Get latest updates on income tax rules and 24Q form filing for FY 2018-19.

In India, 2016 ended with the news of Demonetisation surfacing all over the country and impacting rich and poor alike. The prolonged cash shortage created a lot of confusion and chaos for the common people, and it hugely impacted disposable income of the countrymen. Government of India planned this move to cease cash-centric black market and cleanse & digitize the economy, but it received mixed reactions.

After this recent financial reformation, it was that time of the year when finance gurus, corporate people and individuals speculated the ease of income tax rates and anxiously waited to hear the changes in some important tax laws.

In this post, you’ll find several tax-related proposals announced by Mr. Arun Jaitley, Indian Finance Minister, to be made effective for Financial Year 2017-18.

01. Low Income Tax Rate

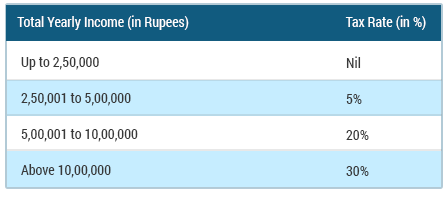

The government has reduced income tax rate from 10% to 5% for employees having salary slab between Rs 2.5 lakh and Rs 5 lakh.

A uniform tax benefit of Rs 12,500 is available for all other income groups. This may relief middle-class salaried individuals.

02. Additional Surcharge

Tax payers in income group of Rs 50 lakh to Rs 1 crore are liable to pay an additional surcharge of 10%.

The 15% surcharge remain unchanged for tax payers with total taxable income above 1 crore.

03. Low Tax Rebate

Under Section 87A, there is zero tax liability for those with income upto Rs 3 lakh per annum. Tax rebate has reduced from Rs 5,000 to Rs 2,500 for resident individuals whose total income does not exceed Rs. 3,50,000. Change in tax rebate has given a hit to the salaried employees.

04. Exemption on Home Loan Interest

In the Union Budget 2017, the government proposed a limit of Rs 2 lakh per annum subjecting to “Loss from house property”. Earlier there was no such limit and home loan borrowers privileged full tax deduction on the interest they paid on the home loan. This has been changed for the financial year 2017-18.

05. Aadhaar is Mandatory for PAN Application and Tax Filing

According to the new Union Budget 2017, it is mandatory to mention Aadhaar details in the ITR filing.

Also, existing PAN card holders have been asked to link their PAN to Aadhaar. For those who wish to apply for PAN cards, it is mandatory to have Aadhaar first.

06. Tax Return

Tax return filing has been simplified. A new one page ITR form is introduced for people having income less than Rs 50 lakh per annum and rental income from one house property.

07. Deduction on Rent Paid

People living in rented accommodations and paying heavy amounts need to deduct and submit TDS. In case, the monthly rental payment exceeds Rs 50,000 than it will have 5% TDS deduction. This will be made effective from June 1, 2017.

08. Late Tax Filing

Late tax filers and defaulters will have to pay fine up to Rs 10,000. Low tax payers or those falling in income group less than Rs 5 lakh may be asked to pay Rs 1,000 as fine for late tax filing.

All these new taxation related laws have been clearly outlined by government and the citizens are expected to abide by these rules. It has become challenging for organizations to incorporate these changes quickly in their payroll processing.

Click here to read useful information that would help you file ITR-1 and report taxes and investments accurately under “Income from Other Sources” section

Why Every Business Needs a Reliable Payroll Software?

Accomplishing business functions, such as Tax Compliance, Payroll Processing, Financial Accounting and Consolidation, requires enough resources, manpower, dedicated time, and a prominent level of competence.

Being India’s leading payroll software provider, Empxtrack has incorporated all the latest income tax changes to help clients avoid compliance risks and unnecessary penalties. Payroll management has become much easier and faster with Empxtrack payroll software.

Empxtrack offers you a full-suite of well-integrated HR tool to handle all aspects of your payroll processing, depending upon your requirements.

Click here to read latest income tax rules for FY 2019-29.

Process payroll for 25 employees at no cost

* No credit card required

A wrong selection of ITR form will lead to misinformation in the complete Report and the Income Tax Department can issue a notice for under-reporting Income. So to avoid this type of hassle you need to choose the correct ITR form. But many do not aware of how to choose ITR form.