As we step into the financial year 2024-25, we will observe new income tax rules 2024 with significant changes. The Indian government has made these changes to simplify taxes and match the ever evolving economy. One of the key changes is the introduction of a new income tax regime, offering taxpayers an alternative to the existing one.

This post highlights the intricacies of the new income tax slabs 2024-25 and compares the new tax regime vs old tax regime. Consequently, this comparison would help taxpayers in making informed decisions.

Understanding the New Income Tax Regime 2024

The new income tax regime 2024-25 aims to simplify the tax structure. This results in offering lower tax rates without claiming deductions and exemptions. Under this regime, taxpayers have the option to choose either the new tax slab rates or the old tax regime with deductions and exemptions.

Key Features of the New Tax Regime

As per the income tax rules 2024, here are a few benefits of the new tax regime:

Lower Tax Rates

One of the primary benefits of the Indian New Tax Regime 2024 is the introduction of lower tax rates across various income slabs. This reduction in tax rates directly translates into lower tax liabilities for taxpayers, hence allowing them to retain a higher portion of their income. However, tax liability will be zero for salaried people with income up to 7.5 lakh.

Simplified Tax Filing

The New Tax Regime streamlines the tax filing process by eliminating most deductions and exemptions. Consequently, this simplification reduces the complexity of tax calculations and paperwork, therefore making it easier for taxpayers to file their returns accurately and efficiently. As a result, taxpayers save time and effort previously spent navigating through numerous deductions and exemptions.

Increased Flexibility

The New Tax Regime offers taxpayers greater flexibility in managing their finances and tax planning strategies. With the option to choose between the new regime vs old regime tax annually, taxpayers can evaluate their financial circumstances each year and subsequently opt for the regime that best suits their needs. This flexibility enables taxpayers to adapt their tax planning strategies to changing economic conditions and personal financial goals.

Reduced Compliance Burden

By eliminating most deductions and exemptions, the New Tax Regime reduces the compliance burden on taxpayers. With fewer rules and regulations to navigate, taxpayers can focus on their core financial activities without the added complexity of maximizing deductions or keeping track of exemption limits. This reduction in compliance burden further translates into a more straightforward and hassle-free tax filing experience for taxpayers.

Self-employed professionals, especially those managing irregular finances, should consider the specifics of filing 1099 taxes to understand their true tax obligations. Opting for such resources ensures they efficiently allocate funds for taxes due throughout the year.

Surcharge Rate Reduction

The surcharge rate for individuals earning over ₹5 Crores has decreased from 37% to 25%. This reduction in surcharge rate applies exclusively to those opting for the new tax regime.

Rebate Limit Enhancement

Under the new tax regime, there’s an enhancement in the rebate limit. For incomes up to ₹7 lakhs, the rebate limit has been raised to ₹25,000.

Deductions and Exemptions that can’t be Claimed

The following are some of the major deductions and exemptions can’t be claimed under the new tax regime:

- » Deduction under Section 80TTA/80TTB

- » Professional tax and entertainment allowance on salaries

- » Leave Travel Allowance (LTA)

- » House Rent Allowance (HRA)

- » Allowances to MPs/MLAs

- » Minor child income allowance

- » Helper allowance

- » Children education allowance

- » Other special allowances [Section 10(14)]

- » Additional depreciation under section 32(1)(iia)

- » Deductions under section 32AD, 33AB, 33ABA

- » Various deductions for donation for or expenditure on scientific research contained in section 35(2AA) or 35(1)(ii) or (iia) or (iii)

- » Deduction under section 35AD or section 35CCC

- » Interest on housing loan on the self-occupied property or vacant property (Section 24)

- » Chapter VI-A deduction (Section 80C, 80D, 80E and so on, except Section 80CCD(2) and Section 80JJAA)

- » Exemption or deduction for any other perquisites or allowances including food allowance of Rs 50/meal subject to 2 meals a day

