The four labour codes are the biggest reforms in India’s employment landscape. This is not just any policy update but a structural shift that makes a labour law compliance checklist more essential than ever.

Organisations therefore need to prioritise labour code compliance due to its growing significance in business operations. For small businesses, startups, factories, and MSMEs, this means taking on new responsibilities to comply with updated labour rules and wage structures. Thus, ensuring workplace compliance in India. The good news is, you don’t need to feel overwhelmed.

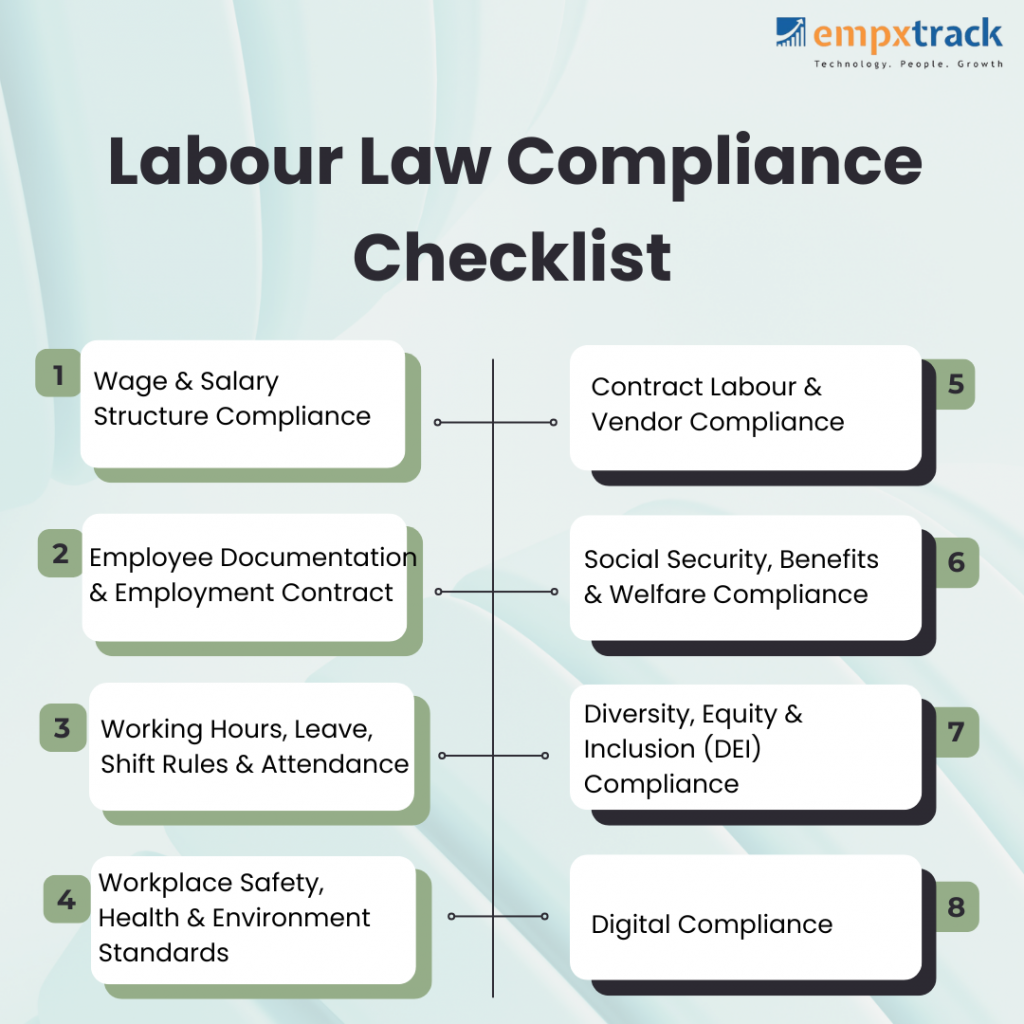

In this post, we have created a simple and practical checklist for labour law compliance that anyone can easily follow. After all, a structured approach to compliance can significantly reduce legal risks for organisations. By following this, businesses can ensure they stay up to date with legal requirements while fostering a fair and safe workplace for all employees.

