This blog explains the steps involved in Payroll calculations to minimize challenges and develop a satisfied workforce.

6% – 13% employees have payroll related challenges every pay period. Most of these lead to queries for the payroll processing department (HR or accounts) and thus create significant dissatisfaction, re-work, stress and disruptions.

It is believed that a payroll processing software can help avoid these challenges. Yes, this is true but only partly!

A good payroll software helps but only so much. Therefore, a well-defined and streamlined payroll process with a suitable payroll software can help you completely avoid disruptions, cut costs and increase employee satisfaction.

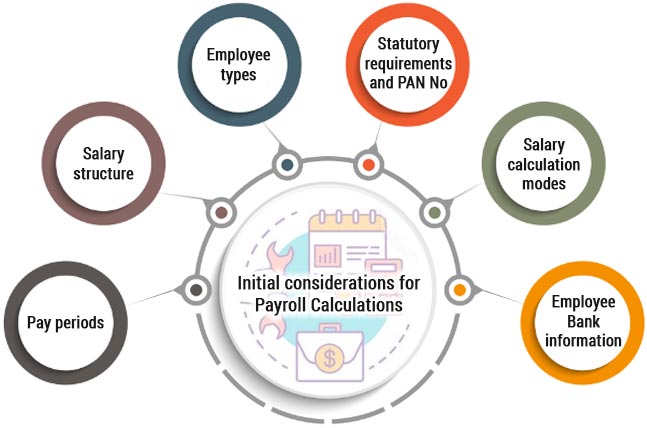

Initial considerations for Payroll Calculations

Pay periods

Usually, payroll calculations cover pay periods that span a month, a fortnight, or a week. A payroll cycle meaning monthly, weekly or biweekly payouts to employees in exchange of their services or work.

Calculate the payroll at the end of each pay period using the payroll calculation formula. There are a few important considerations while defining pay periods.

- Governments require payroll reporting by financial years, broken down into monthly, quarterly, half-yearly, and annual returns of various types.

- To ease and streamline the processes, the pay periods should ideally correspond to the financial year. In the Indian payroll context financial years span 01 Apr to 31st March of the following year. Your pay periods should map to this as well.

- Moreover, there should be a gap of 3 – 5 days between the end of the pay period and the payout date. Hence, this reduces pressure on the payroll processing department. So if you want to pay a salary on the 1st of each month, the corresponding pay period should end on the 25th of the prior month.

Salary structure

There may be different types of employees in your organization and it is helpful to define one or more salary structures for each type of employee.

The salary structure is a collection of salary heads that include

- – Wages (Basic salary),

- – Allowances (Dearness Allowance, House Rent Allowance, Transportation Allowance etc.),

- – Benefits (Retirement benefits: Provident Fund & Gratuity, Health Insurance: ESI, Medical Insurance) and

- – Accruals (Annual Bonus, Performance Linked Bonus)

- – Claims (Tax free allowances to employees against bills. Include Book allowance, Telephone allowance, Driver allowance, Petrol allowance)

- – Perquisites (These are not paid to employees but included in their salary structures and taxable)

However, salary structures exclude miscellaneous heads such as rewards, referral bonuses, joining bonuses, sales commissions, and expense reimbursements.

In essence, a salary structure helps in easy identification of CTC (Cost to Company ), running reports, creating offer letters and managing increments and helps in streamlining the payroll process.

Remember that a salary structure is just a template that contains various heads. The values for each salary head will vary for each employee.

Employee types

There are different salary components and taxation rules for different kinds of employees. Therefore, you need to identify the employee types applicable to your company.

While the topic is a blog in itself, the different kinds of employees covered include: Salaried, Hourly, Piece rate, Consultants and Commission agents. Therefore, this blog post applies to the first two categories viz Salaried and Hourly employees.

Statutory requirements and PAN No

For Salaried and Hourly employees, there are a number of statutory obligations that include

- – Minimum wages (based on the location of work of the employee)

- – Provident Fund (largely universal and based on your companys’ size)

- – Health Insurance (ESI) (based on the availability of ESI clinics / hospitals and your companys’ size)

- – Professional Taxes (based on the state where the employee works)

- – Statutory Bonus (based on the state wherHe the employee works) and

- – Gratuity (largely universal and based on your companys’ size)

Moreover, the Government of India mandates employers to record the PAN number of every employee whose payroll is calculated, especially where taxes are deducted. Therefore, employers must include this PAN number in various reports submitted for statutory filing. There are additional such identifiers including PF No, ESI No that transfer the benefit deductions to the correct employee records.

