Once the payroll is calculated, you can clear payroll if you realize that something is missing. To clear payroll, use the erase payroll option. You may also want to delete the payroll calculation for employees if you have calculated the salary for an exited employee. In such cases, you need to perform a full and final calculation for the employee instead of calculating the salary for the employee.

You can clear the payroll soon after calculation or after the payroll is rejected by the approver with suggestions.

To clear payroll after calculation, you need to:

● Open the Calculated tab to view the calculated payroll.

● Select the employees whose salary calculation needs to be erased and then click Erase to delete the payroll for the selected employees.

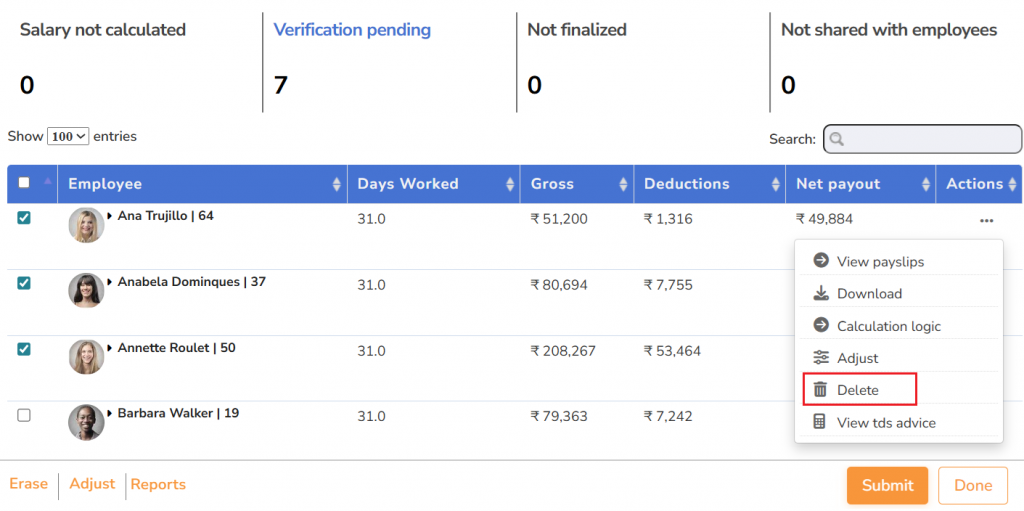

● Alternatively, click on the corresponding Delete icon from the Actions tab for an employee whose salary record you want to remove. This will delete the employee’s salary calculation record.

● The selected payroll is erased.

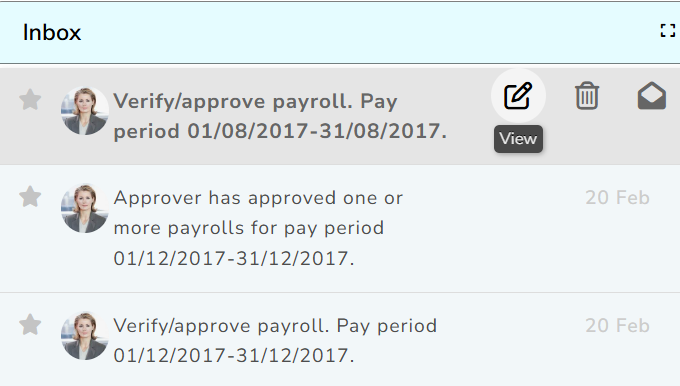

● The payroll also needs to be cleared after the approver verifies it and finds an error. During verification, if the approver finds any errors, they can send it for recalculation. A rejection message for one or more payroll records appears on the home page.

