Refer to Empxtrack Payroll FAQs and find answers to commonly asked questions on how payroll processing is done in Empxtrack

What are the features of Empxtrack Payroll?

Empxtrack Payroll manages all aspects of payroll processing and takes care of all deductions and compliance requirements. Some of the main features are:

- Employee database

- Multiple salary structures for different employee groups

- Configurable salary heads

- Investment declaration based on new and old tax regime

- Availability of ESIC, PF, PT, LWF

- Downloadable calculated salary

- Multiple statutory reports and bank reports

- Comprehensive, configurable payroll reports

- Arrear and full & final calculation for accurate salary disbursal

- Quick payslip generation with multiple payslip formats

- Options to configure payroll, attendance, leave rules etc

- Leave and attendance dashboards for quick analysis

Note: Empxtrack also offers a free payroll software for up to 10 employees every month, at absolutely no cost. Upgrade the application to process payroll for more than 10 employees, and get advanced features with multiple configuration options.

Learn more about Payroll Management using Empxtrack

How can I start using Empxtrack Payroll for my organization?

After registering for Empxtrack’s free offering, access the system with your login credentials shared on your registered email ID. Then complete the initial setup of the application and select the Payroll product. Click on “Login to the portal” and go live with the payroll application.

What are pay periods and how to set or modify pay periods?

A pay period is the duration for which you pay a salary. Pay periods are typically Monthly, Bi-weekly or Weekly.

Empxtrack allows automatic generation of pay periods for each financial year once you specify the start date of the first pay period.

Note: Empxtrack Free Payroll offers Monthly, Bi-weekly and Weekly pay periods. Setup pay periods as per your company requirements. The Enterprise version of empxtrack allows you to have customized pay periods.

Can I delete employee data from the application?

Once an employee profile is created, it cannot be deleted. You can mark an employee as “Exited” in the application.

Learn more about Mark Employee Exited from Empxtrack System

How to setup or modify salaries for employees?

Setting employee salaries is very easy in Empxtrack. Under the View employees widget click the employee name or photograph. Click See full profile, go to Employment history section and Assign or modify salary.

Alternatively, type “assign salary” in the Search and select Setup salary structures. Click Assign salary to employees under Actions. Specify monthly or annual salary for an employee.

Set salaries for multiple employees by using Upload salary details functionality.

Notes:

- For ease of use and reporting, salaries are based on salary structures and the paid version of Empxtrack supports multiple salary structures with editable heads and capabilities to assign formula to salary heads.

- In Empxtrack Free Payroll, you can setup earning and deduction values at the time of calculating salaries.

How does empxtrack calculate salary?

Empxtrack Payroll software uses the following steps while calculating employee salary:

| Days worked | Attendance rules and daily hours logged identifies the number of days an employee has worked Holidays, weekends and Leave are counted as paid days. Percentage of Salary to be Paid = Days Worked / Total days in month |

| Out of salary payments | Any out of salary payments (such as commissions, arrears, loan returns etc.) are input by HR |

| Eligible salary | Eligible salary = Percentage of salary to be paid * Employee monthly Salary + Out of salary payments |

| Deductions | Deductions such as ESI, PF, TDS, Professional taxes are identified on the basis of location, investment declarations, and taxation rules |

| Net salary calculations | Eligible salary – Deductions |

Paid and advanced version of empxtrack allows addition of salary structure and offers multiple configuration options. It also provides different rules for different kinds of employees and integrations with other modules for seamless calculation of Net salary.

Note: In Empxtrack Free Payroll, you can calculate employee salary in a few clicks. Specify the earnings and deductions, and you get the calculated salary.

Watch a short video on how to process payroll with Empxtrack free payroll

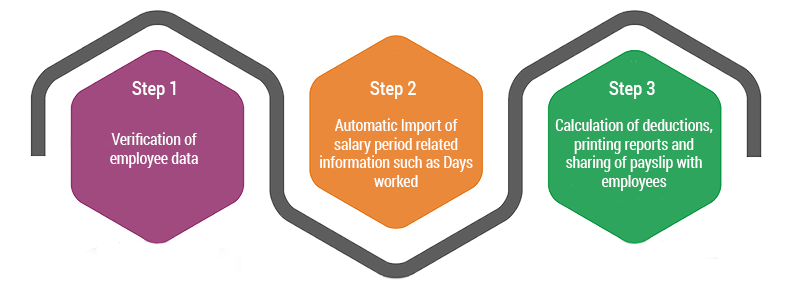

What are the steps in payroll processing?

