This help page demonstrates step wise instructions to calculate deductions and setup disburse date in the Empxtrack payroll software.

To calculate deductions and setup disburse date, follow these steps:

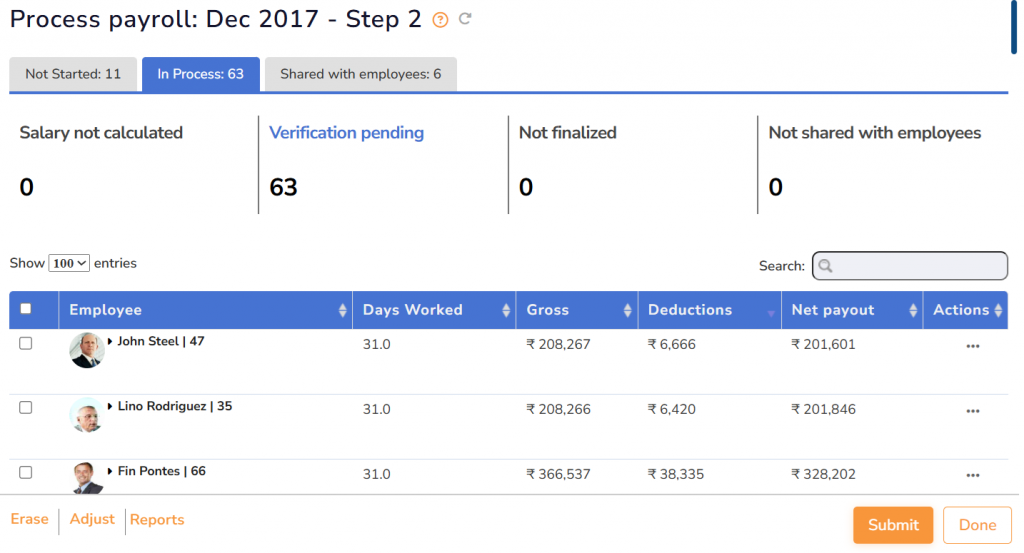

● In the step 2 of the Payroll run, you can view the calculated gross, deductions and Net payouts, including the payment mode in the dashboard as shown below:

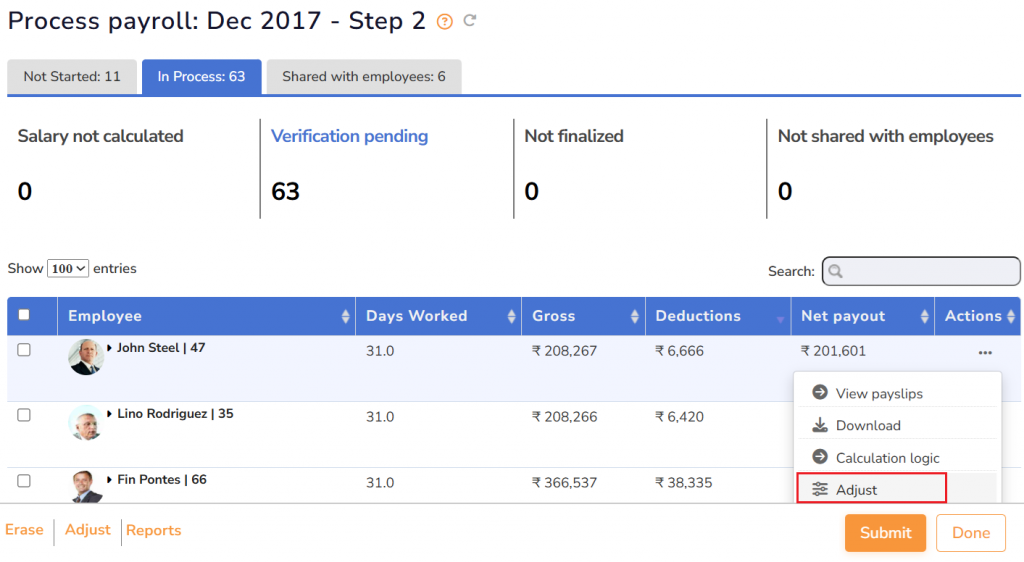

● To adjust the deductions before finalizing the payroll for an employee, you need to click on the Adjust icon.