Salary calculation modes

The Indian tax structure includes various deductions and exemptions, making it fairly complicated. Subsequently, the payroll calculation formula in India incorporates various components such as basic salary, allowances, deductions, and taxes to ensure accurate employee compensation.

Since accurate deductions (taxes and benefits) are the responsibility of the employer, therefore, it is important to define the basis of the salary calculation (payroll formula), document it, and share it with all employees. For clarity, you can include this in your company policy document.

Most companies use Leave Without Pay (absent without leave) or Days worked to calculate the eligible salary.

In addition to a base salary, additional payouts mechanisms may include pieces created (piece rate employee), sales achieved (commission based employee).

Employee Bank information

The government discourages salary payment by cash due to its logistical challenges.. Moreover, check payments often take longer to transfer to employees bank account and are inconvenient.

Automatic bank transfers are the new norm for salary payments. Once setup, bank transfer is easier, faster and has a significantly lower cost.

Since employees may maintain an account in a bank that is different from the companys’ bank account, it is important to maintain bank transfer information for each employee.

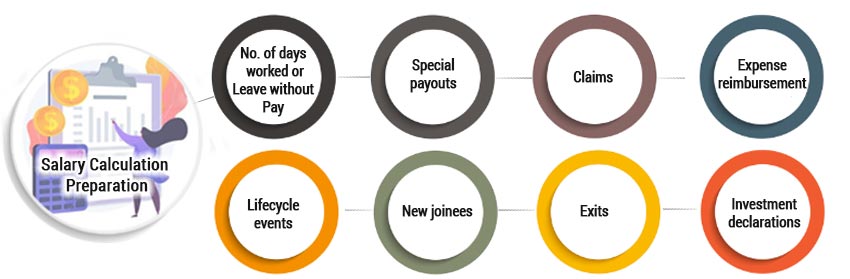

Salary Calculation Preparation

Before you pay the salary, there are a number of steps that need to be carried out for accurate salary calculation.

Identification of Number of days worked or Leave without Pay

This step is often the most time consuming and prone to errors. Employees might be marked absent (leave without pay) while attending a business meeting, visiting a client, or awaiting manager approval for their leave application.

In other cases, employees may fail to regularize their attendance, or their overtime hours and compensatory offs may go unrecorded or unapproved.

Each of these situations leads to incorrect calculation of the salary payout and is the primary reason for payroll calculation formula related challenges, errors, rework and dissatisfaction.

Therefore, HR runs reports and proactively identifies any such situations.Employees or managers need to be contacted and errors rectified.To emphasize, a self services platform that includes Attendance and Leave can assist HR significantly in this area.

Special payouts

Senior management or business unit heads sometimes pay employees outside the payroll for special rewards, sales commissions, or referral bonuses, often without involving HR or accounts.

As a matter of fact, this practice encourages the correct behavior, but the key challenge lies in recording these payments and deducting appropriate taxes. Follow these rules to avoid audit related challenges

- – First, institute a process that encourages a reward to be given as a letter and not a check.

- – Next, ensure that HR is always intimated when such a reward or recognition is given.

- – If the payout is to be made prior to the payroll, ensure that appropriate taxes are deducted. Unless the amounts are very small, ensure that the payment is by check.

- – lastly, include this payout as payments outside the payroll prior to the payroll calculation.

Note: Empxtrack offers a feature Capture payments outside the payroll to handle this situation and Empxtrack accurately calculates taxes to keep you statutorily compliant.

Claims

Organizations may offer senior employees certain tax-free benefits based on their job requirements. These include reimbursements of various types such as mobile reimbursement, car maintenance allowance, driver salary, petrol allowance, meal & entertainment allowances.

Include the other items to reduce the employee’s tax outgo, even though the last item is not part of the salary structure.

Additionally, you need to collect the claimed amount for each eligible employee, tally it with eligibility, validate the bills submitted and payout the same as a non-taxable or taxable amount.

Also, if you have a large employee base using such benefits, a workflow driven self-services platform would help manage this better. Particularly, record all such amounts before running the payroll.