Table of Contents

- 1. Why is Labour Law Compliance Important in India

- 2. Why Small Businesses Must Follow the New Labour Codes

- 3. Labour Law Compliance Checklist

- Wage & Salary Structure Compliance

- Employee Documentation & Employment Contract Compliance

- Working Hours, Leave, Shift Rules & Attendance Compliance

- Workplace Safety, Health & Environment Standards

- Contract Labour & Vendor Compliance

- Social Security, Benefits & Welfare Compliance

- Diversity, Equity & Inclusion (DEI) Compliance

- Digital Compliance

- 4. Conclusion

- 5. Frequently Asked Questions

Why is Labour Law Compliance Important in India

Labour law compliance is of utmost importance in order to ensure workers’ job security, promote healthy work experience and offer fair wages and benefits to all. Adhering to these labour laws compliance also ensures that employees are treated fairly with no scope for discrimination and exploitation by the management.

Staying compliant not only protects employees’ rights but also helps businesses avoid penalties and reputational damage that can result from non-compliance. Comparatively, compliant organisations face fewer disruptions and can focus on their long term growth.

Compliance plays a crucial role in standardising HR processes and creating efficient and transparent HR operations. By adhering to statutory compliance, such as those related to wages, social security, working hours, workplace safety etc, businesses can not only standardize their HR practices, but also run operations smoothly.

Why Small Businesses Must Follow the New Labour Codes

Small businesses are feeling the impact of the new labour codes more acutely, nevertheless it is crucial for them to stay compliant with the latest laws and regulations. Compliance helps avoid legal penalties, fines, legal notices and inspections that can disrupt operations. Furthermore, following these regulations ensures employees’ rights are protected, from fair wages and social security benefits, to safe working conditions, which in turn fosters loyalty and trust.

Maintaining compliance also enhances the business’s reputation, which signals out that professionalism and ethical practices are followed and prioritised. This in turn, can help attract talent and potential clients.

Moreover, adherence to the codes streamlines HR processes, including payroll, record-keeping, and contracts auditing. By implementing it, small businesses will not only mitigate risks but also ensure workplace transparency for smooth operations. Ultimately, consistent compliance creates a stable foundation for long-term success.

Labour Law Compliance Checklist

Here is a HR compliance checklist India for 2026.

Wage & Salary Structure Compliance

● Audit salary structures with a chartered accountant to identify allowance exposure

● Ensure Basic + DA = at least 50% of total wages

● Give minimum wage according to the rates notified by state government

● Deduct PF and ESI as per eligibility

● Identify employees whose take-home salary may change

● Budget for increased PF contributions

● Pay overtime at double wages

● Make salary payments on time by setting automated payroll alerts to prevent delays

Employee Documentation & Employment Contract Compliance

● Issue appointment letters to all new hires and current employees who don’t have them

● Review and revise standard employment agreements with legal counsel

● Document performance issues formally

● Train managers on the new exit procedures

● Estimate severance liability for your current headcount

● Budget 2–3 months of salary per departing employee

Working Hours, Leave, Shift Rules & Attendance Compliance

● Maintain the 48-hour weekly work limit

● Provide a mandatory weekly off

● Paid leave starts after 180 days of service

● For night shifts, ensure transport and security arrangements via approved vendors

● Implement tracking systems for gig worker hours and payouts

● Follow night shift rule for women with their consent and safety measures

Workplace Safety, Health & Environment Standards

● Designate a safety officer and schedule annual safety audits

● Maintain basic safety and cleanliness standards

● Provide proper sanitation, drinking water, and adequate ventilation

● Document current safety practices (even basic ones)