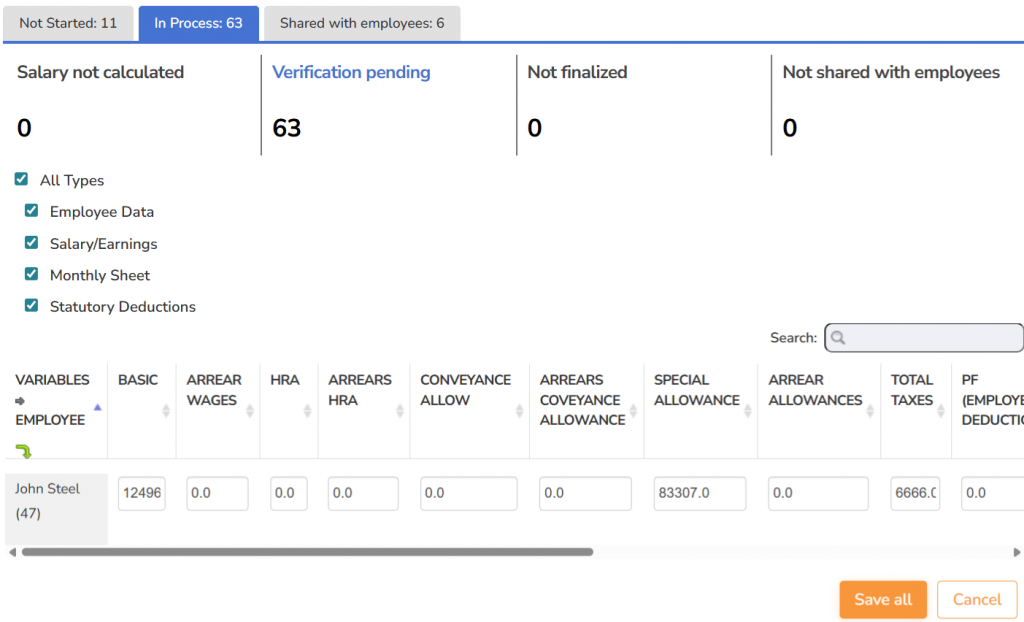

● On the next page, provide the updated value of deduction heads and click on the Save all button to save the adjustment.

● Once all deductions are updated, click Submit and set up the disburse date.

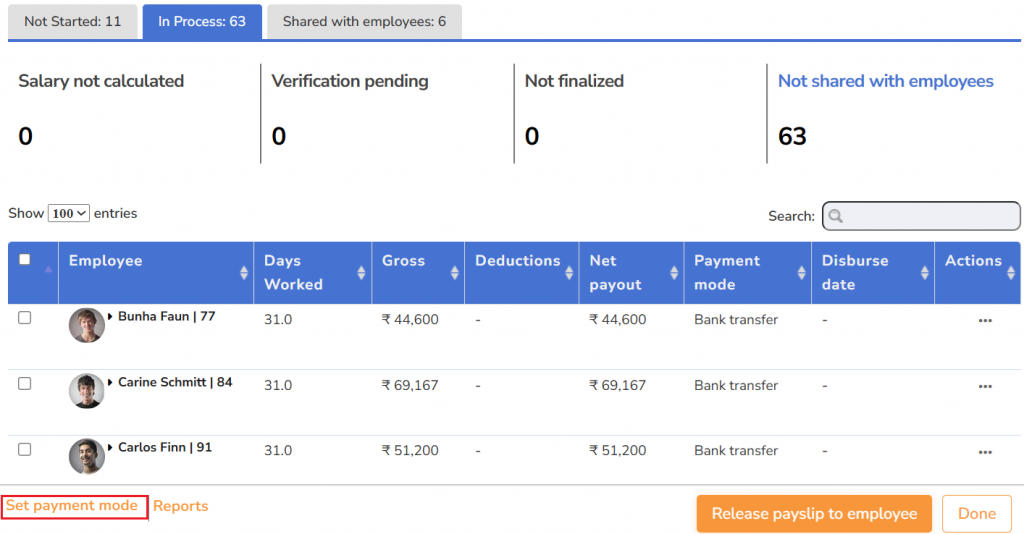

● To set up the disburse date, select all the employees and click on the set payment mode.