Expense reimbursement

Companies often reimburse expenses through payroll. Therefore, if your company does this, ensure all approved expense reports are included before payroll calculation.

Lifecycle events

There could be a number of different lifecycle events and these may impact salary calculations and deductions. These include

- – Addition and removal of dependents (impact on taxes and benefit costs)

- – Addresses changes (impact on taxes)

- – Investment changes (such as house loan or payback)

- – Election of new benefits (impact on benefit costs and taxes)

- – Promotions, salary increments and salary structure changes (impact on arrears, taxes)

Specifically, identify and communicate each of these events for accurate salary calculations.

New joinees

Add a new joinee to the HRIS with all data records (such as PAN No, address information, dependent information), salary structure, and benefit deductions.

To allow accurate calculation of taxes, you also need to capture prior salary information through Form 12B.

To ensure that payroll calculations for new joinees is accurate and does not disrupt the process for all other employees, identify a cut-off date post which you will not include the new joinee in the current months’ payroll.

Let’s consider a payroll calculation example. if your pay period is from 26th through 25th of next month, exclude all new joinings after 20th in the current payroll run. The new joinee would have additional days counted in the subsequent pay-period. Communicate this to the new joinee as also make this a part of your company policy.

Exits

Many companies stop the payroll run for employees who have handed in their resignations. This is tricky – especially in cases where employees just stop coming to work post the pay period end date (eg. absconding employees). Hence, we can achieve this by separating the payroll processing and disbursement processes.

In case you have a formal clearance and Full and Final process, try to keep it after the payroll payout date to reduce the workload.

Also, educate your managers to communicate immediately if they receive a resignation or believe that they have an absconding employee.

Moreover, an exit process that ties into your payroll can reduce workload in managing exited employees.

Investment declarations

At present, Indian payroll allows various deductions under sections such as 80C, 80D, 24B. Accordingly, employees declare their investment plans under these schemes at the beginning of the year. House rent is also declared by employees.

This allows a reduced tax outgo.

To ensure accurate taxes towards the end of the financial year, you need to collect proof of the declarations and then change values as required. Hence, complete this promptly and identify a pay period, such as October, to deduct taxes based on employees’ actual investments. For the period Jan – Mar, you in-any-case need to use actual investments as a basis of tax calculation.

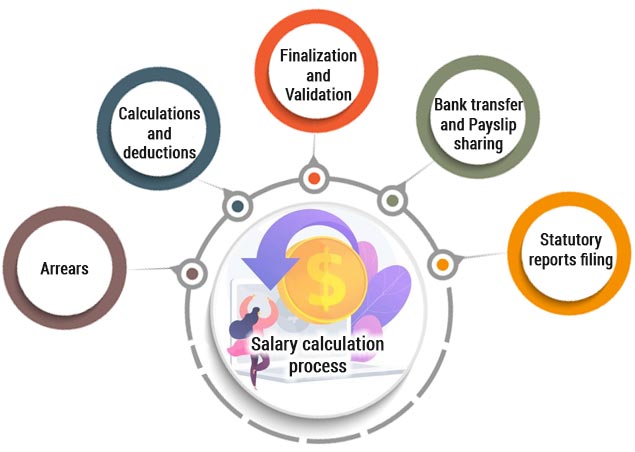

Salary calculation process

Once you identify all areas impacting salary calculations and collect the data points, you calculate the gross salary, deductions, and net salary. Moreover, there are a few things to consider here too.

Arrears

An employee’s salary may have changed in a prior period because there was a delay in the performance increment cycle.

Therefore, the company must pay salary changes retrospectively, and this process is called arrear calculation. The calculation will include additional income, increased taxes and deductions.

Once you have identified such cases, include the additional salary and deductions in the payroll run.

Calculations and deductions

Once you have identified all the elements for payroll calculations, it is easy to calculate the gross salary and deductions. Before calculations, the system can create a gap report to identify suspected issues like missing attendance, unavailable PAN numbers, or address changes. This report can preempt the removal of errors.

