution of the employee.

In your case, your employer seems to have deducted PF for both contributions (employee and employer) from your salary. It must have been mentioned in your offer letter at the time of joining

Sir my salary is more than 21730: So I do not want to deduct EPF from my salary then sir any such rules or form

Dear Dinesh

If you r in PF your contribution will be deducted & deposits with PF authuthorities, no matter what’s your Basic/applicable salary.

Hi its Teena I just want to confirm that my total salary is 9000 and for the last 2 years my PF was decreasing from my full salary and now after 2 years suddenly my basic pay has been reduced and the PF has been reduced from it. And this work was done to save money.

Basic – 5400+HRA – 2250+CA – 1350+ Total – 9000+PF 648+ESI – 68. In hand 8284.Before changes my Pf was deducted from my full Salary that is 9000 and PF is 1080

I just want to know if it is correct or not. If not, please tell me what action can be taken on doing this work

As per practice, basic will not be reduced, it is never advisable to reduce basic.

If your basic is reduced then u have to check what all formalities was done to do so.

As it is objectionable matter

Basic+DA is not reduced because as per law whenever minimum wages is decided according to there category like unskilled, semi skilled, skilled or highly skilled it should be remain same according to law.basis is 5400 is totally worng.

Dear Concern

As per salary prescribed by your employer, the deduction rates are corrects.. no need to take further action on this matter..if you have any queries let me know..

Aadi Sharma

Hi, If the salary is 25000/- before any deduction and the contribution of the employer is 40% on the 25000/- i.e. (10000 x 12%=1200) and the employee share will be on the gross i.e.25000/-( in his own willingness ) which comes to 3000/- and how to file enter in the ecr ? can you please explain,it very urgent Please confirm if this is correct UAN NUMBER#~#NAME OF THE EMPLOYEE#~#25000#~#10000#~#10000#~#10000#~#3000#~#833#~#367#~#0#~#0

Hello, one of our employee’s monthly CTC is Rs. 22,000/-. The deduction includes Rs. 200 Professional Tax, Rs. 1430 Employer PF, Rs. 1320 PF Employee. So the total deduction is Rs. 2950. Hence the gross will go around 19,000. So do we still have to deduct ESI? Or PF Amount Deduction is considered as a part of Gross Salary? Thank you.

As per ESIC rules, if an employee getting monthly payable salary upto 21000 then he is liable to pay ESIC contributions.

Yes u have to

Suresh

As an employee, can I take only ESI ?… I dont want to contribute for EPF… please suggest

Yes, you can take only ESIC benefits and not contribute to PF, if your monthly gross salary is falling under the ESIC limit i.e 21000 per month.