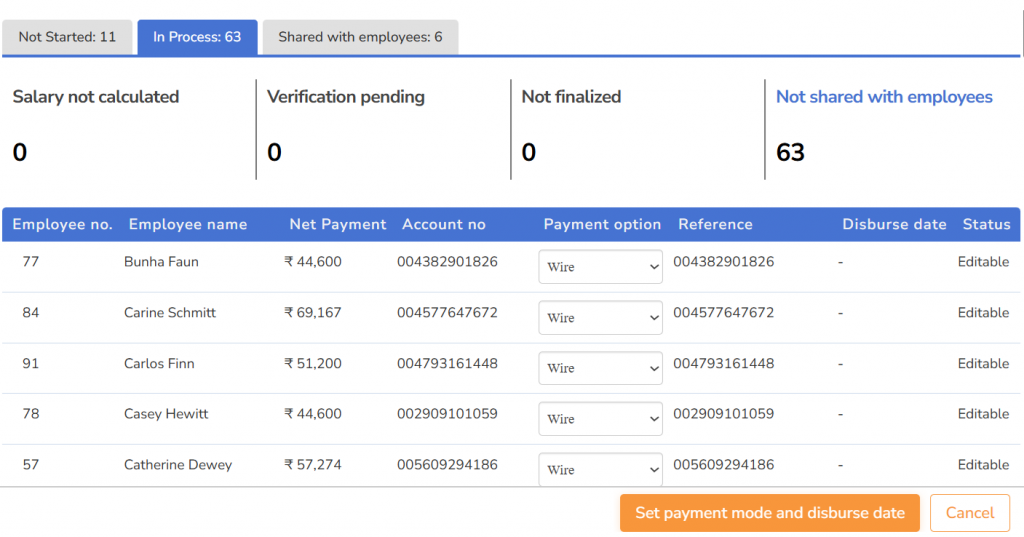

● On the next page you can double check/ update the payment option before setting up the disburse date, once done click on Save all button.

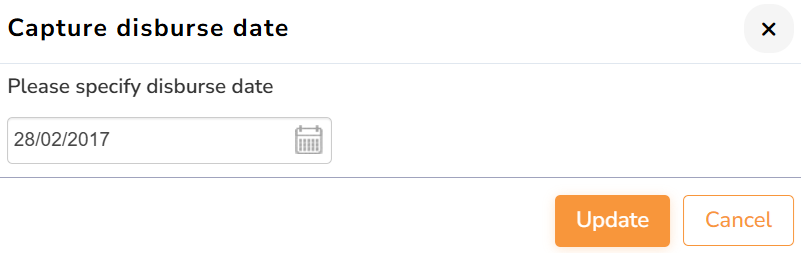

● Click on the Set payment mode and disburse date button to provide the disburse date on the calendar. Use the calendar control to add a specific disburse date and then click on the Update button.

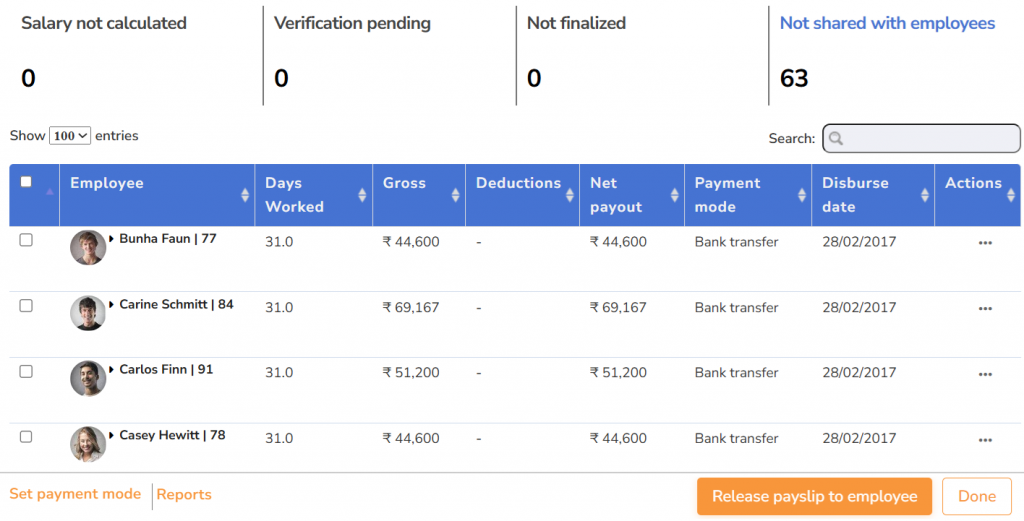

● Once the disburse date is setup you can view the dashboard shown below.

Learn more about Empxtrack Payroll

Suggested Links

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet

- Clear Payroll