While the below calculations may not cover all cases, they can help you plan the calculations.

| Illustrative calculation | Comments | |

|---|---|---|

| Eligible Monthly Salary | Monthly Salary * (Total days in Month – Leave without Pay) / total days in month | Formula can vary based on the calculation basis. We can have hours worked, a piece rate, overtime, or fixed amount to identify the Eligible Monthly Salary. |

| Gross taxable Payout | Eligible Monthly Salary + Taxable Claims + Arrears + Payments outside payroll | |

| Taxes | Taxes on Gross taxable Payout | Taxes calculation is complex since we have to identify total yearly taxes by reducing yearly income by exemptions and deductions, reduce the amount of taxes paid already and divide the remaining amount by the pending pay periods Taxes will be different for consultants and commission agents. |

| Other deductions | ESI PF Gratuity Professional Taxes Others Health insurance | Rates as applicable |

| Net Payout | Gross taxable Payout + Non-taxable Claims – Taxes – Other deductions | This is the salary transferred to the bank. |

Finalization and Validation

It is always better to introduce a maker-checker process in your payroll. The maker does all of the above activities and the checker (who can be a senior employee such as CFO, Head HR or company director) who approves the processing.

The best way to validate a payroll is to compare it against a prior month’s payroll. Thus, dig deeper to identify reasons for any changes and you will quickly be done with approvals.

Bank transfer and Payslip sharing

After finalizing, mark the payroll as disbursed on the payout date. Also, print salary slips and share them via email or the self-service portal.

Evidently, the system creates bank reports to enable electronic transfers from your company’s account to individual accounts.

Statutory reports filing

There are a number of reports that are required post payroll processing and each of these follows its own cycle. More information is available on the blog Statutory Compliances in Indian Payroll Management System but at a high level, the reports include

| Period | Payroll reports and challans |

|---|---|

Monthly | Provident Fund ESI Professional Taxes TDS |

Quarterly | Form 24Q |

| Annual | Form 16 Form 24 Q (last quarter 24Q is annual) |

Conclusion

Timely payroll processing is a difficult and challenging process. However, if the above steps are communicated and followed diligently, the work of your payroll processing team can reduce significantly.

Moreover, implementing a payroll process that handles payroll calculations in a predictive manner with zero errors indicates a mature and stable company and leads to higher satisfaction amongst employees and HR.

Frequently Asked Questions

Q1. | How to calculate payroll? |

| Ans. | To calculate payroll, determine each employee’s gross pay by adding their salary and any bonuses, subtract taxes and deductions, and then calculate the net pay. Make sure to account for any overtime, leave, and benefits as part of the gross pay. |

Q2. | What is payroll calculation? |

| Ans. | Payroll calculation is the process of determining the total earnings of employees for a specific pay period, including wages, bonuses, and overtime. Additionally, it also involves subtracting applicable taxes and deductions to arrive at the net pay that employees receive. |

Q3. | How to calculate employee payroll taxes? |

| Ans. | To calculate employee payroll taxes, start by determining the employee’s gross pay for the pay period. Then apply the appropriate state, and local tax rates for income tax, as well as Social Security and Medicare taxes (depending upon your country or geography), to calculate the total deductions. Finally, deduct these taxes from the gross pay to find the net pay. |

Q4. | How to do manual payroll? |

| Ans. | To easily manage manual payroll calculation in excel, follow these steps: |

Q5 | How to manage payroll calculation in excel? |

| Ans. | To manage payroll in Excel, start by setting up a spreadsheet with employee details like names, employee IDs, and salary or hourly rates. Use formulas to calculate gross pay based on hours worked or monthly salary. Then, apply tax and other deductions. Finally, subtract these from gross pay to get net pay. While Excel can handle these tasks, using payroll software like Empxtrack can streamline the process and ensure accuracy, especially with compliance-related calculations and statutory, bank and other payroll reports. |

Just discovered this Future Salary Calculator, and I’m blown away by its features. It’s intuitive, comprehensive, and perfect for anyone looking to plan their financial future confidently.

This is a very nice one and gives in-depth information. I am really happy with the quality and presentation of the article. I’d really like to help appreciate it with the efforts you get with writing this post. Thanks for sharing

Thanks for pointing out that when there is a change in an employee’s benefits, it should also be reflected in their payroll. I’m thinking about hiring an entire kitchen staff for my restaurant business that will open next year and this will be the first time in my life that I will be having employees. Perhaps it would be better if I just get some payroll processing services so that it can be managed properly and with little chance for errors.