Contract Labour & Vendor Compliance

● Ensure contractor license validity

● Check contractor classification

● Revise vendor agreements with clear worker-classification language

● Ensure contractor documents and compliance are valid

Social Security, Benefits & Welfare Compliance

● Ensure maternity benefits for eligible workers

● Fixed-term employees receive nearly identical benefits to full-time staff

● Provide gratuity for fixed-term employees after 1 year of service

● Maintain PF/ESI registers

● Budget 1–2% of gig-worker payouts for welfare contributions

Diversity, Equity & Inclusion (DEI) Compliance

● Draft and publish DEI policies ensuring equal opportunities

● Conduct a pay-equity audit (gender/role based)

● Publish equal opportunities for transgenders

Digital Compliance

● Maintain a backup of all the documents digitally

● Automate attendance, leave, payroll and salary slips

● Maintain digital records of salary payment

Conclusion

It is crucial for businesses large and small to stay compliant with the latest labour laws. By doing so, they can safeguard both employees’ rights as well as the organisation’s legal standing. This will also mitigate legal risks and foster a positive work environment.

Moreover, following these regulations will minimize administrative errors and reduce the possibility of any disputes. HR teams can thus focus more on strategic initiatives such as talent development and workforce planning.

Non-compliance can expose the business to significant legal and operational risks. Thus, staying fully compliant with the help of a labour laws compliance checklist, will ensure smooth operations and build trust with employees. Ultimately, it will strengthen the organisation’s long-term growth and stability.

More has been covered in our previous posts about the labour codes and their implications for workers and businesses. Read them in detail and know everything about the labour codes reforms in 2025.

Frequently Asked Questions

Q1. | What is included in an HR compliance checklist? |

| Ans. | The HR compliance checklist includes wage and salary compliance, employee contract and documentation, attendance and shifts, workplace safety, environmental and health, social security benefits, contract labour and vendor,DEI and digital compliance. |

Q2. | What salary rules should HR follow under the new labour codes? |

| Ans. | Under the new labour codes, HR must ensure that the Basic Salary + Dearness Allowance (DA) together form at least 50% of an employee’s total wages. They should ensure that salary payments are made on time and set automated payroll alerts to prevent delays. Besides this, HR should budget 2–3 months of salary per departing employee. By doing this, they can ensure that they are adhering to workplace compliance in India. |

Q3. | What documents must employers maintain for compliance? |

| Ans. | Employers must maintain a set of documents to ensure compliance under the new labour codes and statutory compliance checklist. These documents include employee records, attendance and leave records, wage and payroll records, health and safety records, social security records such as PF and gratuity and contract labour registration. |

Q4. | Are gig workers included in the new compliance requirements? |

| Ans. | Yes, gig workers are included under the new labour codes. For the first time, the Social Security Code, 2020, formally recognises gig and platform workers and brings them under the social security framework. |

Q5. | How can employers stay compliant with working hours and shifts? |

| Ans. | Employers can stay compliant with working hours and shifts by following these compliance best practices for HR: Adhering to the working hours limit Paying overtime correctly Rotating shifts responsibly Using attendance and shift planning software Staying updated with state specific rules Ensure that policies are clearly communicated and followed through with regular labour law audits. |

Q6. | What social security benefits must employers provide in 2026? |

| Ans. | In 2026, employers must extend social security benefits to all categories of workers including those in the unorganised sector as well as gig and platform workers. These workers will be covered under schemes for PF, ESI, and additional protections such as disability and life insurance. Thus, ensuring broader and more inclusive social security coverage across the workforce and also implementing labour law compliance audit. |

Q7. | How can HR prepare for the new labour code changes? |

| Ans. | HR can prepare for new labour code changes by auditing and revising current processes, updating payroll and salary structures, digitizing records, training staff, and communicating changes to employees. A labour law compliance checklist and HR compliance guide can help them significantly across all labour code areas. |

This is going to be extremely useful for HR professionals and employers alike. Thanks for sharing such a detailed and practical compliance checklist.