- » Employee’s (own) contribution to NPS

- » Donation to Political party/trust, etc

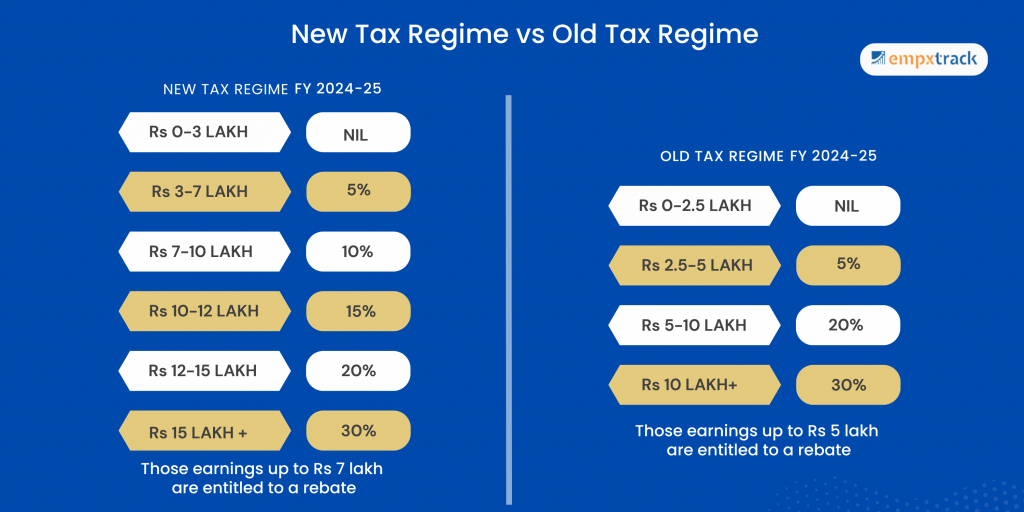

New vs Old Tax Regime Comparison

Now let’s see a comparative analysis of the new tax regime and the old tax regime. Examining various aspects such as tax rates, deductions, exemptions, and implications for different taxpayer profiles.

Here are some highlights of new vs old tax regime comparison

Tax Rates

New Tax Regime: The new tax regime offers lower tax rates across different income slabs, providing relief to taxpayers.

Old Tax Regime: The old tax regime follows a progressive tax structure with higher tax rates, but taxpayers can avail deductions and exemptions to lower their taxable income.

Deductions and Exemptions

New Tax Regime: Taxpayers opting for the new tax regime cannot claim deductions and exemptions, leading to higher taxable income but lower tax rates.

Old Tax Regime: The old tax regime allows taxpayers to avail various deductions and exemptions, reducing their taxable income and overall tax liability.

Impact on Different Taxpayer Profiles

Salaried Individuals: Salaried individuals with limited deductions may find the new tax regime beneficial due to lower tax rates and simplified tax filing.

Self-Employed Professionals: Self-employed professionals who rely heavily on deductions may prefer the old tax regime to maximize tax savings.

Senior Citizens: Senior citizens with lower income may benefit from the new tax regime’s lower tax rates, especially if they have minimal deductions.

How Payroll Software Can Help in Managing New Income Tax Rules 2024-25?

Since there are amendments in the new income tax slabs 2024, it may become difficult for organizations to manage them manually. As a result, employees may also face challenges in getting maximum benefit from the income tax slabs 2024 25. Hence it is important to implement and use reliable payroll software solutions for managing the new income tax slabs 2024. A leading payroll software provider like Empxtrack can play a crucial role in helping organizations effectively manage the latest Indian income tax rules 2024-25.

There are a number of ways in which a payroll software can be useful. Firstly, the software easily manages the income tax calculations, ensuring accuracy and compliance with the latest rules. Secondly, real-time tax updates in the software as per government laws help organizations to minimize errors and get 100% accurate tax calculations. Thirdly, the configurable payroll system enables the employees to choose any tax regime (old or new).

In addition to this, integration capabilities, complete data security, comprehensive reports and availability of self-service portal also benefit employers as well as employees.

By leveraging Empxtrack’s capabilities, organizations can streamline their payroll processes, minimize compliance risks, and empower employees to manage their tax obligations effectively.

Conclusion

The income tax changes 2024 significantly impact the taxation landscape, offering taxpayers a choice between the new tax regime and the old regime. While the new tax regime provides lower tax rates and simplified tax filing, it comes at the cost of forfeiting deductions and exemptions available under the old regime.

Before making a decision, taxpayers must carefully evaluate their financial situations, tax planning objectives, and eligibility for deductions. Ultimately, choosing the right tax regime can lead to significant tax savings and ensure compliance with the evolving tax laws.