Empxtrack free payroll process has been streamlined around 3 simple steps that help in easing the pains associated with payroll processing. Each of these steps offers significant configurability and options based on the Empxtrack version being used. Read more about different steps related to payroll processing in the following help sections:

Watch the videos on:

Running Payroll for the First Time with Empxtrack

Process Payroll with Empxtrack Free Payroll

What are the different challans and statutory reports supported in Empxtrack payroll?

The paid and advanced version of Empxtrack Payroll offers all the necessary statutory reports that are required for payroll reporting and statutory compliance. You can read more about these reports with the associated help links for India Payroll.

| Report Name | Help URL |

| ESIC + PF ESIC is an Employees state insurance corporation. The benefits given by the ESIC are in line with the conventions of Conventions of International Labor organization. It includes benefits like medical, sickness, disablement, benefits, etc. An employer deducts ESIC and PF contribution from an employee’s income every month to meet statutory compliance. Each of these social security schemes has a specific percentage of contribution from employees and employers. | Generate ESIC |

Form 24Q Each employer is responsible to submit Form 24Q, a quarterly statement, to the income tax department. Form 24Q is used for preparing eTDS returns for TDS deducted on salary. This form is expected to be submitted on a quarterly basis with complete details on salaries paid to the employees and their tax deduction details for each month. | Generate Form 24Q |

Form 16 Form 16 is generated to certify details regarding an employee?s salary earned throughout the year and the deductions made. The deductions are paid to the government by the employer. Tax payers ought to use Form 16 for filing tax returns at the end of the financial year. | Generate Form 16 |

Note: Empxtrack Free Payroll offers –

- Statutory deductions report containing details of PF, PT, TDS, and ESI

- Salary register containing details payouts, monthly variables, deductions, extra payments, arrears etc. This comprehensive payroll report is used to import data into your financial system

- Variation report allows you to compare the existing payroll with a prior payroll and look up any variations. This only works if the prior payroll is finalized in the system

How to capture investment declarations?

Empxtrack allows storage of exemptions and deductions mapping to the relevant sections of the Income tax. These help in accurate calculations of Taxes deducted at source – a key responsibility of every employer.

The product also supports a workflow to allow HR to verify the employee declarations.

Watch the video on how to configure payroll and setup investment declarations

Note: Empxtrack Free Payroll does not allow managing investment declaration information. Upgrade your application to avail this functionality.

How to set up ESI, PF Eligibility for Indian payroll?

All versions of Empxtrack support ESIC and PF deductions.

ESIC Deduction Rule: If an employer has more than 10 employees, the company must deduct ESIC from their employees’ salary based on the ESIC salary rules explained below. Deduction of ESIC is not mandatory for an employer with less than 10 employees.

Exception – Employers in Chandigarh and Maharashtra should have a minimum count of 20 employees instead of 10.

An employee having a monthly gross salary greater than and equal to Rs 21,000 (Rs. 25,000 for employees with disability) is eligible for ESIC. Ideally, the ESIC deduction from employee salary is made on this formula Gross salary x 0.75/ 100. Employer contribution is Gross x 3.25/ 100.

PF Deduction Rule: If an employer has more than 10 employees, the company must deduct PF from their employees’ salary. Employee and employer contribution for provident fund is 12% of wages.

Note: In the free version of Empxtrack Payroll, you can take care of statutory deductions at the time of salary calculation after specifying earnings and deductions.

In the advanced version of Payroll, type Configure payroll on the Search bar. Select Company settings to enable/ disable PF and ESIC.

Additionally, if employees want to set their individual preference for ESIC and PF, then HR can type “Employee payroll preferences” in the Search and select Employee payroll preferences and overrides to allow overriding ESIC and PF rules.

How to set bank accounts and other statutory ids for employees?

Employee profile data contains a section called documents and Ids. A number of predefined ids such as bank account, PAN no, PF No, UAN No etc are available and you can specify details against these for each employee.

This data should be setup prior to running the payroll since these IDs are used in statutory reports and bank reports.

