This blog talks about the payroll challenges faced by businesses across, and how a payroll management tool helps resolving these challenges.

Transitioning paper-based payroll processing to an online payroll system has always been a debatable topic for the leadership in many organizations.

Despite having payroll software and resources, organizations consistently face payroll challenges. A payroll management administrator encounters many payroll issues on day-to-day basis, each with varying degree of success in resolving them.

Many organizations outsource their payroll services to avoid all the trouble involved with payroll processing and the challenges they face. They are unaware of the consequences of sharing confidential employee data with the third party service providers. Outsourced payroll management may involve some risks. On the other hand, having an in-house online payroll software offers ample benefits.

Make Payroll Management Easier & Faster!

In a recent survey, more than half of the employers accepted the fact that their payroll management process needs enhancement and there is a great scope for improvement in it. Organizational inconsistency in payroll management, over and under payments and incorrect tax withholding are the most common payroll errors faced today.

As organizations continue to search for excellence in business, they need centralized and standardized payroll processes to have significant cost savings. This is where an advanced integrated payroll software comes in. It enables HR (or payroll administrator) to manage payroll operations effectively and eliminate all the risks related to payroll processing.

Five Common Payroll Challenges in Payroll Processing

Here are five common problems that companies having in-house payroll management face, and some useful tips to resolve them.

Administrative Issues

Many businesses, especially smaller ones, still carry out their payroll process manually. A manual payroll system typically requires a great deal of manual interventions. It creates an administrative burden for you and your HR staff.

Errors in data entry can create payment issues and the misapplication of rules. This can be resolved by using an integrated payroll software. In fact, a great initial solution is to simply invest in payroll software, which can be far more cost-effective than hiring additional staff to handle a growing manual process.

Organizational Challenges

Maintaining payroll records and employee information in an effective and accurate manner is one of the major organizational challenges. Sometimes it is simply a matter of work flow – keeping files and documents in a central location and creating uniform filing processes.

Gradually minimizing or even eliminating paper forms and files can be an effective solution. This can be accomplished by using a payroll software that has all your human resource and payroll functions integrated.

Incompatible Software

If you haven’t experienced it already, you may find that not all payroll programs are compatible. For example, the program used for your employee profiles or records may be different from the system you use for pay and benefits. And what about the program used for your employee performance?

Finding and investing in a program that can integrate all of these functions will streamline your overall process, reduce the amount of time spent tracking and with data input, and even allow your entire department to become more efficient and cost-effective.

Tracking Employee Absence

Manually tracking your employees’ vacation and sick days can be a cumbersome task with potential for mistakes. Paper time cards and even simple digital time sheets are notoriously prone to misuse and unintended errors. This can have an overall impact on payroll calculation.

Having an efficient time tracking software eliminates multiple time-card problems and buddy punching issues.

Compliance Risks

Irrespective of the size of the organization, even a small payroll error may cost a lot to your business. To avoid compliance issues and risks, companies need to stay compliant with hundreds of federal and state labour laws. An organization should be well-versed with the labour regulations in its country of operation. It is necessary to adhere to statutory compliances as it keeps business safe from the legal trouble and other risks.

Online Payroll Management Helps Meeting Payroll Challenges

Fortunately, an automated cloud-based payroll management software can avoid this risk. A leading payroll management software provider, like Empxtrack, supports an organization’s ongoing and changing compliance demands, and is a cost-effective solution for small and mid-size businesses.

Empxtrack payroll software offers:

- Secure SSL encryption

- Instant access on payroll updates anytime anywhere

- Record keeping for several years

- Configurable and customizable features

- Automatic payroll updates

- Immediate processing and easy printing

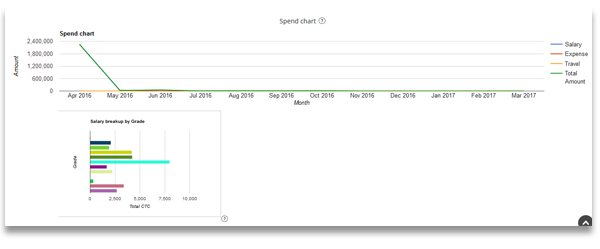

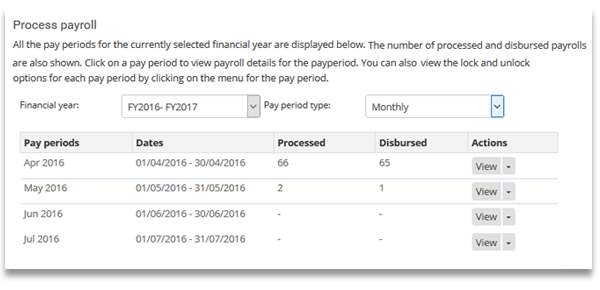

- Bird’s eye view through payroll dashboards

Avoid your expenditure on hiring employees to manage payroll. Build your own reports and access multiple reports such as variation, bank reports, payslips, deductions, pay-outs, accruals etc. Use an online payroll management software instead. Before making a buying decision, take a free-of-cost product demo to understand Empxtrack better and to resolve your payroll challenges.

well explained.

It was very useful to me. Keep sharing such ideas in the future as well. I am glad to come here Its help me to choose Human resources solution

Thank you for your information. this is about solve-5-major-payroll-challenges-with-an-online-payroll-software. I’m learning about payroll system from you.