In conclusion, understanding the income tax rules of 2024 requires careful consideration of whether to opt for the old tax regime or the new tax regime. Most importantly, it’s essential to weigh the implications of each option before making a decision. By weighing the pros and cons of each regime and seeking professional advice if needed, taxpayers can make informed decisions This will certainly help the taxpayers to avail the maximum benefits of the income tax rules 2024-25.

Frequently Asked Questions

Q1. | What are the key changes introduced in the income tax rules 2024? |

| Ans. | In 2024, the income tax rules have undergone significant changes. These include revised tax slabs with lower rates, the introduction of a new tax regime, emphasis on digitalization, and stricter anti-avoidance measures. |

Q2. | How do the revised tax slabs in 2024 impact individual taxpayers? |

| Ans. | The revised tax slabs for 2024 offer lower tax rates across different income brackets, resulting in reduced tax liability and increased disposable income for taxpayers. |

Q3. | What is the new tax regime introduced in 2024? |

| Ans. | The new tax regime introduced in 2024 offers lower tax rates but eliminates most deductions and exemptions available under the old regime. Taxpayers have the option to choose between the old and new regimes based on their individual preferences and financial circumstances. |

Q4. | What are some advantages of opting for the new tax regime? |

| Ans. | Opting for the new tax regime may result in lower tax rates and simplified tax filing procedures, in addition to reducing the compliance burden on taxpayers and increasing take-home pay. |

Q5. | Can taxpayers switch between the old and new tax regimes? |

| Ans. | Yes, taxpayers have the flexibility to switch between the old and new tax regimes each financial year. This can be based on their financial goals and tax planning objectives. |

Q6. | What digitalization initiatives are introduced under the new income tax slabs 2024-25? |

| Ans. | The latest income tax rules emphasize the adoption of digital technologies for tax compliance and administration, including electronic filing of returns, online payment platforms, and pre-filled tax returns. |

Q7. | How do the latest income tax rules impact small business owners? |

| Ans. | Small business owners must familiarize themselves with the latest income tax rules. They should moreover leverage digital payroll processing tools to streamline tax reporting and payment processes. |

Q8. | What are the standard and other deductions given under the new income tax regime? |

| Ans. | All salaried individuals using old or new income tax regime can have a standard deduction of Rs. 75,000. There are two other deductions which are added under the new tax regime. Firstly, deduction from family pension income of Rs. 25,000. Secondly, deduction of the amount paid or deposited in the Agniveer Corpus Fund under Section 80CCH. |

Q9. | Are there any specific provisions for senior citizens under the latest income tax rules, as per the income tax changes 2024? |

| Ans. | Senior citizens may benefit from the revised tax slabs and lower rates introduced in 2024, especially if they have minimal deductions. However, they should carefully evaluate their options based on their financial circumstances. |

Q10. | What is the exemption provided on leave encashment as per the new income tax rules 2024-25? |

| Ans. | If you are opting for the new tax regime, you will receive an exemption on leave encashment. After the budget 2023, the exemption limit for non-government employees for leave encashment has increased significantly from Rs. 3 lakhs to Rs. 25 lakhs. Therefore under Section 10(10AA), leave encashment up to Rs. 25 lakhs is tax-free upon retirement. |

Q11. | How can taxpayers stay informed about the latest income tax rules 2024 and changes? |

| Ans. | Taxpayers can stay informed about the latest income tax rules and changes by regularly checking updates from the income tax department. They can further consult tax professionals, and utilize online resources provided by the government. The implementation of online payroll software also keeps the taxpayers informed about the income tax slabs 2024-25 as well as old tax regime vs new tax regimes. All this helps in making informed decisions. |

The detailed overview provided on the new income tax regime for the financial year 2024-25 is incredibly insightful and comprehensive. It excellently outlines the key changes, benefits, and comparisons between the new and old tax regimes, offering valuable information to help taxpayers make informed decisions. The breakdown of the new tax rates, savings and investments, simplified tax filing process, increased flexibility, reduced compliance burden, and surcharge rate reductions presents a clear picture of the advantages of the new regime. This post is a valuable resource for anyone navigating the complexities of the evolving tax landscape.