You can specify company bank account(s) details and for each employee specify IFSC code, account number and linked company bank account. This will allow you to generate bank reports for each company account and allow electronic transfers.

Learn more about setting employee’s bank information

Can I create company policy documents for specific employee groups?

Company policy documents can be associated with specific employee groups. This functionality is available in the advanced versions of Empxtrack. Upgrade your application to avail this feature.

How can I apply for half day leave?

Login to the portal as an Employee >> Click Leave tab on the Homepage >> On My Leave page under Actions dropdown, click Apply for any leave type >> Select Ends on first half or Starts from second half checkbox when applying for leave.

Watch a short video on how to apply for leave as an employee

Can I delete an approved leave?

A leave can be cancelled at any point of time. Leave can even be cancelled post approval. The leave transaction cannot be deleted.

How can I delete past leave records?

Past leave records cannot be deleted. You can filter the leave records based on the financial period.

Do you have a help manual to implement and use Empxtrack Free Payroll?

Yes, we have a Product Guide that you can download once you are in the Setup mode of the application. The product guide offers step by step instructions to setup and use Empxtrack Payroll software.

Additionally, you can explore Online help and Product videos for detailed guidance.

What is the maximum limit of employees for whom I can run Empxtrack Payroll for free?

The free version of Empxtrack can be used for up to 10 employees every month without any investment or credit card requirement. Upgrade your application for more employee licenses and additional features.

Can I use Empxtrack Payroll even if I am not a payroll expert?

You don’t have to be a payroll expert to use the software. The application is very simple to use and you can access Online help and FAQs to learn more.

Additionally, you can also explore the Empxtrack Support Forum, where you can find answers to common questions and participate in a discussion relevant to you.

I am using a legacy payroll software. Will I be able to transfer data to Empxtrack Payroll?

Yes, Empxtrack allows easy import of past payroll and employee data. Make sure you create a past financial year in the system before uploading past salaries.

Refer to the help page that explains steps to setup a financial year

Can I upgrade to the paid version of Empxtrack Free Payroll?

Yes, you can by clicking on the Upgrade button on your application. Buy additional employee licenses or get advanced features of Payroll. Add additional products for free.

Migrate from Free payroll to Paid Edition

Can I sign up for free payroll in the middle of a financial year?

Yes, you can sign up anytime and start using the free version of Empxtrack Payroll software at any given time during the financial period. Process payroll for up to 10 employees every month at absolutely no cost, and avail innumerable benefits.

How can I setup basic company information and get support for application setup?

Type “company settings” in the Search bar and select General settings. Go to Company settings. Upload or change the company logo, input address and other contact details of the company to personalize the application.

For getting support, send your queries through Request Support available in your application or directly email at hrportal@empxtrack.com. The paid users can reach out to their account manager to seek support.

Setup basic company information

Setup Empxtrack Free Payroll for your company

How to start using Empxtrack Free Payroll?

Empxtrack has two user roles – HR manager and Employee. The person who enrolls for the product is given HR privileges.

When you are in the Free Payroll and logged in as HR

- Complete initial setup of the application

- Configure the pay period and payroll variables

- Once done, start processing payroll for your employee

Setup Empxtrack Free Payroll for Your Company

How do I upgrade Empxtrack Free Payroll?

- Click on the Upgrade Products button

- Add free trials for additional products or buy additional employee licenses for Payroll.

- You can also buy implementation service hours to avail dedicated support from our team or get customizations as per your needs

- Provide your credit card information. We capture payment information through RazorPay and Stripe, a globally acceptable and secure payment processor

- Once purchase is verified, the system will automatically be upgraded to the purchased Empxtrack version

- Empxtrack team will provide required support to configure the product as per your needs

Which additional features do I get on upgrading the Empxtrack free payroll application?

Empxtrack offers a comprehensive list of paid products for customers. Upgrade to process payroll for more than 10 employees or get advanced features.

Some of the advanced features include support of formulae in salary structures, custom workflows for salary approval, custom payslips, unlimited API calls and webhooks, customization for tax calculations and arrears, option for varying weekends, options to manage payments outside payroll and other income, payroll dashboards, additional statutory reports, investment declarations, and a lot more.

Besides, Empxtrack allows you to start using additional Empxtrack products such as Leave management, Attendance, Performance Appraisal, Exit management, 360 Feedback, and more.