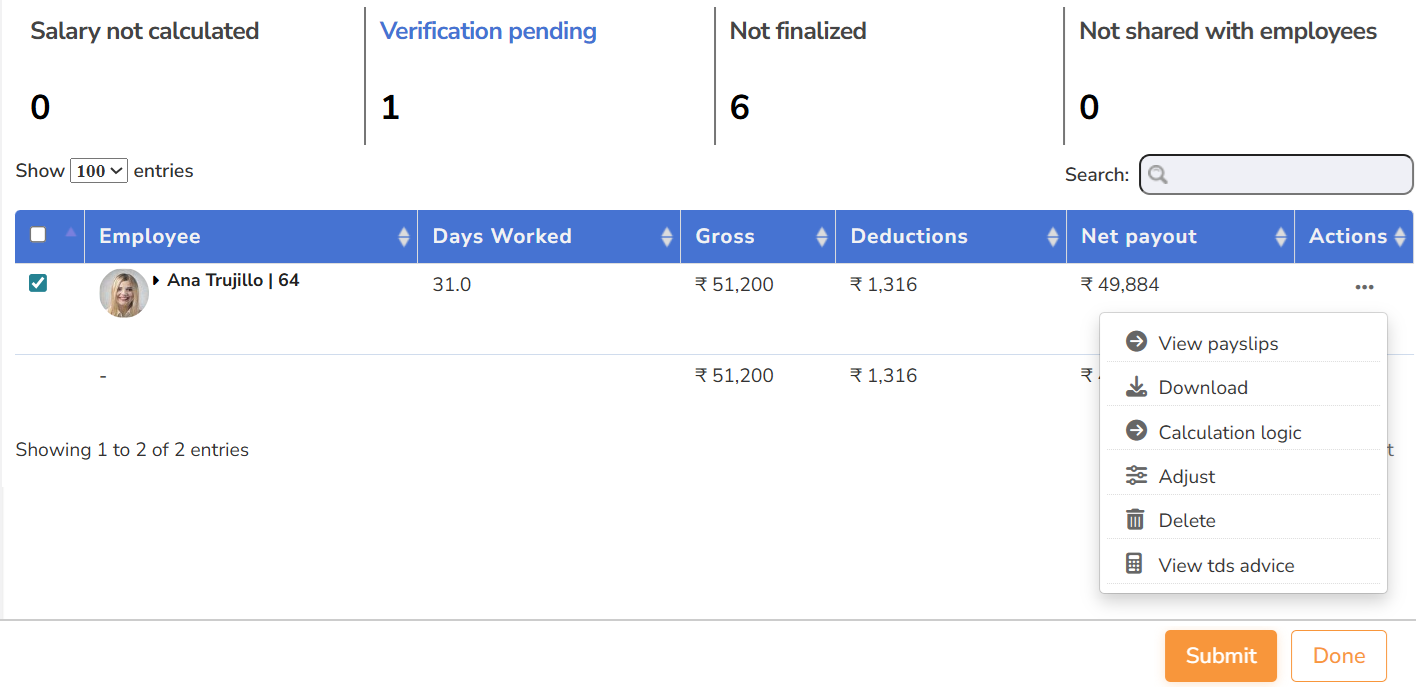

● The records for which recalculation is recommended by the approver appear under the Verification pending tab.

● Erase the payroll by clicking on the icon for the respective record(s) and then calculate the payroll again.

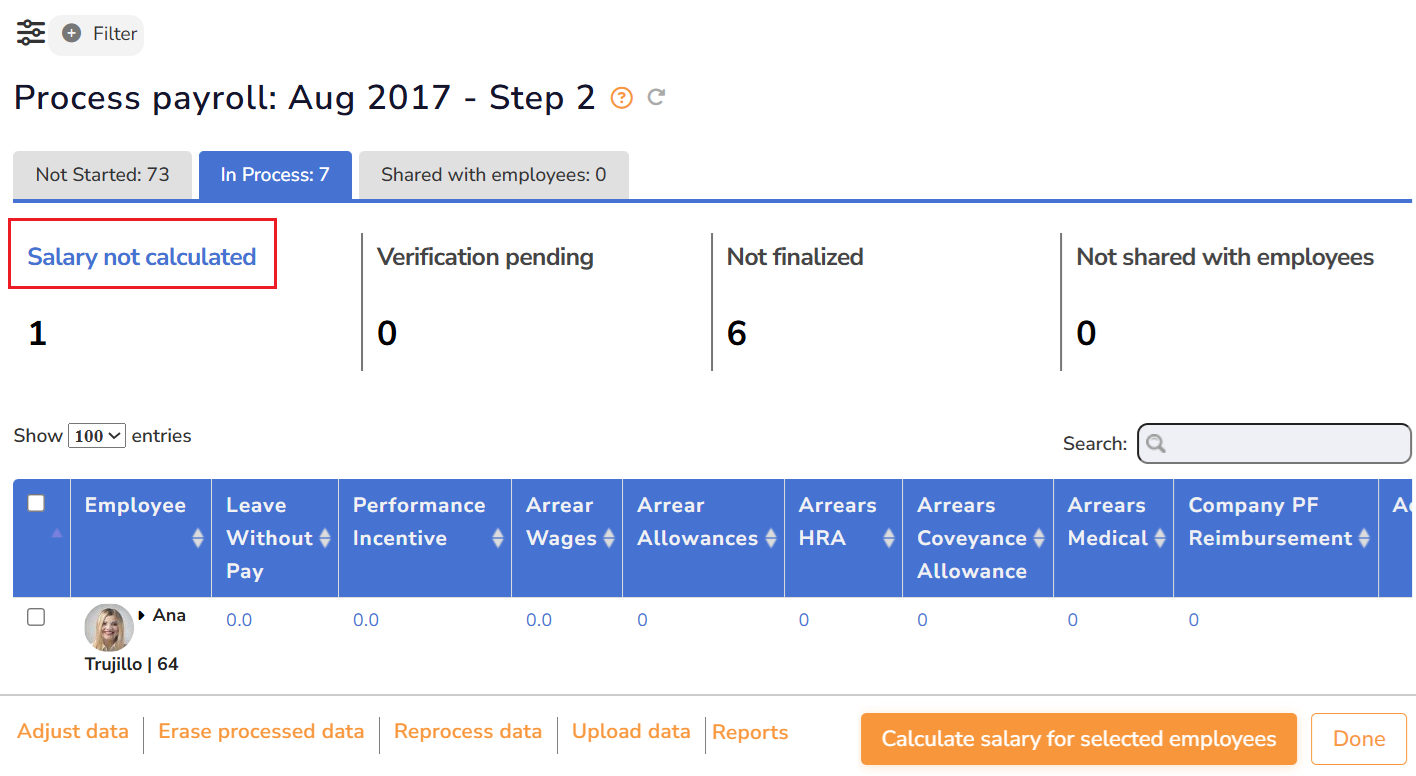

● The employee whose payroll is erased appears in the Not Calculated tab.

● For the erased payroll, you need to run the payroll process again. To know more about running the payroll process, click Run Payroll.

Suggested Links

- Initiate Payroll

- Calculate Payroll

- Adjust Payroll

- Submit Payroll for Approval

- Finalize Payroll

- Set Payment Mode

- Disburse Payroll

- Manage Challan Info

- Capture Multiple Challan

- Capture Challan TNS 281 Details

- Generate Form 24Q

- Add Acknowledgment Info

- Employee data verification and update

- Import number of days employee worked

- Update out of payroll payments

- Calculate deductions and set up disburse date

- Share payslips with employees

- View Payroll Reports

- View and download statutory reports and challans

- Setup and Upload Monthly Sheet